-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

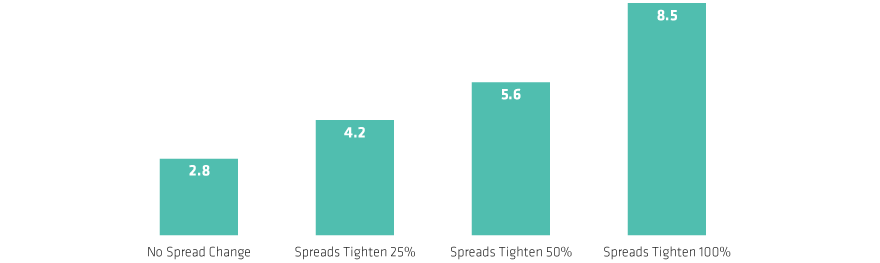

Mid-Grade Munis Have Room to Rebound

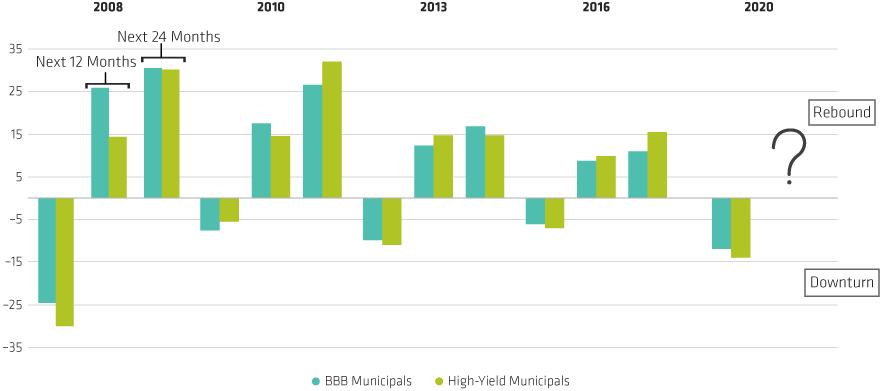

As of June 12, 2020

For illustrative purpose only. There I no guarantee the investment objective will be achieved. Illustrates expected returns for a hypothetical 10-year BBB-rated municipal bond under-various scenarios, from no change in spread to a full (100%) return to 2020’s lowest spread level.

Source: Bloomberg and AllianceBernstein (AB)

As of May 31, 2020

Drawdown periods are as follows: 2008: May2007–Dec 2008; 2010: Nov 2010–Jan 2011; 2013: May 2013–Aug 2013; 2016: Oct 2016–Nov 2016; 2020: Mar 2020–Apr 2020.

Source: Bloomberg Barclays, Morningstar and AllianceBernstein (AB)

Daryl Clements is a Senior Vice President and a Municipal Bond Portfolio Manager on AB’s Municipal Fixed Income team, where he is responsible for overseeing the firm’s various separately managed accounts (SMA) and mutual fund assets. He joined AB in 2002 as a municipal credit research analyst, responsible for evaluating municipal issuers nationwide, with a particular focus on the transportation, public power and tobacco-backed bonds sectors. In 2006, Clements was promoted to the portfolio-management team and became a member of the Tax-Exempt Fixed Income Investment Policy Group. Since that time, municipal assets under management have increased from US$22 billion to nearly US$80 billion. Within that growth, Clements spent considerable time expanding and broadening the team’s SMA business. Prior to joining the firm, he was an associate director and municipal credit analyst for Financial Guaranty Insurance Company for six years and a municipal research associate for five years before that with Moody’s Investors Service. Clements holds a BS in business, management and finance from Brooklyn College and an MBA in finance from Pace University. In 2008, he co-authored the “How to Analyze Airport Revenue Bonds” chapter in The Handbook of Municipal Bonds. Location: New York