Many energy companies have been downgraded to junk status, but some will rebound faster than others as commodity prices recover. Investors tapping global bond markets for income should take note.

In the first quarter alone, more than $64 billion in US corporate bonds tumbled from investment grade to junk—already more than the $40 billion downgraded in 2015. Roughly three-quarters of this year’s downgrades were energy or metals-and-mining companies hit by the commodity price plunge.

Regardless of which country investors call home, the US high-yield bond market is a key source of income-generating opportunities, so this development calls for a response.

At first blush, it might seem prudent to avoid these “fallen angels,” as former investment-grade bonds are known. When the major ratings agencies strip a company of its investment-grade status, many investors conclude that the company’s future is bleak.

Too Much Supply, Too Little Demand

This is partly because many managers are prohibited from owning any subinvestment-grade bonds. If a bond drops to high yield, investment-grade-only portfolio managers have to sell it. This forced selling often causes prices to fall more than they should.

At the same time, willing buyers can be hard to find right after a bond falls to junk. Some investors are put off by the negative headlines. Some high-yield managers don’t spend much time analyzing investment-grade bonds, so it can take them longer to research a fallen angel before deciding whether or not to invest.

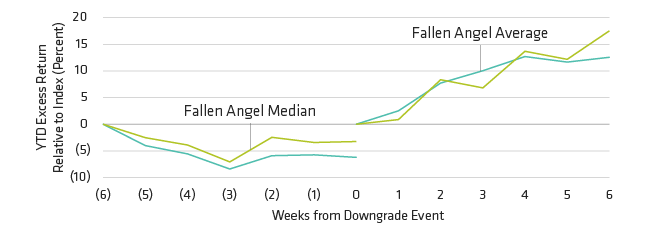

The result: a lot of fallen angels enter the high-yield universe undervalued relative to their credit fundamentals. But when investors refocus on fundamentals, many of these bonds end up outperforming original-issue high-yield bonds. Investors who can recognize the mispricing before the rest of the market does can potentially capitalize on these dynamics. But they need to act fast. As the following Display shows, fallen angels can start to recover quickly after a downgrade.