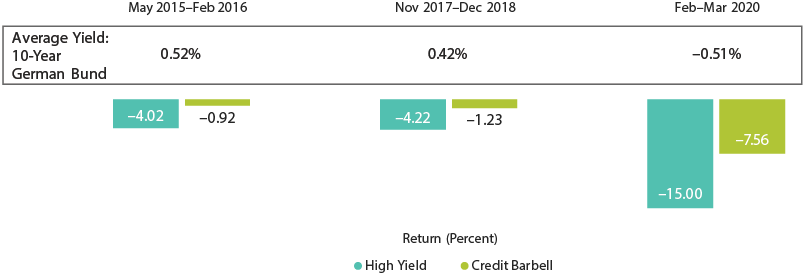

During the periods shown above, when high-yield spreads widened meaningfully, government bond yields were at or below half a percent. Yet in every case, a balance between government and high-yield bonds significantly muted the credit downdraft.

Even when German bund yields were negative, as in the most recent downturn, government bonds proved an adequate buffer and led to meaningfully higher returns for a balanced strategy compared with risk assets alone.

The Path to Efficient Income

Despite the advantages to holding government bonds as a buffer, some income investors may be tempted to simply forgo exposure to rate risk in today’s low-yield environment. In this case, the most likely alternative to a balanced bond strategy is an investment-grade corporate portfolio.

At first glance, a corporate portfolio seems like a reasonable option. We can construct a US investment-grade corporate portfolio that has roughly the same average quality as a simply constructed balanced portfolio comprising 50% US Treasuries and 50% US high yield (excluding debt rated CCC). The two hypothetical portfolios would have an average quality of A–/BBB+ and also have similar durations and historical volatility.

But there the similarities end. When we compare the average yield on the investment-grade corporate portfolio (2.2% as of early June) to the average yield on the naïve balanced portfolio (3.4%), we see that the balanced strategy supplies meaningfully higher income—and income would be higher still if we were to diversify across higher-yielding sectors.

Beyond a Static Balanced Bond Approach

The balanced bond strategy story doesn’t end here. Active management can increase income still further as well as potentially enhance downside mitigation and/or upside participation.

Managers can and should go beyond naïvely constructed, fixed allocations—diversifying their credit exposure across higher-yielding sectors, capitalizing on relationships along the yield curve, and tilting the structure toward rates or toward credit, depending on the market environment. Here are some approaches to consider today:

Actively manage interest-rate risk. As we’ve argued above, it’s important to hold duration during stressed market environments, even when yields are low. But where you take that interest-rate risk is also important. For example, the intermediate range of the US Treasury yield curve is relatively attractive today. Because it’s steeper, it provides both more generous yield and a price bump as bonds “roll” down the curve toward maturity.

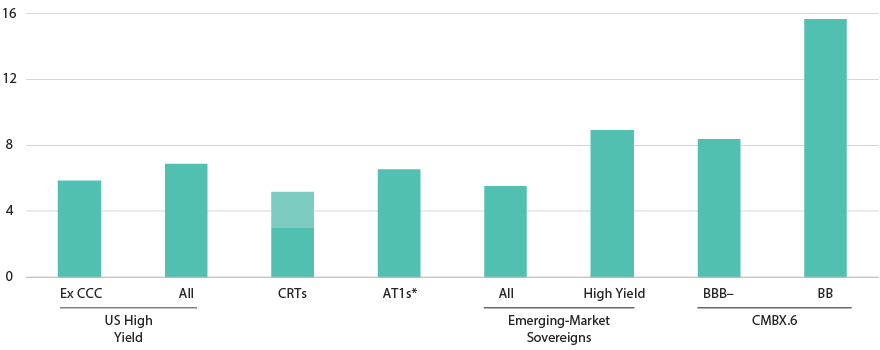

Diversify beyond US high-yield corporates. On the credit end of the balanced portfolio, consider diversifying across sectors to enhance income and potential return. This approach takes advantage of differing correlations among sectors and capitalizes on relative value opportunity.

For example, today we see opportunities—and compelling yield (Display 4)—in select BBB-rated corporates; subordinated (AT1) European bank debt; securitized assets, such as credit risk–transfer securities; sovereign emerging-market debt; and even fallen angels.