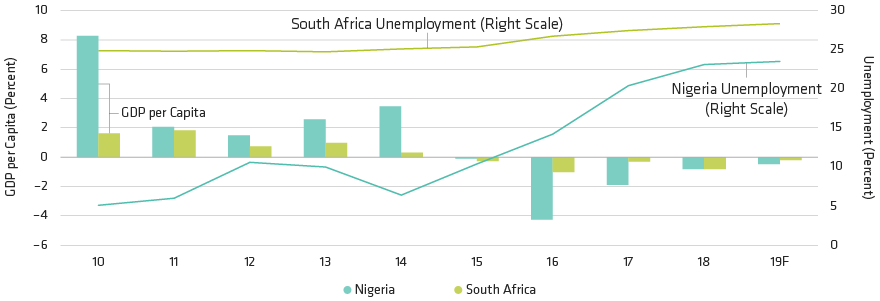

Both economies need radical change, but that’s easier said than done. So far, neither government has developed a strategy for solving these problems, meaning job-creating economic growth will be in focus when voters go to the polls.

The good news is that the risks often associated with African elections—last-minute spending sprees, ruling parties’ historical reluctance to relinquish power—have faded. Although recent instability in Gabon and Democratic Republic of Congo were reminders of African political risks, we’ve seen a number of peaceful and market-friendly transitions across the continent.

In Nigeria, Oil Still the Kingmaker

Power changed hands peacefully in Nigeria in 2015. But since Nigeria is one of the world’s largest oil producers, declining oil prices at the time meant that incoming President Muhammadu Buhari inherited a slowing economy. His government has struggled to turn things around, and his approval rating collapsed from around 80% after being elected to roughly 40% a year later.

Even so, Buhari seems to have a slight edge heading into the February 16 election. But his main rival, former Vice President Atiku Abubakar, is seen as slightly more market friendly, and could stage an upset in what’s almost certainly going to be a close election, in our view.

The two men’s party platforms and policies are not that different, but we suspect the market would cheer an Abubakar victory simply because it would shake up the uninspiring status quo. Abubakar has implied that he would support a more flexible exchange rate for the naira, a precondition for the country to be added back into global bond indices.

But for most investors, the bottom line has a lot to do with oil prices. If prices rise, the next president—whoever it is—will likely have more success implementing structural changes; if they fall, he’ll struggle. That’s just the luck of the draw for any Nigerian president, given the country’s dependence on oil.

Building on South Africa’s Progress

South Africa, on the other hand, got a dose of political change when Cyril Ramaphosa became president of the ruling African National Congress (ANC) in late 2017 and then president of the country nearly a year ago when his predecessor, Jacob Zuma, resigned.

Markets welcomed the change, but optimism has since faded as the depth of domestic corruption and institutional decline came to light. We think South Africa is healthier today than it was a year ago, but many of the social and economic challenges that the ANC inherited in 1994 at the end of apartheid have not been addressed.

To be fair, Ramaphosa has made significant strides over the past 12 months. According to recent opinion polls, the ANC should be able to win about 60% of the vote when the election is held—most likely in May. That’s important, because we think the bigger the margin of victory for Ramaphosa, the stronger his mandate for change.

The Elephants in the Room

We think economic growth in Nigeria and South Africa could accelerate after the elections on greater certainty and improved consumer and business confidence. But we expect real GDP growth to remain subdued in 2019—a touch above 2% in Nigeria and roughly 1% in South Africa.

Even so, we’re expecting asset prices to rally in both countries despite the macroeconomic challenges. Nigerian assets are likely to rise more if Abubakar wins. In South Africa, a strong showing for Ramaphosa could lead to sharp gains.

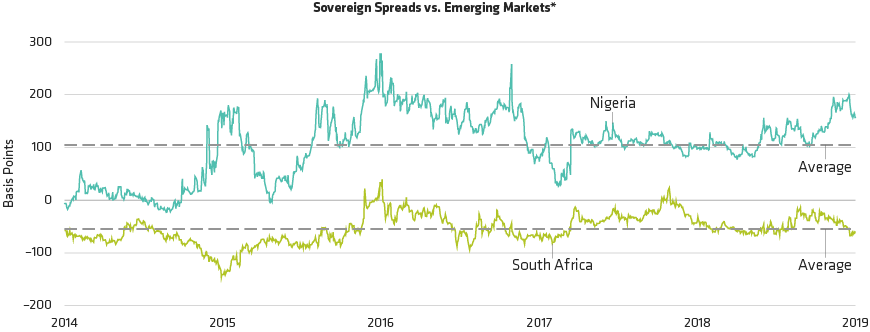

Bond prices in both countries seem to offer value and look to be on favorable trajectories (Display) in 2019 despite the macroeconomic challenges.