Upcoming Webcast

Check the Right Boxes with High-Yield Bond ETFs

Key Takeaways

- High-yield bonds have historically delivered strong returns and helped mitigate overall portfolio risk, but investors trying to time entry may trip up

- One of the keys is to get the investment strategy right, which involves understanding the pros and cons of various approaches

- Investors should consider the AB High Yield ETF (NYSE: HYFI) or AB Short Duration High Yield ETF (NYSE: SYFI), which follow disciplined, active approaches

1. Explore the Investment Case for High-Yield

High-yield has delivered equity-like returns. Since the inception of the Bloomberg US High Yield Index, its returns have been comparable to those of equities based on the S&P 500—providing attractive income and growth with less volatility.1

Action item: Consider high-yield as a strategic allocation seeking to generate equity-like returns with steady income and more-consistent performance.

High-yield may reduce overall portfolio risk. Among asset classes, high-yield offers one of the highest Sharpe ratios, indicating strong risk-adjusted returns. Its compelling balance of risk and reward has the potential to enhance income while diversifying equity risk.

Action item: Adding high-yield bonds to portfolios may improve the portfolio’s overall risk-adjusted returns with its balance of income and downside mitigation.

“Junk bonds” is an inaccurate label for high-yield. This misconception about high-yield dates back to the 1980s, but the reality has been anything but “junk.” Over the past 30 years, defaults have averaged just 3% annually, and they’ve been below 2% over the past five years.2

Action item: Reconsider outdated views on high-yield’s riskiness. It’s a viable, strong-performing asset class with a wide array of opportunities.

2. Focus on Time in the Market, Not Timing the Market

Yield to worst has been a strong predictor of high-yield returns. When it comes to yield, what you see is what you get. Historically, yield to worst at a given point has been a reliable indicator of forward high-yield returns. High-yield has consistently outpaced other bond sectors, even after accounting for credit losses. In fact, returns have topped 20% since the end of 2022, despite looming recession fears.3

Action Item: Research how closely high-yield returns have tracked the yield-to-worst metric at a given point in time as a way to gauge return potential.

Elevated yields may enhance the high-yield opportunity. Yields are at their highest in two decades, which may offer a rare opportunity to lock in meaningful income. Waiting could mean missing out on compelling yields.

Action Item: Consider accessing attractive yields in high-yield bonds now, before falling rates start to close the window.

Credit spreads may stay tight for a while. Historically, tight spreads have been poor return predictors, because they can stay tight for some time. It’s notoriously hard to time spread changes, and missing even just the best performing month in a given year can put a dent in performance.

Action Item: Credit spreads aren’t the whole story—stay invested in high-yield to capture its full potential over the long run.

3. Choose the Right Approach and Vehicle for the Market

Passive high-yield investing faces potential pitfalls. Passive strategies may struggle to replicate broad benchmarks and may hold weaker issuers, increasing default risks. Active management may mitigate these risks through credit selection and risk oversight.

Action Item: Acknowledge the value of active management in navigating credit markets and seeking to generate consistent returns.

Uncertain outcomes call for strategies that can adapt. Investors often rely on social proof, but consensus views have often been wrong. The market underestimated the pandemic recovery, inflation’s persistence and the economy’s resilience. Now, it expects a soft landing: How confident are you in that scenario?

Action Item: Prepare for multiple outcomes by leaning into a strategy able to adapt to changing risks and opportunities.

“Winning by not losing” is key in the high-yield market. Active strategies have historically outpaced passive by avoiding defaults through rigorous credit research and active risk management. Passive strategies may get stuck holding weaker issuers, which can hurt returns.4

Action Item: Consider how actively managed strategies can help add value by using research to select quality issuers and manage credit risks.

It’s more expensive to trade a basket of high-yield bonds than an ETF. ETFs are commingled vehicles that trade on the world’s most efficient market—US equities. That provides investors with a seamless way to access high-yield exposure.

Action Item: Explore how ETFs offer an efficient way to access high-yield bonds with liquidity and transparency.

The cost of owning an ETF is more than just the expense ratio. The total cost of ETF ownership includes the spreads to buy and sell it, along with commissions and the expense ratio.

Action Item: Looking at expense ratio alone paints an incomplete picture. Take a more holistic view to understand the total cost of ETF ownership.

Check the Right Boxes with AB Short Duration High Yield ETF (NYSE: SYFI) and AB High Yield ETF (NYSE: HYFI)

When it comes to low-cost high-yield bond ETFs, investors should take a closer look at AB Short Duration High Yield ETF (NYSE: SYFI) and AB High Yield ETF (NYSE: HYFI).

