-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

A Recipe for Lower Volatility in High Yield

04 April 2016

3 min read

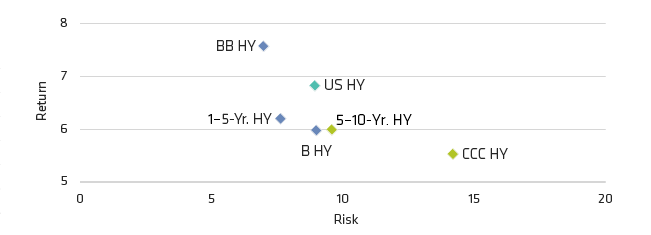

High Quality And Short Duration

Better Returns, Less Volatility (January 1994–December 2015)

As of December 31, 2015

1–5-year HY is represented by Barclays US High Yield 2% Issuer Capped 1–5 Year; US HY is represented by Barclays US High Yield

2% Issuer Capped index; 5–10-year HY is represented by Barclays US High Yield 2% Issuer Capped 5–10 Year; BB HY is represented by Barclays US High Yield 2% Issuer Capped Ba Component; B HY is represented by Barclays US High Yield 2% Issuer Capped B Component; and CCC HY is represented by Barclays US High Yield 2% Issuer Capped CCC Component.

Source: Barclays and AB

Drawdowns Smaller For Short-duration High Yield

Monthly Returns (Percent)

Historical analysis does not guarantee future results.

As of December 31, 2015

High yield represented by Barclays US Corporate High Yield, short duration high yield by Barclays US High Yield BB/B 1–5 Year.

Source: Barclays and AB

About the Author