Economic Perspectives

Showing 1-13 of 1,316 Results

With flexibility, humility and disciplined processes, equity investors can find a way forward.

A well-planned defensive strategy can position equity portfolios to be resilient in a very harsh market environment.

Negotiating with one key trade partner is tough enough. Negotiating with two is highly testing.

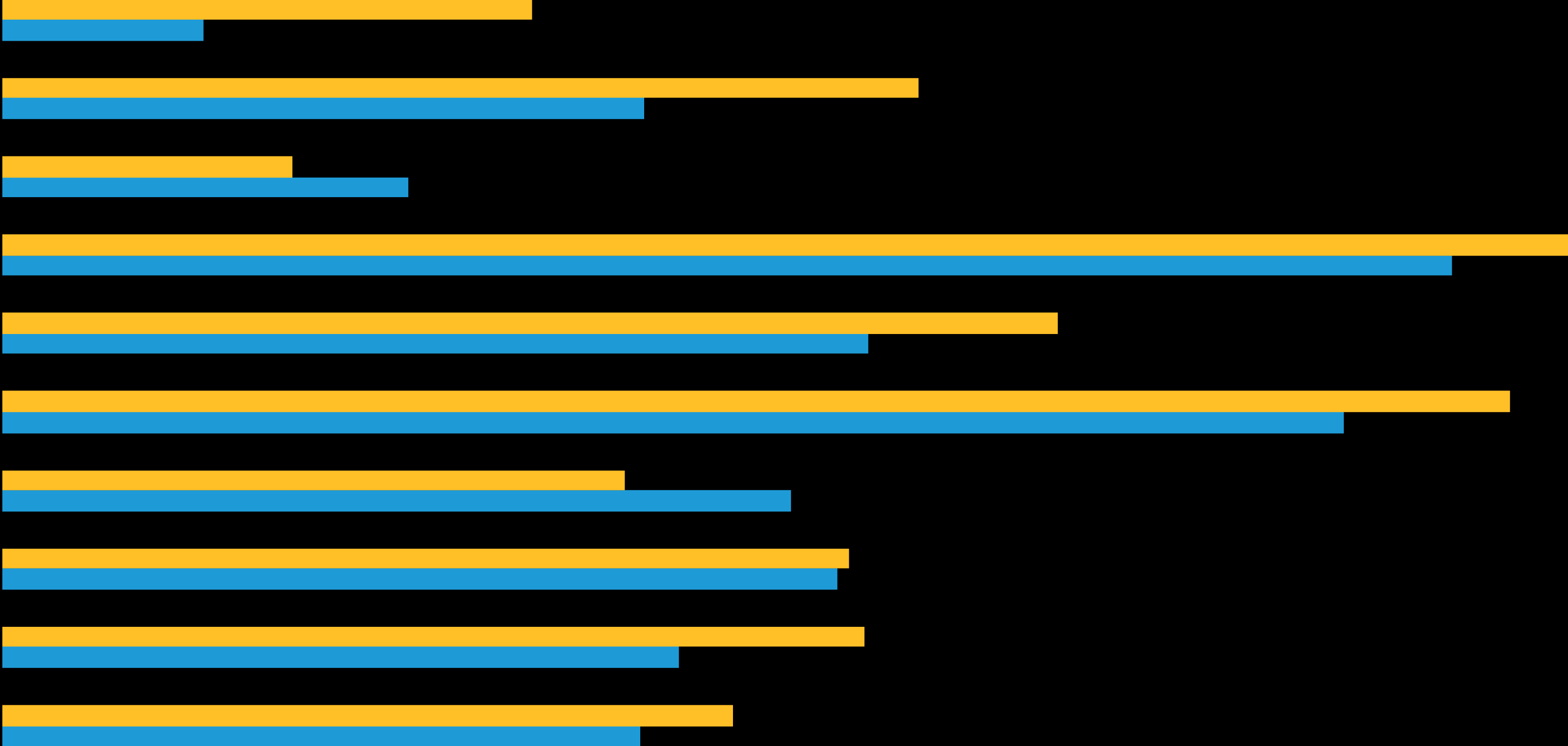

High-yield bonds may be an attractive choice for investors looking to rebalance portfolios.

