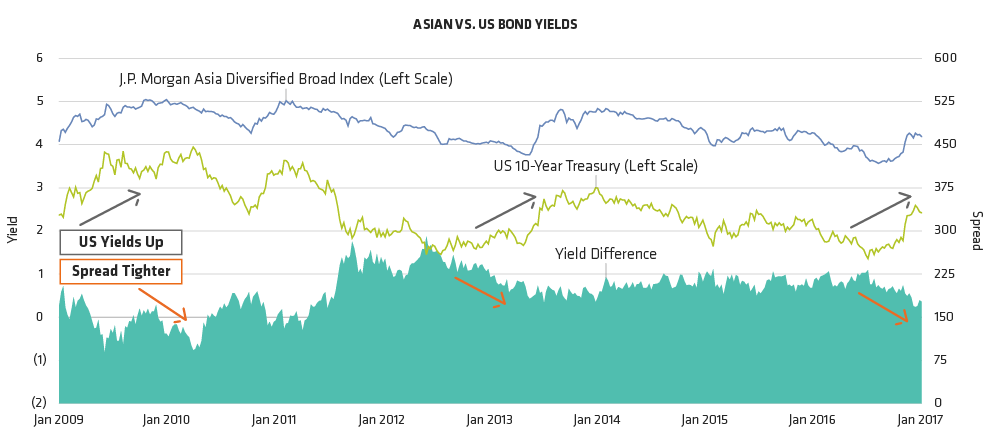

While we are not forecasting significantly higher global yields in 2017, the additional yield available in the Asian bond market and the potential for some outperformance in a rising yield environment help to make Asian bonds attractive, in our view.

The region’s economic diversity means that some countries are at different points of the monetary policy cycle, even while the region as a whole is growing. This offers bond investors the potential to make portfolio gains in countries where interest rates are falling. For global investors, it could be a source of diversification away from other regions where interest rates might be rising (or where they remain negative).

China’s growth is forecast to slow and the country has a lot of debt, but its size and growth rate should remain a source of support for the region. Compared to the US—a US$18 trillion economy growing at 2.5% a year—China is a US$11 trillion economy growing at 5.5% a year.

We retain our view that the renminbi (RMB) will not be a source of additional volatility in 2017. Recent actions by China to restrict capital flows and reduce speculative short positions give us confidence that stability will be the most likely outcome for the RMB.

Regional Trade and FDI Favor Stability

Any US protectionist measures against Asia could be a negative for investor sentiment in the corporate bond market, but we would not expect the reaction to last long.

This is because a scaling back of US economic engagement with Asia would not necessarily result in a vacuum in trade or foreign direct investment (FDI) in the region; instead, it would leave more room for companies from China, India and Japan to pursue their ambitions there and maintain a good level of economic activity.

So how should Asian bond investors position their portfolios to weather Trump-induced volatility?

Research the Risks, Exploit the Opportunities

One way is to be underweight markets such as Hong Kong and Singapore, which are sensitive to US interest rates, and to be overweight in countries where policy is more likely to be eased further, such as Indonesia, India and South Korea.

Investors with access to strong research capabilities can take advantage of opportunities in lesser-known markets such as Sri Lanka, where government bond yields are above 12%.

Asian currencies, in which most global investors are underweight, have the potential to strengthen from current levels, supported by relatively strong economic growth and the region’s robust current account surpluses.

In the short term, then, we believe that Asian bonds and currencies can reasonably withstand any turbulence resulting from the new president’s actions. But the longer-term outlook is even more interesting.

Trump’s Triumph?

For some years now, Asian capital markets have been developing to a point where global investors are beginning to assess them on their own terms—as a region distinct from the broad classification of “emerging markets.”

If Trump succeeds in creating a more isolationist America, that process will likely accelerate, forcing global investors and the managers of bond market indices to review and perhaps increase their allocations to the region.

President Trump may then go down in financial history as helping to make the Asian bond markets an even more vibrant and attractive investment opportunity than they are now.