- Institutional Investor

- Investment Professional

- Individual Investor

The Iceland website is not available. You will be redirected to the Luxembourg website which contains funds approved for marketing in Luxembourg, and where several of these funds are not registered for marketing in Iceland.

Heimasíða Íslands er ekki aðgengileg. Þér verður vísað á heimasíðu Lúxemborgar sem inniheldur sjóði sem samþykktir eru til markaðssetningar í Lúxemborg og þar sem nokkrir þessara sjóða eru ekki skráðir til markaðssetningar á Íslandi.

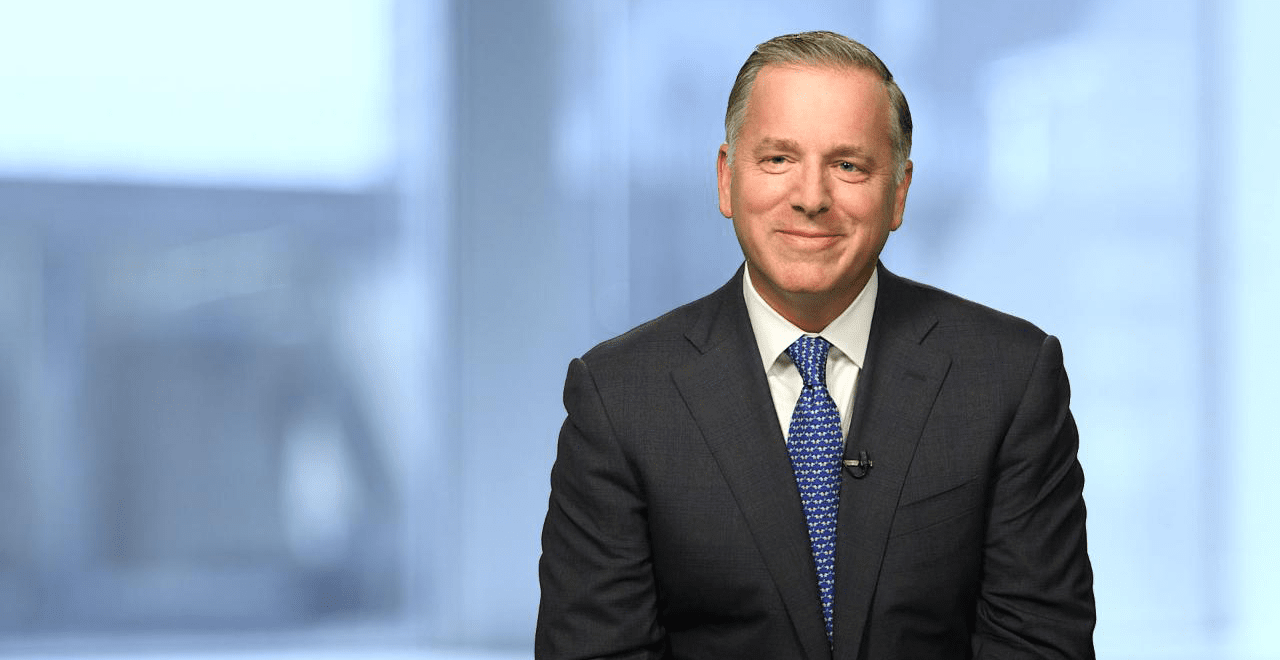

James T. Tierney, Jr.

11 Years at AB|36 Years of Experience

James T. Tierney, Jr. is Chief Investment Officer of Concentrated US Growth. Prior to joining AB in December 2013, he was CIO at W.P. Stewart & Co. Tierney began his career in 1988 in equity research at J.P. Morgan Investment Management, where he analyzed entertainment, healthcare and finance companies. He left J.P. Morgan in 1990 to pursue an MBA and returned in 1992 as a senior analyst covering energy, transportation, media and entertainment. Tierney joined W.P. Stewart in 2000. He holds a BS in finance from Providence College and an MBA from Columbia Business School at Columbia University. Location: New York

Published Work

As the AI halo begins to fade, equity investors are seeking companies that can profit from—and not just pontificate about—artificial intelligence.

James T. Tierney, Michael Walker | 20 August 2024

Competition for electric vehicles is mounting, but demand persists. So how can equity investors capture the potential of the fast-changing industry?

James T. Tierney, Michael Mathay | 04 April 2024

Earnings haven’t been consistently rewarded in equity markets recently. That could change faster than you think.

Dev Chakrabarti, James T. Tierney | 12 February 2024

Recent labor agreements in the auto and airline industries spotlight the profitability conundrum facing US companies—and equity investors.

James T. Tierney | 23 November 2023

Equity investors should look beyond the hype for companies with clear strategies to profitably monetize the benefits of generative AI.

James T. Tierney, Michael Walker | 06 September 2023

Despite softening demand, US home prices remain elevated. The culprits are high interest rates, limited supply and owners' reluctance to take on new mortgages.