They may be the main target of US tariffs, but many Chinese companies can cope with trade-war pressures.

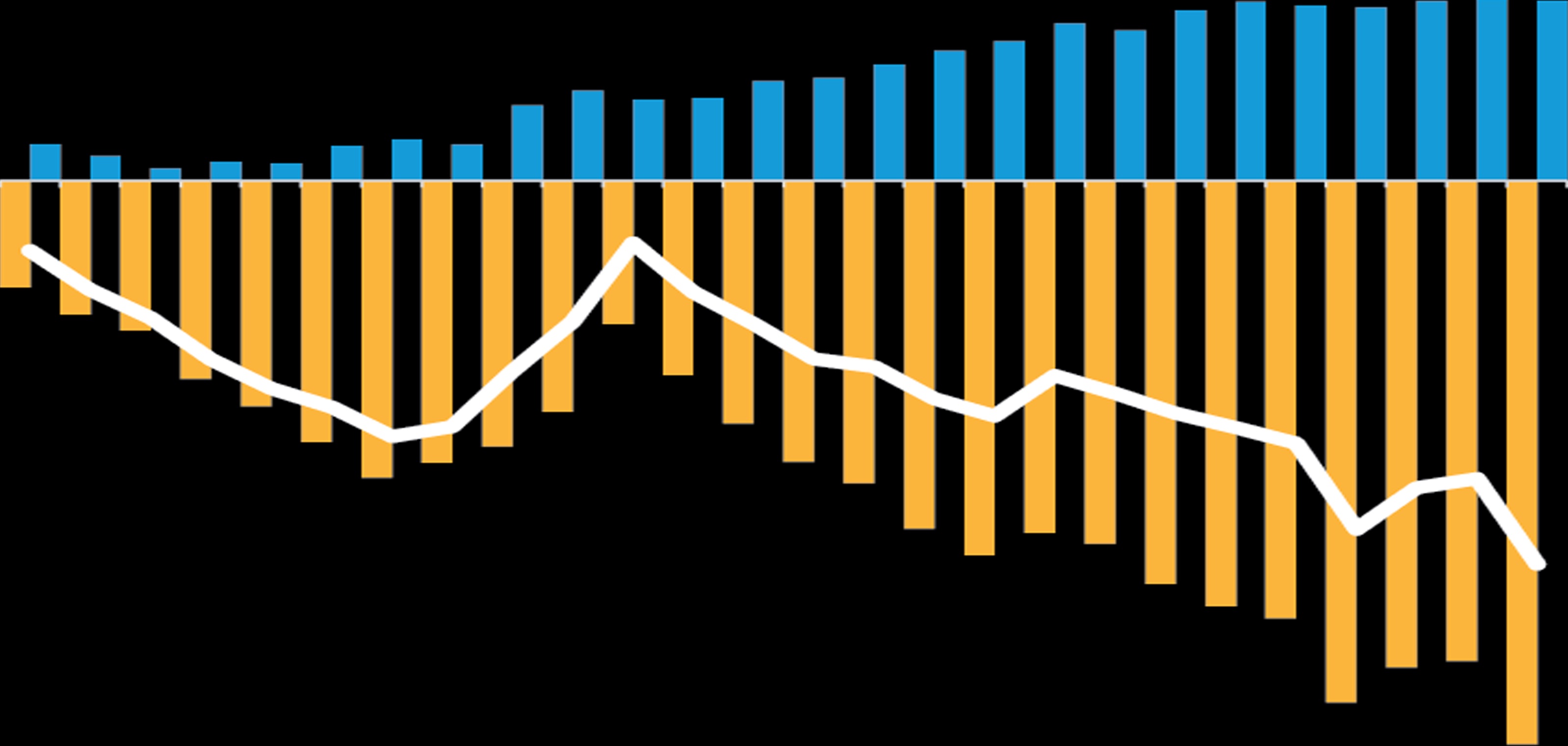

We check in on what has been a rollercoaster ride for markets as tariff policies bite.

What triggered April’s Treasury sell-off? What’s next? And how should investors manage duration risk?

