Latent factors or clustering tools can help identify newly forming risks. For example, during the pandemic, we detected a “stay at home” cluster risk, in which stocks including internet retail companies, at-home entertainment names and other stocks that fit the theme were trading with similar patterns. Enthusiasm over AI could also create linkages between stocks that would typically not be seen as related. For example, our analysis has detected a cluster related to the AI theme, in which data centers and energy stocks are trading similarly. Two years ago, this cluster did not register since the related stocks had different performance patterns. Identifying the cluster has helped our portfolio managers understand their exposure to this new theme earlier in the cycle. It also enables the teams to manage risk relative to this cluster and not just via static industries as in traditional risk models.

What’s Next? From Mega-Caps to Elections

Properly deploying these tools requires keeping an active eye on the risk horizon. Today, prominent risks on our radar include market concentration risk and the US election.

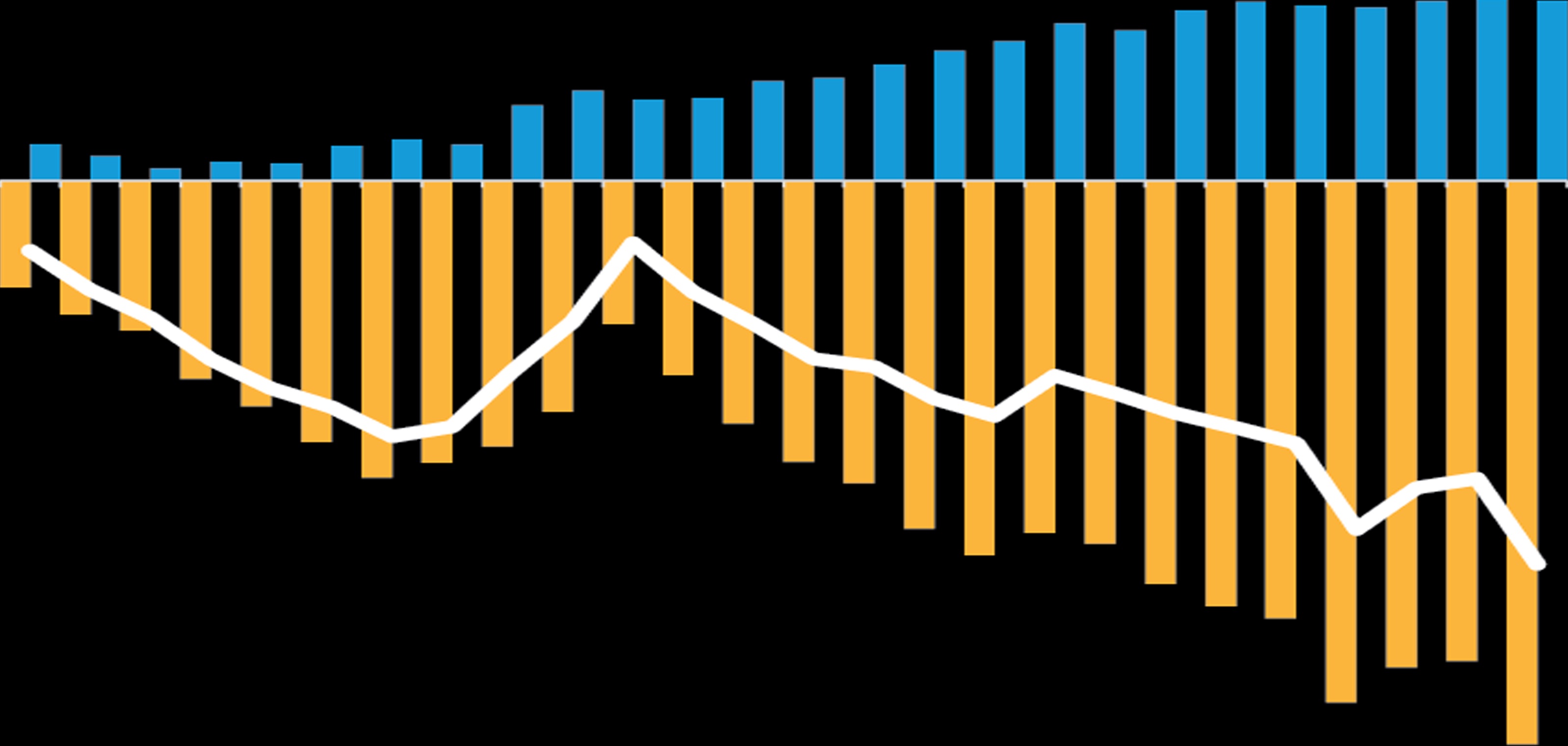

Since late 2022, enthusiasm over AI has fueled a surge in a group of seven mega-cap US stocks. The heavy concentration of benchmarks in the so-called Magnificent Seven (Mag 7) creates risks for investors who don’t load up on the entire group, as well as for portfolios that hold positions in the entire cohort, which may be vulnerable if sentiment toward the group sours.