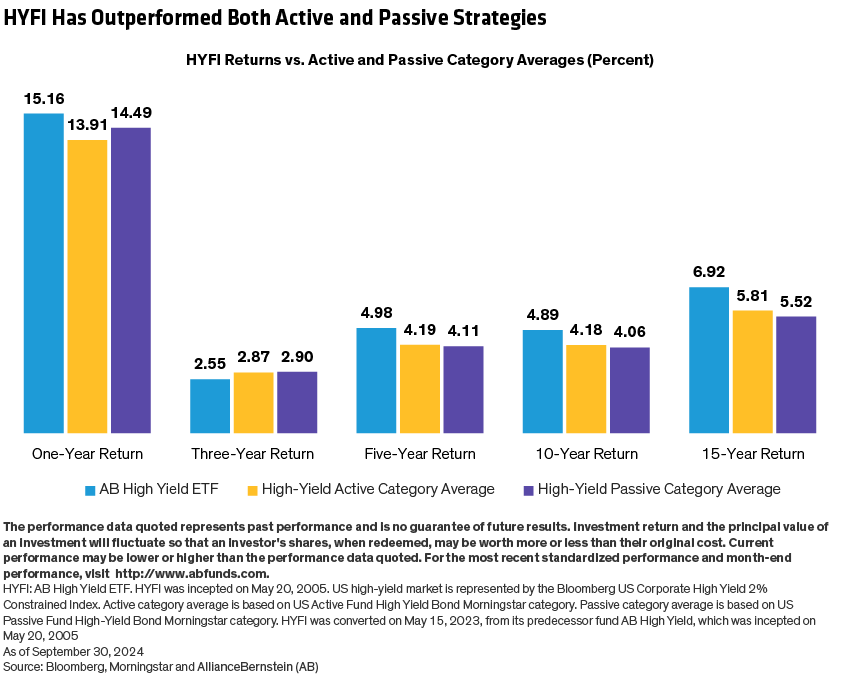

HYFI seeks to deliver high income through security selection, dynamic beta management and a disciplined investment process. Over time, HYFI’s performance has outpaced both its active and passive peer groups (Display). seeks to provide attractive income while aiming for less volatility than traditional high-yield approaches.

Both ETFs have access to the same underlying liquidity as many larger, more frequently traded ETFs, enabling them to handle large transaction sizes without moving the market or reducing investor returns.

For standardized performance, click here.

1 Source: Morningstar. Performance is from 1/1/1983-12/31/2024. Bloomberg US High-Yield Index, Annual Returns: 8.31% (1983-2024), Standard Deviation: 15.22 (1995-2024). S&P 500, Annual Returns: 10.57% (1983-2024), Standard Deviation: 8.56 (1995-2024).

2 Source: J.P. Morgan.

3 Source: Bloomberg US High Yield Index. Performance is from 1/1/1983-12/31/2024.

4 Source: Morningstar.

Sharpe ratio measures return relative to the investment risk taken.

Yield to Worst denotes the lowest possible amount of interest which can be earned on a callable bond.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Risks to Consider

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV and with supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (a.k.a. junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear layers of asset-based expenses, which could reduce returns.

Leverage Risk: To the extent the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Management Risk: The Fund is subject to management risk because it is an actively-managed ETF. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein L.P. (AB) is the investment Advisor for the Fund.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

Prior to close of business on 5/12/2023, the Fund operated as an open-end mutual fund. The Fund has an identical investment objective and substantially similar investment strategies and investment risk profiles to those of the predecessor mutual fund. The NAV returns include returns of the Advisor Share Class of the predecessor mutual fund prior to the Fund’s commencement of operations. Performance for the Fund’s shares has not been adjusted to reflect the Fund shares’ lower expenses compared to those of the predecessor mutual fund’s Advisor Share Class. Had the predecessor fund been structured as an exchange-traded fund, its performance may have differed. Please refer to the current prospectus for further information. Performance prior to 7/27/16 reflects the AB High Yield Portfolio, a series of AB Pooling Portfolios that was reorganized into the Fund and is the surviving entity in the reorganization. Performance for those periods would have been lower if such an accounting survivor had operated at the Fund’s current expense levels. Prior to 4/30/21, the Fund was called the AB FlexFee High Yield Portfolio. Data prior to 4/30/21 relate to the AB FlexFee High Yield Portfolio.