Position for Today’s Environment

In our view, bond investors can thrive in today’s favorable environment by applying these strategies:

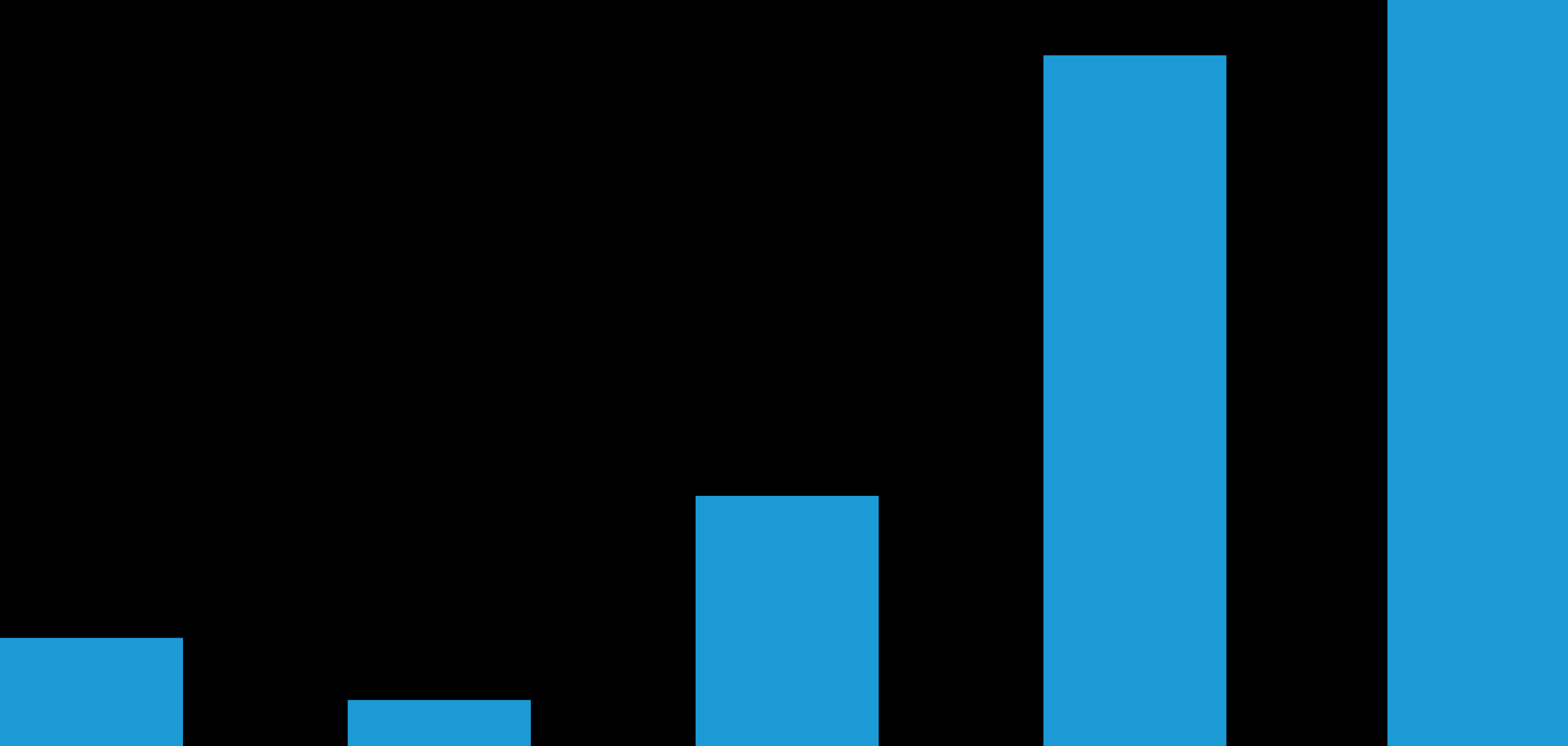

Get invested. If you’re still parked in cash, you’re losing out on the daily income accrual provided by higher-yielding bonds, as well as the potential price gains as yields decline. While cash rates are currently higher than much of the yield curve, that’s typical ahead of easing cycles—and in the runup to large capital-gain opportunities. That’s why it’s so important that bond investors get off the sidelines and get invested now. In fact, in today’s environment, investors should probably allocate more to fixed income than they have historically.