From a risk-management perspective, we can use our mosaic to create a better understanding of the Mag 7. Start by understanding the factor exposures associated with this group. Then, check what scenario analysis and clustering can teach us about the cohort and other stocks that might be related to it. Finally, weigh the amount of risk budget being spent on the truly idiosyncratic part of positions in each stock and confirm whether it aligns with the portfolio’s conviction and philosophy.

Investors must pay special attention to the risks from underweighting stocks. Before the Mag 7’s dominance, the risk of not owning a large stock wouldn’t have been too worrisome. But now, not owning a company like NVIDIA adds elevated benchmark risk. Since the stock is such a huge component of the S&P 500, portfolios that avoid or underweight NVIDIA will persistently underperform the broad benchmark if its winning streak continues.

What about the US election? A good starting point is to try and identify groups of stocks that could be affected in different ways. Broker baskets provide helpful clues. These are baskets of stocks that brokers believe are likely to rise or fall based on certain outcomes. Of course, a portfolio will only have exposure to some of these stocks. So we can fill in the gaps by taking a similar approach to the macro sensitivities and estimate election betas to these baskets, which can then be applied to all stocks.

To do this, we calculate a time series of returns for the broker baskets, similar to the macro sensitivity approach. Then, we calculate the rolling beta of all stocks versus the returns of these election baskets. This way, we can see how the performance patterns of all stocks relate to this basket, which can help investors detect adjacent stocks—such as customers or suppliers of companies in the baskets—that may be affected by elections but are not covered by brokers.

Culture Matters for Risk Management

Even the most cutting-edge risk tools won’t get the job done without the right organizational culture. That’s because these tools provide intelligence that requires thoughtful interpretation and application.

Quantitative analysts are typically responsible for developing and managing risk-management tools. In a large investment house with many equity portfolios, we think developing risk tools centrally can help spread best practices and scale innovation. But to be effective in fundamentally driven portfolios, we believe quants should be embedded in the investment team. This allows them to function as a second pair of eyes and raise questions about blind spots that might not be detected in fundamental research. Quantitative teams operating outside the core investment group might not enjoy enough trust for their recommendations to be taken seriously. Working within the team maximizes the benefit of multiple perspectives from quantitative and fundamental analysts to facilitate an integrated approach to risk analysis.

At the same time, risk-management functions are also needed to evaluate looming dangers across the equity markets. This is especially important when looking at issues that are likely to affect all portfolios, such as election risks.

Clear communication is an essential ingredient for quantitative analysts to influence their peers who might not be versed in technical jargon. And for any of these tools to be effective, investment teams need humility—regarding what they know and what they don’t know. We believe these soft skills are just as important for effective risk management as having the right technical tools and should be emphasized in training programs.

AI can support clearer communication between quantitative analysts and the wider investment teams. For example, risk data often manifests in complex data tables that require deciphering. Using large language models (LLMs), an AI technology, it may be possible to create summaries of the data in written paragraphs that are more digestible to a portfolio team than a table of numbers.

Questions to Ask Your Manager

With these issues in mind, investors can approach portfolio managers with a set of questions that sheds light on the efficacy of a firm’s risk-management process and culture.

What kinds of multidimensional tools are used? Which types of risks are targeted with each tool? How does the portfolio team create a risk-aware culture to thoroughly integrate assessments from various sources? Can they demonstrate actionable insights from a risk-management process? How are portfolio managers incentivized to create a risk-aware culture? Ask for an example of lessons learned from a big risk that was missed.

The answers to these questions can help investors determine whether an asset manager is strategically focused on risk management as an integral part of the investment process, or just treats it as an afterthought. Taking calculated risks will always be the cornerstone of alpha for actively managed portfolios. With a comprehensive risk-management structure, as well as the right tools and culture in place, clients can gain confidence that portfolio managers are dynamically attuned to the risks that can make—or break—even the best-laid investment strategy.