Investing in Chinese Stocks After the Trade Truce

Historical and current analyses do not guarantee future results.

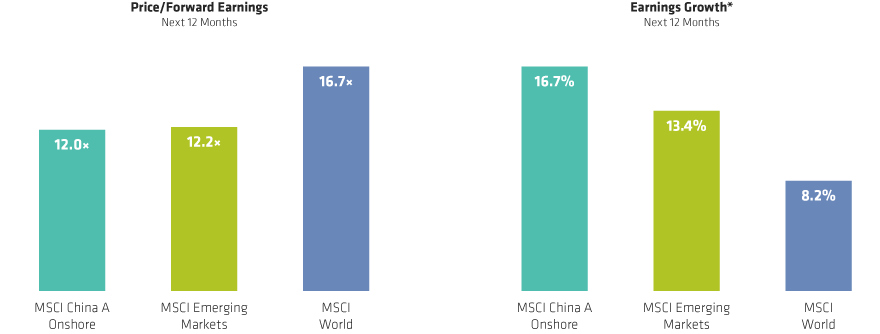

First display as of November 30, 2019; second display as of December 5, 2019

*Based on consensus earnings per share estimates. MSCI China A Onshore Index EPS growth (next 12 months) estimate is the market-cap weighted average of EPS growth estimates for Chinese companies listed in the Shanghai and Shenzhen stock exchanges.

Source: FactSet, I/B/E/S Thomson Reuters Datastream, UBS and AllianceBernstein (AB)

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

John Lin is the Chief Investment Officer of China Equities. He has been the lead Portfolio Manager of China Equities since 2013 and is responsible for managing the China A Shares Value, China Net Zero Solutions, China Low Volatility and All China Equity Strategies. Lin is also a Portfolio Manager for Emerging Markets Value Equities since 2021. From 2008 to 2022, he served as a senior research analyst, responsible for covering financials, real estate and conglomerate companies in Hong Kong and China. Lin joined the firm in New York in 2006 as a research associate, covering consumer services companies for US Small & Mid-Cap Value Equities. Previously, he was a technology, media and telecom investment banker at Citigroup. Lin holds a BS (magna cum laude) in environmental engineering from Cornell University, and an MBA from the Wharton School at the University of Pennsylvania, where he earned the distinction Graduation with Honors. Location: Singapore

Stuart Rae joined AB in 1999 and has served as Chief Investment Officer of Asia-Pacific Value Equities since 2006. Previously, he was CIO of Australian Value Equities from 2003 to 2006.

Coming from a consulting and science background, AB's research focus was a great fit from the start. "Our challenge at AB is rather like solving a puzzle," Rae says. His investment philosophy centers on employing a systematic "quantamental" investment process that combines quantitative analysis, fundamental insights and grassroots research to identify the most attractive value investment opportunities.

The tools and technology Rae uses to build optimal portfolios are always evolving, and this dynamic environment continues to motivate him. "You can never 'solve' the equity market," he says. "That's what makes it such an interesting challenge."