-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Mid-Grade Munis Have Room to Rebound

17 June 2020

4 min read

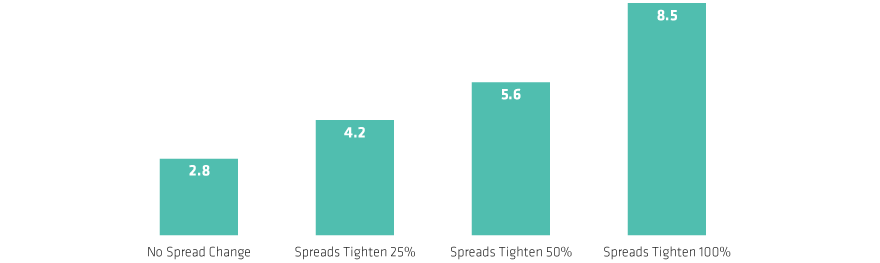

Spread Tightening Can Significantly Boost Potential Returns

Expected 12-Month Returns for 10-Year BBB-Rated Bonds as Spreads Tighten to 2020 Lows (Percent)

As of June 12, 2020

For illustrative purpose only. There I no guarantee the investment objective will be achieved. Illustrates expected returns for a hypothetical 10-year BBB-rated municipal bond under-various scenarios, from no change in spread to a full (100%) return to 2020’s lowest spread level.

Source: Bloomberg and AllianceBernstein (AB)

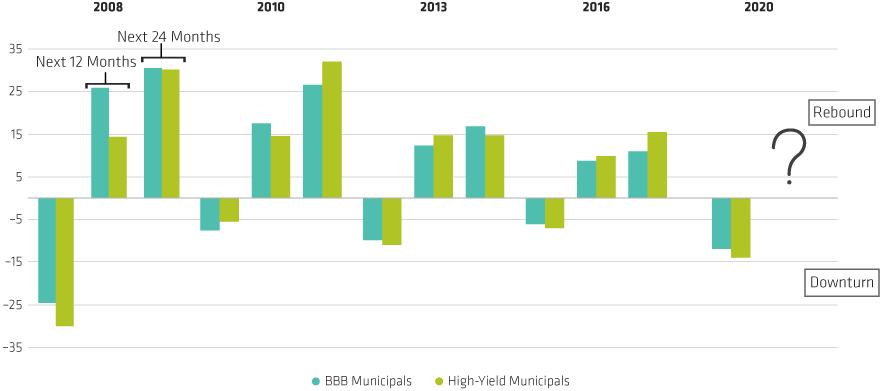

Sharp Rebounds Have Followed Muni Downturns

Cumulative Returns During Downturns and Rebounds (Percent)

As of May 31, 2020

Drawdown periods are as follows: 2008: May2007–Dec 2008; 2010: Nov 2010–Jan 2011; 2013: May 2013–Aug 2013; 2016: Oct 2016–Nov 2016; 2020: Mar 2020–Apr 2020.

Source: Bloomberg Barclays, Morningstar and AllianceBernstein (AB)

About the Author