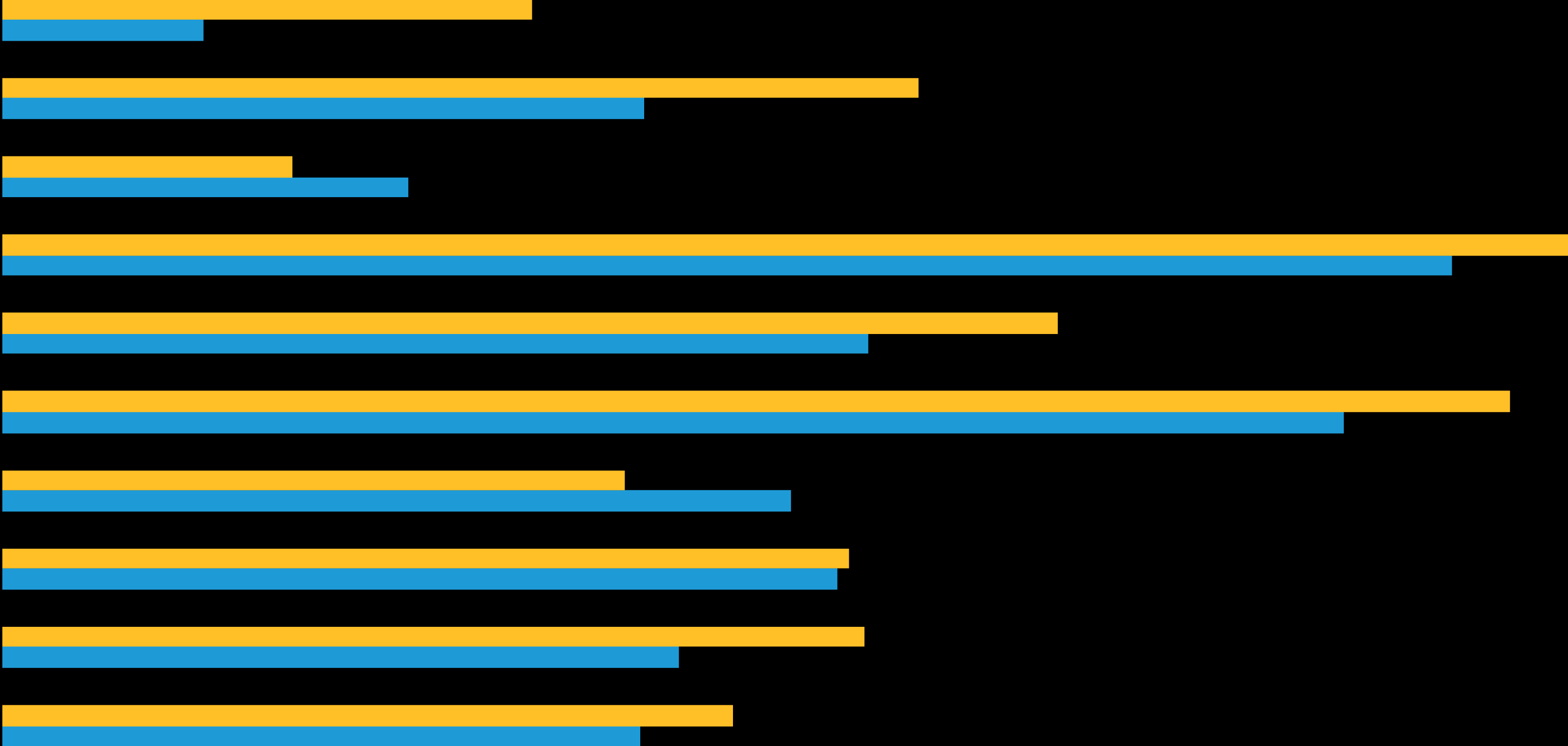

Extend duration. If your portfolio’s duration, or sensitivity to interest rates, has veered toward the short end, consider lengthening it. As the economy slows and interest rates decline, duration benefits portfolios. Government bonds, the purest source of duration, also provide ample liquidity and help to offset equity market volatility.

Think global. Not only do idiosyncratic opportunities increase globally as central banks forge their own paths, but the advantage provided by diversification across different interest-rate and business cycles is also more powerful when central banks are out of sync.

Hold credit. We don’t think this is the time to avoid or underweight credit. Though spreads are on the tighter side, yields across credit-sensitive assets such as corporate bonds and securitized debt are higher than they’ve been in years, and over time a bond derives most of its return from yield. In fact, corporate fundamentals are still in relatively good shape, having started from a position of historic strength. And falling rates later in the year should help relieve refinancing pressure on corporate issuers. Further, as money moves out of cash, we anticipate robust demand for credit, especially investment-grade debt; this positive technical should help support credit spreads. That said, investors should be selective and pay attention to liquidity. CCC-rated corporates and lower-rated securitized debt are most vulnerable in an economic slowdown.

Adopt a balanced stance. We believe that both government bonds and credit sectors have a role to play in portfolios today. Among the most effective strategies are those that pair government bonds and other interest-rate-sensitive assets with growth-oriented credit assets in a single, dynamically managed portfolio. This pairing also helps mitigate risks outside our base-case scenario of weaker growth—such as the return of extreme inflation, or an economic collapse.

Protect against inflation. Given the heightened risk of future surges in inflation, the corrosive effect of inflation, and the affordability of explicit inflation protection, we think investors should consider increasing their allocations to inflation strategies now.

Consider a systematic approach. Today’s environment also increases potential alpha from security selection. Active systematic fixed-income approaches can help investors harvest these opportunities. Systematic approaches rely on a range of predictive factors, such as momentum, that are not efficiently captured through traditional investing. Because systematic approaches depend on different performance drivers, their returns may complement traditional active strategies.

The Tide Has Turned in Investors’ Favor

Active investors should prepare to take advantage of opportunities created by heightened volatility and market tailwinds in the second half of the year. In our view, the most critical step is simply to get back into the bond markets so as not to miss out on today’s high yields and exceptional potential return.