Eric Winograd, James T. Tierney | 25 August 2023

Three of our US equity portfolio managers discuss market conditions in 2023 and provide perspectives on positioning for the challenges ahead.

James T. Tierney, Ben Ruegsegger, John Fogarty | 17 August 2023

Here’s what we learned in earnings season about how companies are coping with a particularly tricky set of macroeconomic conditions.

Dev Chakrabarti, James T. Tierney | 16 May 2023

With 2023 approaching, all eyes are on corporate earnings forecasts. We believe companies that demonstrate three critical competitive advantages will be best positioned for earnings success in the coming year.

James T. Tierney | 13 December 2022

Three chief investment officers of our US equity portfolios discuss their approaches to identifying quality stocks and explain why they think quality will ultimately perform well again despite a difficult 2022.

James T. Tierney, Dan Roarty | 15 November 2022

Three chief investment officers of our US equity portfolios discuss their approaches to identifying quality stocks and explain why they think quality will ultimately perform well again despite a difficult 2022.

James T. Tierney, Dan Roarty | 15 November 2022

There are already signs that some deflationary forces may be just around the corner. Investors should consider the implications.

James T. Tierney | 01 August 2022

The recent divergence of the largest US technology and new media stocks reminds us why fundamentals should always trump fads for long-term equity investors.

James T. Tierney, Michael Walker | 23 May 2022

In a tougher economic environment, investors in growth stocks must identify companies with the right features to overcome headwinds to earnings.

Dev Chakrabarti, James T. Tierney | 11 May 2022

Solid earnings growth and high profitability underpin the benefits of US stocks, even in a tougher environment during 2022.

James T. Tierney, Kurt Feuerman | 12 January 2022

Companies that have pricing power will be able to maintain strong margins, even in an inflationary environment.

James T. Tierney | 01 November 2021

A wave of inflation is rolling through the economy. To be successful, companies must have pricing power in their business quiver.

Dev Chakrabarti, James T. Tierney | 03 October 2021

US vacationers are out in force while the holiday scene remains subdued in Europe and Asia. How can equity investors capture the unfolding global mobility recovery?

James T. Tierney, Dev Chakrabarti, Jonathan Berkow | 06 August 2021

Many companies expediting the digital revolution aren't household names. But they often offer stronger growth potential than big-name brands making blockbuster products.

James T. Tierney | 19 July 2021

Investors are reassessing which types of companies will thrive in the next stage of the recovery amid the recent rebound of value stocks. But we think the distinguishing performance factor will be a company’s ability to generate sustainable earnings, regardless of its style classification.

Dev Chakrabarti, James T. Tierney | 13 April 2021

The GameStop drama that has rattled US stocks reflects the growing power of individual investors to shape market events. But there are lessons for traditional, long-term investors, too. When markets ignore fundamentals, redoubling a focus on quality is the best way to produce consistent returns while reducing volatility.

James T. Tierney | 04 February 2021

Portfolio Perspectives: In almost any macroeconomic environment, investors can find great businesses that can continue to deliver growth, but they are few and far between. Equity investors who know how to find them can benefit from shares that have tended to deliver consistent outperformance over time.

James T. Tierney | 20 October 2020

As a leading investment management and research firm, AB's unique combination of expertise, insights and global reach allows us to anticipate and advance what's next-applying collective insights to help keep our clients at the forefront of change.

James T. Tierney | 16 September 2020

The five largest US growth stocks now comprise more than a third of the Russell 1000 Growth Index. Investors should be alert to the risks of high benchmark concentration.

James T. Tierney | 06 July 2020

Economic fallout from the pandemic is devastating US retail. But companies that were already adapting well to seismic changes in the industry should prosper over time.

James T. Tierney, Ann Toschach | 19 May 2020

In the midst of a historic crisis, it's hard to see through the fog. But investors who ask the right questions now will be able to identify companies that can make it through.

James T. Tierney | 25 March 2020

With US equities trading at relatively high valuations, earnings growth will be essential for investors to generate returns in 2020. That’s a tall order in today’s environment. Finding standout companies with sustainable growth potential will be especially important.

James T. Tierney | 03 February 2020

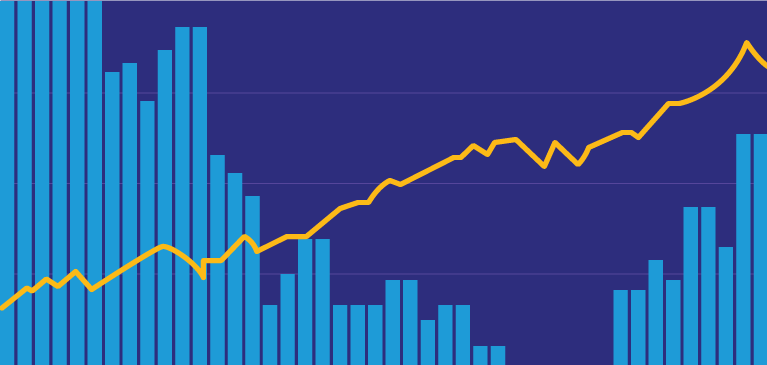

After a series of disappointing initial public offerings (IPOs), private and public equity investors are becoming more discerning about earnings. And for good reason. Profitable companies outperform by a wide margin over time, even among high-growth companies, which often post losses early in their lifecycles.

