When the market starts buzzing about rising rates, high-yield bank loans’ popularity grows. Although the bank loan bandwagon may look tempting, we’ve found reasons why high-yield bonds shouldn’t be so easily dismissed.

Investors are constantly on the hunt for higher yields, especially in the sustained low-yield environment of the past several years. When the US Federal Reserve announces a rate hike—or even hints at the possibility—many investors look to high-yield bank loans for extra income. But loans are not so cut and dried.

Don’t Judge a Book by Its Cover

Here are some oft-cited bank loan benefits and why we think high-yield bonds are a better alternative—even when rates rise.

Floating Rates. Bank loans’ floating-rate coupons are a big draw, and may even appear to give loans a leg up on traditional high-yield bonds. One often-overlooked point is how much the Fed would need to raise interest rates for investors to benefit when the rates adjust, or “float.”

Following the global financial crisis, when interest rates landed near zero, investors started demanding more compensation for the risk they took on with high-yield bank loans. As a result, most bank loans are now issued with a “floor,” or a minimum rate of return that investors receive above the benchmark rate.

Here’s the rub: investors only benefit when the loan’s floating rate rises above the floor.

Also, LIBOR doesn’t necessarily move in lockstep with the Fed. LIBOR trades with a spread to the federal funds rate, and if that spread compresses, it could keep LIBOR from rising significantly for some time—even if the Fed continues to raise rates.

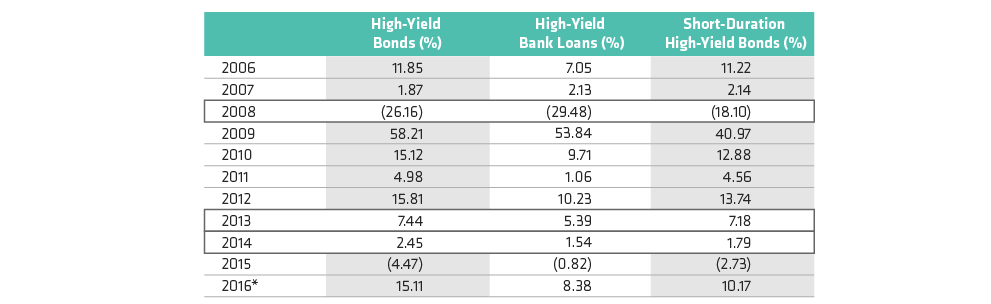

Performance. Bonds have shown resiliency in the past several years, outperforming bank loans for the past eight years, with one exception—2015, when all high-yield sectors took a hit. Bonds stood their ground in some tough years, too: in 2008 during the credit crisis; in 2013 during the “taper tantrum,” when 10-year Treasuries skyrocketed by 160 basis points and spreads compressed; and in 2014 when oil fell, and bonds still beat loans despite having more exposure to the energy sector (Display).