Upcoming Webcast

Three Reasons to Be Active in High-Yield Investing

Key Takeaways

- We think active high-yield strategies are equipped to navigate risks and capitalize on opportunities in the US high-yield bond market.

- Active managers have tool sets to help them “win by not losing,” aren’t bound by inefficient benchmarks and have more positioning flexibility than passive managers.

- The AB High Yield ETF (NYSE: HYFI) seeks high income through an active approach that features security selection, dynamic beta1 management and a disciplined investment process.

Despite narrow credit spreads in the US high-yield market, we see a compelling case for investing today: positive economic news, sound fundamentals, sticky spread trends and attractive yields. Here are three reasons why we believe that actively managed strategies like the AB High Yield ETF (NYSE: HYFI) are a better choice than passive investing.

1. Active Has the Tool Set to Pursue “Winning by Not Losing”

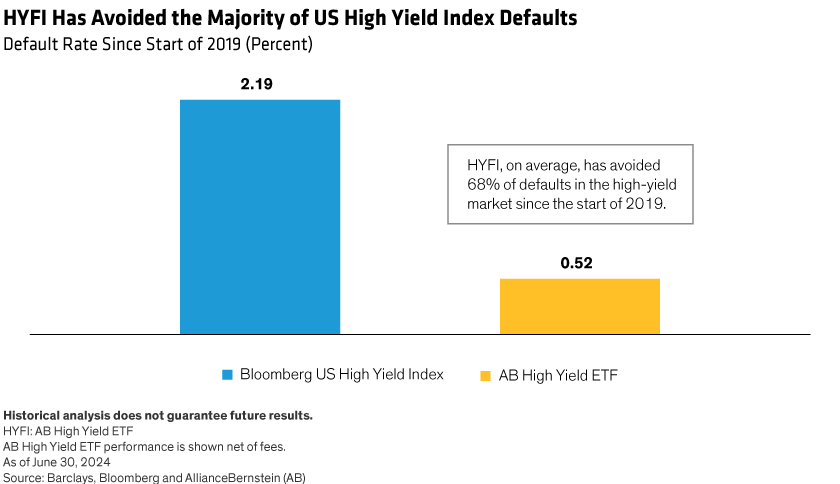

The return potential in bonds is asymmetric. The most an investor can earn over a bond’s life is its yield to maturity, while a default could make it worthless. That makes avoiding defaults key, and we think active managers are better suited for the task than passive strategies. Since 2019, the AB High Yield ETF (NYSE: HYFI) has avoided two-thirds of the defaults in the Bloomberg High Yield Index (Display).

By not following the passive herd, active managers also have a chance to detect—and avoid—deteriorating credit quality before official rating downgrades. Active high-yield managers have other tools for helping to manage the downside, including the ability to take defensive positions, to increase portfolio credit quality and to reduce exposure to riskier sectors.

2. Active Management Isn’t Bound by Inefficient Benchmarks

Benchmarks represent entire markets, so they capture everything. That leaves passive managers to track inefficient index constructs. For example, the biggest companies in the benchmark are those carrying the most debt—not necessarily the most valuable firms.

Passive investing strategies may also be forced to buy firms with heavy debt that have been downgraded from investment-grade, and they face defaults from smaller issuers. Tracking the high-yield benchmark also requires matching allocations to certain industries—which may not correspond to opportunities. Active managers can tailor their sector exposures accordingly.

3. Active Has More Positioning Flexibility Than Passive

The high-yield market is typically less efficient than other bond markets, and when many passive strategies shift their positioning to mirror benchmark changes, trading can be costlier. Skilled active managers may be better positioned to take advantage of that landscape.

Active managers typically hold a fraction of an index’s securities based on high credit conviction and a desire to minimize transaction costs while emphasizing liquidity. That may leave active strategies better positioned to add risk when it becomes cheap to do so (the opposite of what benchmarks do).

Why the AB High Yield ETF (NYSE: HYFI) Makes Sense for Active Investing

Investors seeking an active high-yield strategy should explore the AB High Yield ETF (NYSE: HYFI). HYFI seeks high income through security selection, dynamic beta management and a disciplined investment process. Its performance has outpaced both its active and passive peer groups (Display).

1 Beta measures volatility relative to a benchmark.

For standardized performance, click here.

Need ETF trading guidance?

AB’s ETF Capital Markets team offers complementary trade advisory services. Contact us at etf.capitalmarkets@alliancebernstein.com. Explore AB’s actively managed ETF solutions here.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Risks to Consider

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV and with supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (a.k.a. junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear layers of asset-based expenses, which could reduce returns.

Leverage Risk: To the extent the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Management Risk: The Fund is subject to management risk because it is an actively-managed ETF. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein L.P. (AB) is the investment Advisor for the Fund.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

Prior to close of business on 5/12/2023, the Fund operated as an open-end mutual fund. The Fund has an identical investment objective and substantially similar investment strategies and investment risk profiles to those of the predecessor mutual fund. The NAV returns include returns of the Advisor Share Class of the predecessor mutual fund prior to the Fund’s commencement of operations. Performance for the Fund’s shares has not been adjusted to reflect the Fund shares’ lower expenses compared to those of the predecessor mutual fund’s Advisor Share Class. Had the predecessor fund been structured as an exchange-traded fund, its performance may have differed. Please refer to the current prospectus for further information. Performance prior to 7/27/16 reflects the AB High Yield Portfolio, a series of AB Pooling Portfolios that was reorganized into the Fund and is the surviving entity in the reorganization. Performance for those periods would have been lower if such an accounting survivor had operated at the Fund’s current expense levels. Prior to 4/30/21, the Fund was called the AB FlexFee High Yield Portfolio. Data prior to 4/30/21 relate to the AB FlexFee High Yield Portfolio.