Michael Walker, James T. Tierney | 05 December 2019

As a leading investment management and research firm, AB's unique combination of expertise, insights and global reach allows us to anticipate and advance what's next—applying collective insights to help keep our clients at the forefront of change.

James T. Tierney | 12 November 2019

There's growing evidence that private equity markets are beginning to overheat after several high-profile IPO flops. Investors in stocks should pay attention because private funding troubles are also a very public market affair.

James T. Tierney, Tiffany Hsia | 25 October 2019

My first investment-related job was on the floor of the New York Stock Exchange (NYSE), more than 40 years ago. So I was feeling a bit nostalgic when I recently visited the NYSE to attend Mastercard's analyst meeting, which reinforced my conviction about the importance of innovation in the 21st century.

James T. Tierney | 03 October 2019

Many US corporations are indulging heavily in leverage. That may be all right for now, but if economic conditions deteriorate, those highly leveraged companies will face difficulties in the next few years. But investors can find active equity solutions that generate returns without the risk of excess leverage.

James T. Tierney | 23 September 2019

In today's highly uncertain market environment, investors in US stocks are paying a premium for companies with high-dividend yields. But how much is too much—especially if interest rates stop declining? Stocks with resilient high-growth profiles deserve a closer look.

James T. Tierney | 17 September 2019

I started back in the eighties as part of a centralised research group. Each person was responsible for an individual sector. Instead, what we do within our concentrated approaches today is we work as a team. I'll give you an example, when we go to visit Apple.inc, we bring our retail analyst, we bring our tech analyst, and I go given my media experience. What is Apple? Apple is a little bit of a retailer, a little bit of a tech company and a whole lot of a media company. So I think the combination of three people around the table asking questions really brings some huge synergies to the research that we do on Apple that most centralised research shops can't provide.

James T. Tierney | 04 September 2019

Equity markets recovered in June as the US Federal Reserve turned decidedly dovish, coming in line with most central banks around the world. But after posting strong gains, to end the quarter close to a record high, how much more steam do US stocks have left?

James T. Tierney | 09 July 2019

There are many ways to apply responsible investing principles to portfolios. But some investing approaches may be more conducive to creating a portfolio with strong environmental, social and governance (ESG) qualities than others. Concentrated equities are a case in point.

James T. Tierney, Ton Wijsman | 02 July 2019

From rising sea levels to catastrophic weather events, investors can't afford to ignore the risks of climate change. Since many companies would be vulnerable if current climate forecasts materialize, asset managers may want to consider climate change in their equity research process and engage management teams on the subject.

James T. Tierney, David Tsoupros | 22 April 2019

Many US companies have forgotten how to raise prices because they haven't had to for a long time. In some sectors, such as retail, pricing power has been hobbled by the giant consolidated retailers, leaving other businesses unable to adequately offset inflationary pressures.

James T. Tierney | 27 March 2019

With US stocks facing multiple risks, it's easy to lose sight of the positive trends that could help the market recover. In 2019, investors should search for select stocks with the right attributes to produce positive surprises in a potentially tricky market environment.

James T. Tierney, Kurt Feuerman | 14 January 2019

US companies reported stellar first-quarter profits this year. But some investors suspect that earnings growth has plateaued. Our research suggests that slowing earnings growth means nothing for stock prices.

James T. Tierney | 14 May 2018

Finding high-quality companies is an essential component of many equity strategies. But with revolutionary forces sweeping through key industries, what really defines quality stocks? Investors must think proactively about how to identify quality in a changing world.

James T. Tierney, Dev Chakrabarti | 20 February 2018This is a marketing communication. This information is provided by AllianceBernstein (Luxembourg) S.à r.l. Société à responsabilité limitée, R.C.S. Luxembourg B 34 305, 2-4, rue Eugène Ruppert, L-2453 Luxembourg. Authorised in Luxembourg and regulated by the Commission de Surveillance du Secteur Financier (CSSF). It is provided for informational purposes only and does not constitute investment advice or an invitation to purchase any security or other investment. The views and opinions expressed are based on our internal forecasts and should not be relied upon as an indication of future market performance. The value of investments in any of the Funds can go down as well as up and investors may not get back the full amount invested. Past performance does not guarantee future results.

This information is directed at Professional Clients only and is not intended for public use.