-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

For Muni Investors, COVID-19 Provides Lessons in Liquidity

Past performance and current analysis do not guarantee future results.

As of July 31, 2020

Average return when S&P 500 is negative is based on monthly observations from August 31, 2010, through July 31, 2020.

Source: Bloomberg and AllianceBernstein (AB)

Past performance and current analysis do not guarantee future results.

As of August 14, 2020

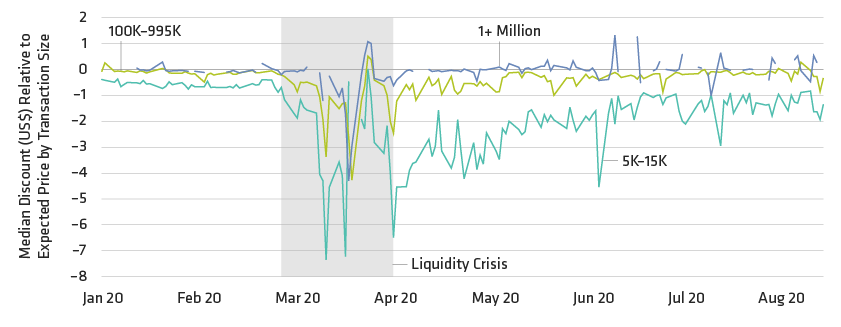

Median discount relative to expected price is the median of actual trade prices compared to the reference price from the Interactive Data Corporation pricing service.

Source: Interactive Data Corporation and AllianceBernstein (AB)