After October’s sharp market declines, many investors might think US stocks look relatively cheap again. But equity valuations require closer scrutiny, and earnings metrics might be distorting the fundamental performance of businesses.

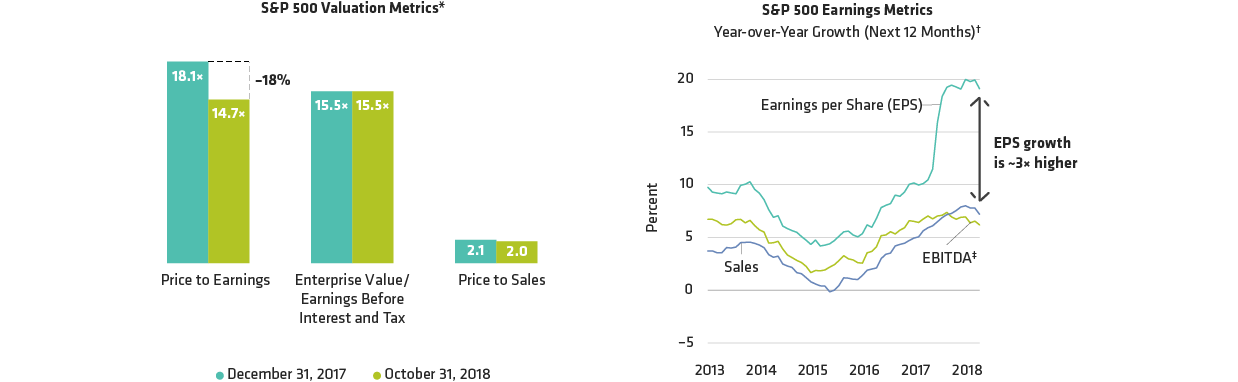

Assessing a stock’s value isn’t always straightforward. Price-to-earnings ratios—the most popular valuation measure—show the S&P 500 trading today at 14.7 times forward earnings estimates, or 18% cheaper than it was at the end of 2017 (Display, left). But other valuation metrics that strip out the impact of tax benefits or focus on sales show virtually no change at all this year.

Why the difference? We think it’s because earnings per share (EPS), the reported bottom line of company profits, is being inflated by the effects of tax reform and large share buybacks. When tax reforms increase earnings and buybacks shrink the share pool, the EPS calculation is boosted. That’s why EPS is growing about three times faster than sales or EBITDA (earnings before interest, tax, depreciation and amortization) (Display, right).

Both EBITDA and sales appear higher up on the profit and loss sheet, and are more closely tied to the actual performance of a company’s business. In other words, the underlying businesses of many companies are growing much more slowly than their earnings suggest. This year’s EPS may just be smoke and mirrors—when the boost from tax reform subsides, companies without real business growth will be exposed. Their lower organic earnings level means that the current attractive valuation is just an illusion, in our view.

Of course, market volatility is creating opportunities for equity investors. But to find them you need to be selective. Study several valuation measures to understand whether a stock is really undervalued or not. And don’t be fooled by solid earnings growth: make sure a company’s business is healthy and firing on all cylinders to deliver high-quality growth over the long term.