-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Can Investors Make Money in a US - China Trade War?

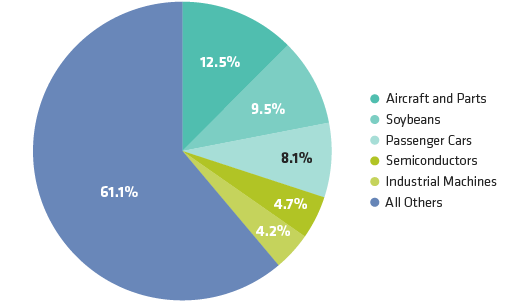

As of December 31, 2017

Source: US Census Bureau and AllianceBernstein (AB)

As of December 31, 2017

Source: US Census Bureau and AllianceBernstein (AB)

-

Identify the most vulnerable products, industries and companies

-

Find companies that could actually benefit from trade war fallout

-

Look for specific targeted areas in which one country may have leverage over another

Stuart Rae is Chief Investment Officer of Emerging Markets Value Equities since 2023 and Chief Investment Officer of Asia-Pacific Value Equities, a position he has held since 2006. He is also a long-standing Portfolio Manager for China Equities. Previously, Rae was CIO of Australian Value Equities from 2003 to 2006. He joined the firm in 1999 as a research analyst covering the consumer sector, initially working in New York and London before moving to Sydney in 2003, Hong Kong in 2006 and Melbourne in 2021. Before that, Rae was a management consultant with McKinsey for six years in Australia and the UK. He holds a BSc (Hons) in physics from Monash University, Australia, and a DPhil in physics from the University of Oxford, where he studied as a Rhodes Scholar. Location: Melbourne

John Lin is the Chief Investment Officer of China Equities. He has been a Portfolio Manager for AB China Equities since 2013 and for Emerging Markets Value Equities since 2021. From 2008 to 2022, Lin served as a senior research analyst, responsible for covering financials, real estate and conglomerate companies in Hong Kong and China. He joined the firm in New York in 2006 as a research associate, covering consumer services companies for US Small & Mid-Cap Value Equities. Previously, Lin was a technology, media and telecom investment banker at Citigroup. He holds a BS (magna cum laude) in environmental engineering from Cornell University, and an MBA from the Wharton School at the University of Pennsylvania, where he earned the distinction Graduation with Honors. Location: Singapore