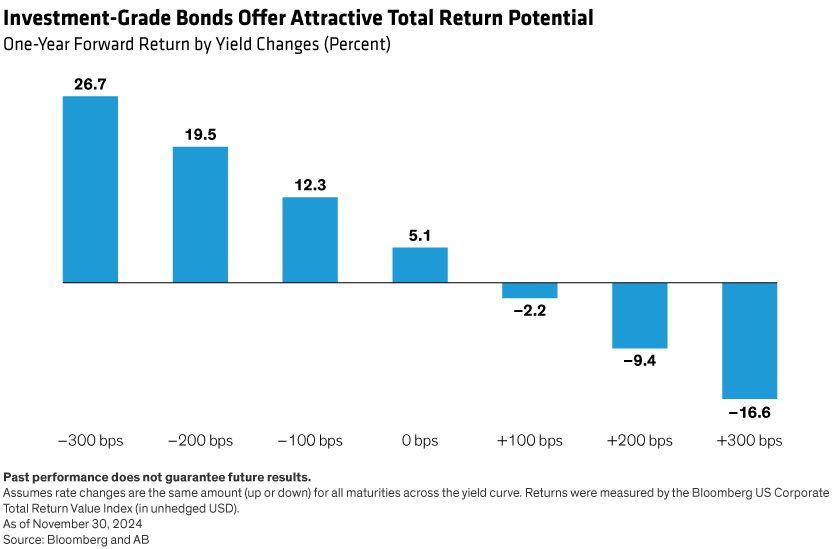

Investment-grade bonds are also appealing from a risk management perspective, in our view. While not our base case, a hard landing scenario should help investment-grade bonds perform strongly, with a fall in yields more than offsetting wider spreads.

Corporate fundamentals remain generally strong, and we don’t anticipate any significant deterioration in credit quality next year. Spreads are tight, but historically have shown the ability to remain in a tight range for some time and could further benefit from investor demand as cash rates continue to fall.

Extend Duration but Position for a Steeper Yield Curve

We believe it’s also prudent to extend duration, or sensitivity to interest-rate risk, in 2025, generally achieved through adding exposure to government bonds. Moreover, we think the entry point is attractive: the US 10-Year Treasury yield has surpassed the three-month cash rate, as measured by the US 3-Month Treasury yield, for the first time since 2022.

While we expect yields to generally move lower, market concerns over growing US budget deficits and higher inflation could keep them higher for longer at longer maturities. The yield curve also tends to steepen during easing cycles, so we currently believe the risk-reward trade-off is more favorable in shorter to intermediate maturities (2–10 years).

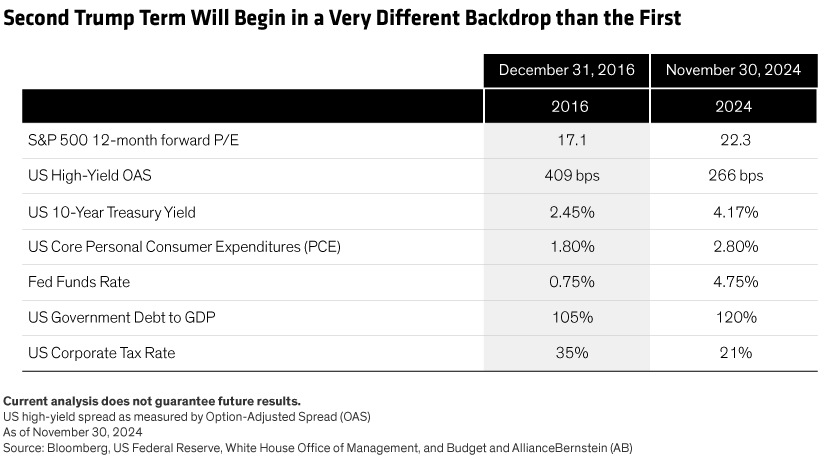

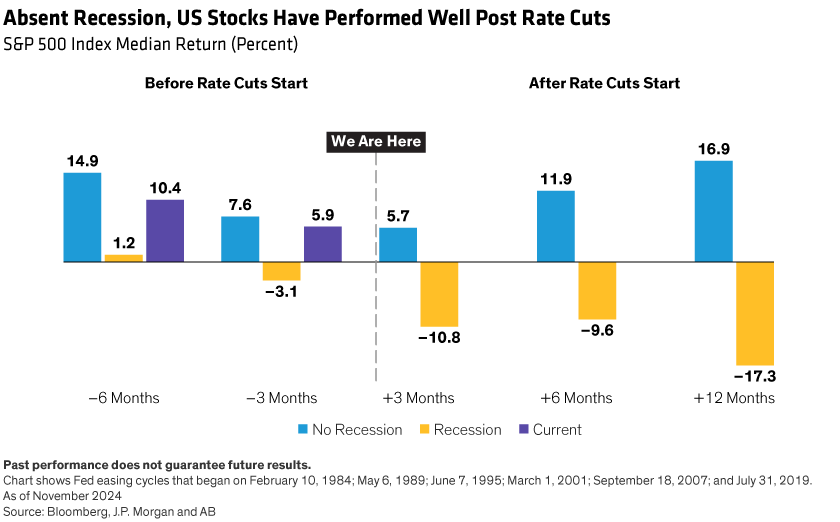

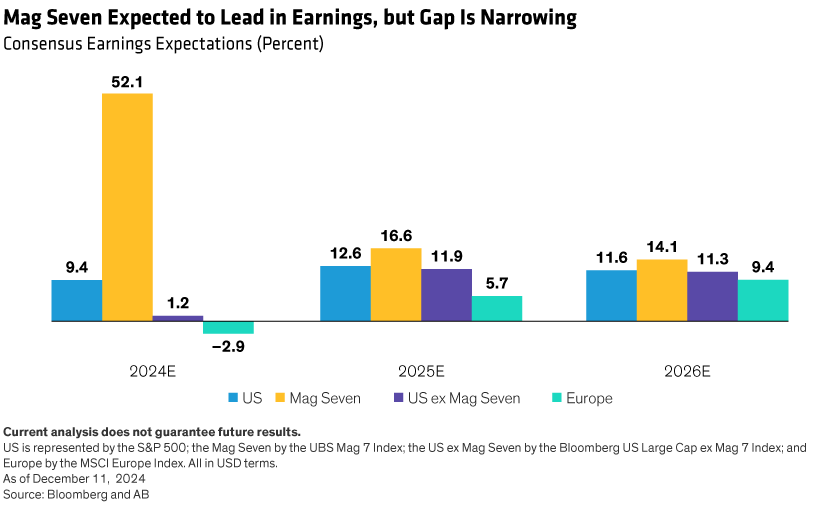

To sum things up, we expect US market leadership to persist, supported by a stronger economic backdrop, deregulation and a potentially more business-friendly administration. While stock valuations are back at 2021 levels, bond yields look more reasonable and offer ample buffer for further policy easing.

We also expect stock-bond correlations to move lower. This should reassert the complementary dynamic that could support risk-adjusted returns for multi-asset income strategies. Diversification across styles, sectors and factors within asset classes will also be key—particularly if we see stagflationary risks rise across the year.

In our view, the environment for multi-asset income strategies to generate both yield and upside potential remains attractive, but as always, a flexible and dynamic approach will remain key as opportunities broaden in 2025.