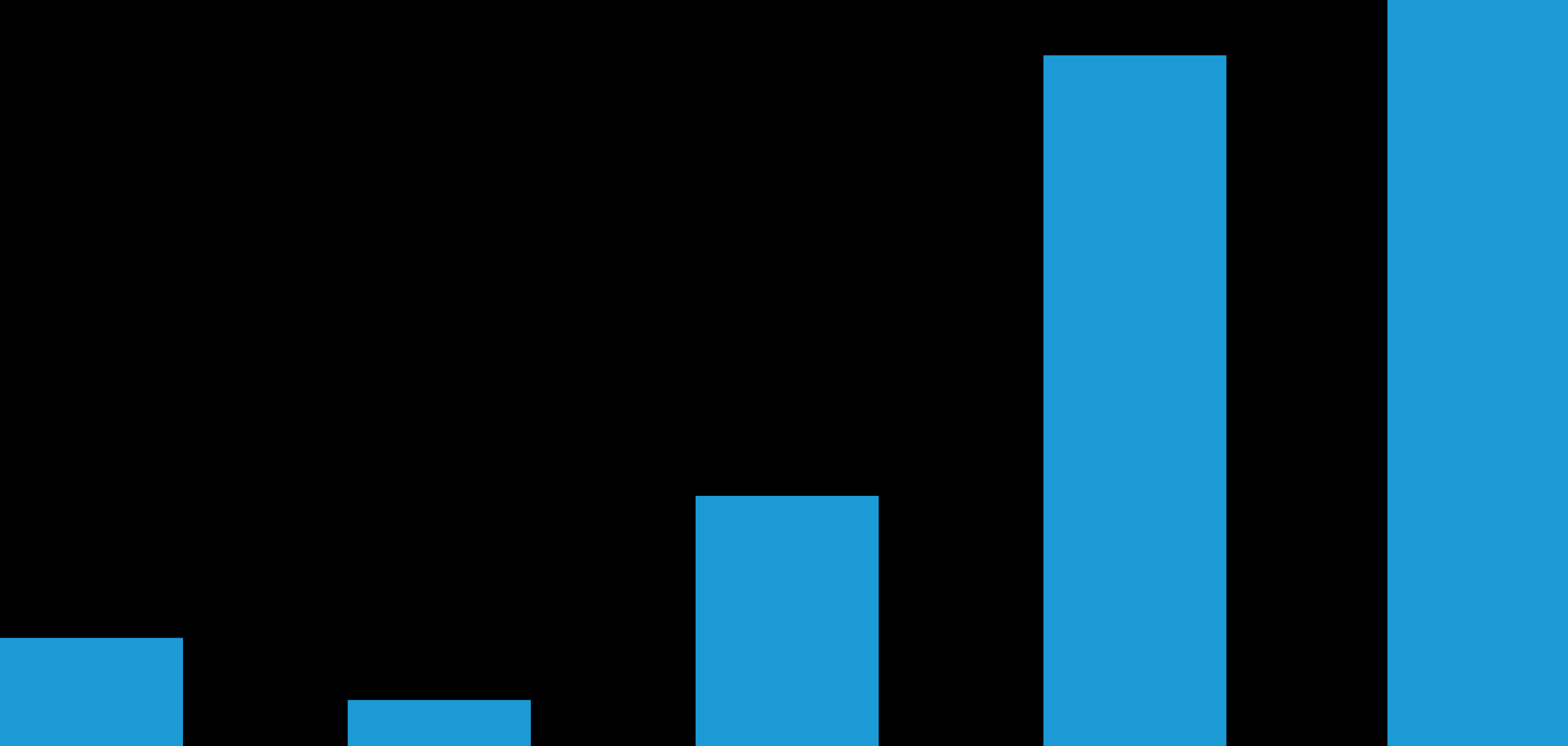

Extreme fear in equity markets has often been followed by extremely good returns.

Emerging-market stocks have done particularly well after equity market crises in the past.

President Trump’s tariffs bring déjà vu for the euro-area economy: it’s back to slower growth and lower rates.

Recent months have seen an upending of the economic and geopolitical system. The investment community has, rightly, focussed on the impact of tariffs but the changes are deeper than that. They amount to a loss of trust that is likely to be demi-permanent and unlikely to be restored.

As volatility rises, staying invested is a strategic priority for capturing long-term return potential in a broadening market.

How might the recently announced US trade measures translate into economic reality?