Upcoming Webcast

Seeking High-Yield Potential in a Tight-Spread World? Think Active ETFs.

Key Takeaways

- Economic good news, solid fundamentals and a favorable supply and demand are supporting high-yield prices and keeping credit spreads tight.

- Tight spreads have tended to stay that way for a while, so investors who remain on the sidelines could be passing up attractive income and return potential.

- We think active management is key—investors seeking to navigate the high-yield market should consider the AB High Yield ETF (NYSE: HYFI).

High-Yield Spreads Are Tight Because of Good News

The biggest reason for tight spreads is good economic news—sustained growth has reduced the possibility of a recession from the cycle highs of 2022. Fundamentals remain strong: firms have fortified balance sheets and locked in lower interest expenses since the pandemic, keeping defaults below historical averages and Wall Street expectations.

Meanwhile, attractive yields have stoked demand for higher potential returns and lower perceived risks. On the supply front, firms have focused more on reducing debt than on using it for growth or acquisitions. This favorable technical backdrop is helping support prices and keep spreads tight.

Debt reduction has lowered the average maturity of the Bloomberg US Corporate High Yield Index to a record low of under five years. So its average duration and spread duration—price sensitivity to spread changes—are also below average.

Tight Spreads Have Tended to Be “Sticky”

Based on our research, when spreads widen, it tends to happen quickly, and so do the recoveries. But judging from history, they could stay in their current tight range for quite a while. Since 1994, when spreads on the Bloomberg US Corporate High Yield Index fell below 400 basis points (bps), they’ve taken an average of 28 months to climb back to the long-term average.

That’s a considerable amount of time to forego attractive income and return potential. When spreads have ranged from 300 to 400 bps, ensuing one-year index returns have averaged about 6.6%. If the Fed avoids a recession, spreads might tighten further. Meanwhile, overall yields are at their highest in years. Yield, which is 7.3% today, has been a much better return predictor than spreads (Display).

Past performance and current analysis do not guarantee future results. An index cannot be invested into directly.

YTW: yield to worst; GFC: global financial crisis

As of August 31, 2024

Source: Bloomberg and AllianceBernstein (AB)

In High-Yield Bond Investing…Think Active

We believe that skilled active management may enable high-yield managers to outperform benchmarks and passive strategies. Winning by not losing—avoiding defaults and managing downside risk—matters more than finding top performers, in our view. Because passive funds are based on an index, they struggle to avoid these risks.

On the other hand, active managers have a broader toolkit that may help enhance returns—including risk management, sector rotation and security selection. And active managers’ selectivity may reduce transaction costs, whereas passive strategies often incur higher costs by trading indiscriminately.

Going Active to Tap High-Yield Potential? Consider the AB High Yield ETF

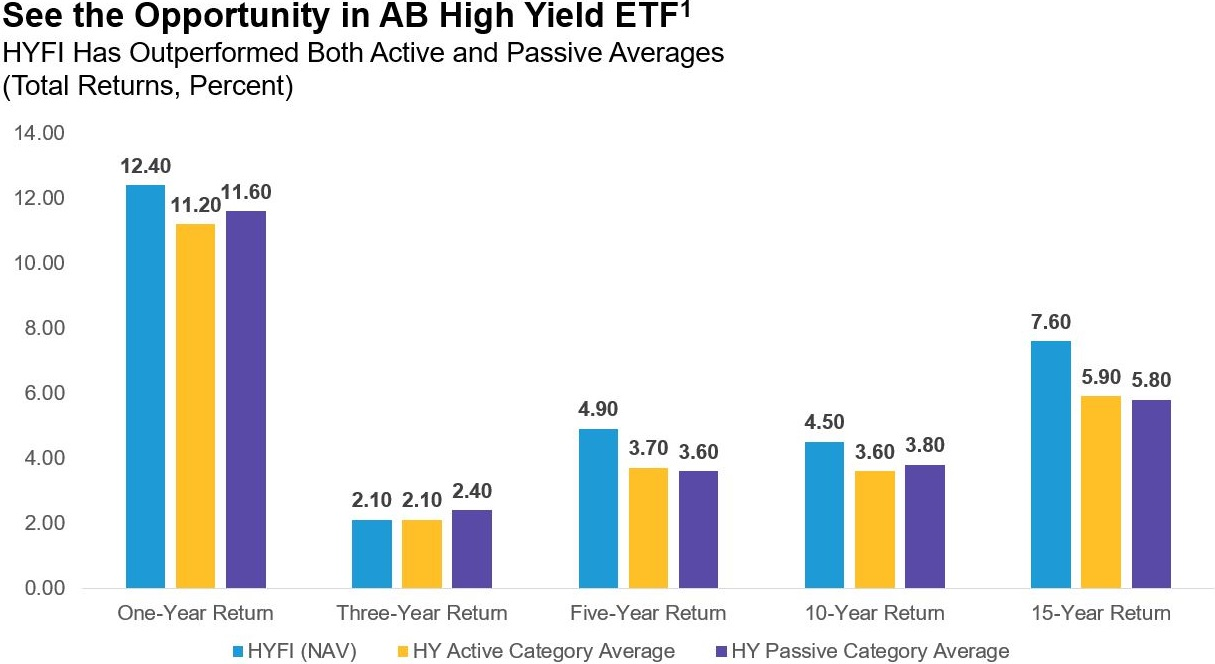

Investors seeking an active high-yield strategy should explore the AB High Yield ETF (NYSE: HYFI), which seeks high income through security selection, dynamic beta management and a disciplined investment process. HYFI’s performance has outpaced both its active and passive peer groups (Display).

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent Standardized Performance and month-end performance at http://www.abfunds.com. The total expense ratio for HYFI is 0.40%.

As of August 31, 2024

Source: Morningstar and AB

For standardized performance, click here.

Need ETF trading guidance? AB’s ETF Capital Markets team offers complementary trade advisory services. Contact us at etf.capitalmarkets@alliancebernstein.com. Explore AB’s actively managed ETFs here.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Risks to Consider

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (a/k/a junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear layers of asset-based expenses, which could reduce returns.

Leverage Risk: To the extent the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates, and any increase or decrease in the value of the Fund’s investments.

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein L.P. (AB) is the investment Advisor for the Fund.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

Prior to close of business on 5/12/2023, the Fund operated as an open-end mutual fund. The Fund has an identical investment objective and substantially similar investment strategies and investment risk profiles as the predecessor mutual fund. The NAV returns include returns of the Advisor Share Class of the predecessor mutual fund prior to the Fund’s commencement of operations. Performance for the Fund’s shares has not been adjusted to reflect the Fund’s shares’ lower expenses than those of the predecessor mutual fund’s Advisor Share Class. Had the predecessor fund been structured as an exchange-traded fund, its performance may have differed. Please refer to the current prospectus for further information. Performance prior to 7/27/16 reflects AB High Yield Portfolio, a series of the AB Pooling Portfolios that was reorganized into the Fund and is the surviving entity in the reorganization. Performance for those periods would have been lower if such accounting survivor had operated at the Fund’s current expense levels. Prior to 4/30/21, the Fund was called AB FlexFee High Yield Portfolio. Data prior to 4/30/21 relates to AB FlexFee High Yield Portfolio.

The Morningstar Rating™ for funds, or star rating, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. The star rating is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10.0% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35.0% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10.0% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five- and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36–59 months of total returns, 60% five-year rating/40% three-year rating for 60–119 months of total returns and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.