For a deeper exploration of this topic, read our white paper, Cutting the Gordian Knot: How ESG Integration Can Help Solve Challenges to Investing in Emerging-Market Corporates.

Shamaila Khan: Bond investors are desperately searching for yield; EM corporate investment can actually be an attractive opportunity for investors. However, I do feel that investors are still very hesitant. They are still concerned about ESG. And I know Patrick that you’ve done a tremendous amount of in-depth research in this regard. Can you please share your views on how you analyze ESG in the sector?

Patrick O’Connell: Emerging-market corporate bonds have had excellent risk-adjusted returns. And yet there are a couple of large myths regarding ESG in emerging-market corporations that I’d like to dispel.

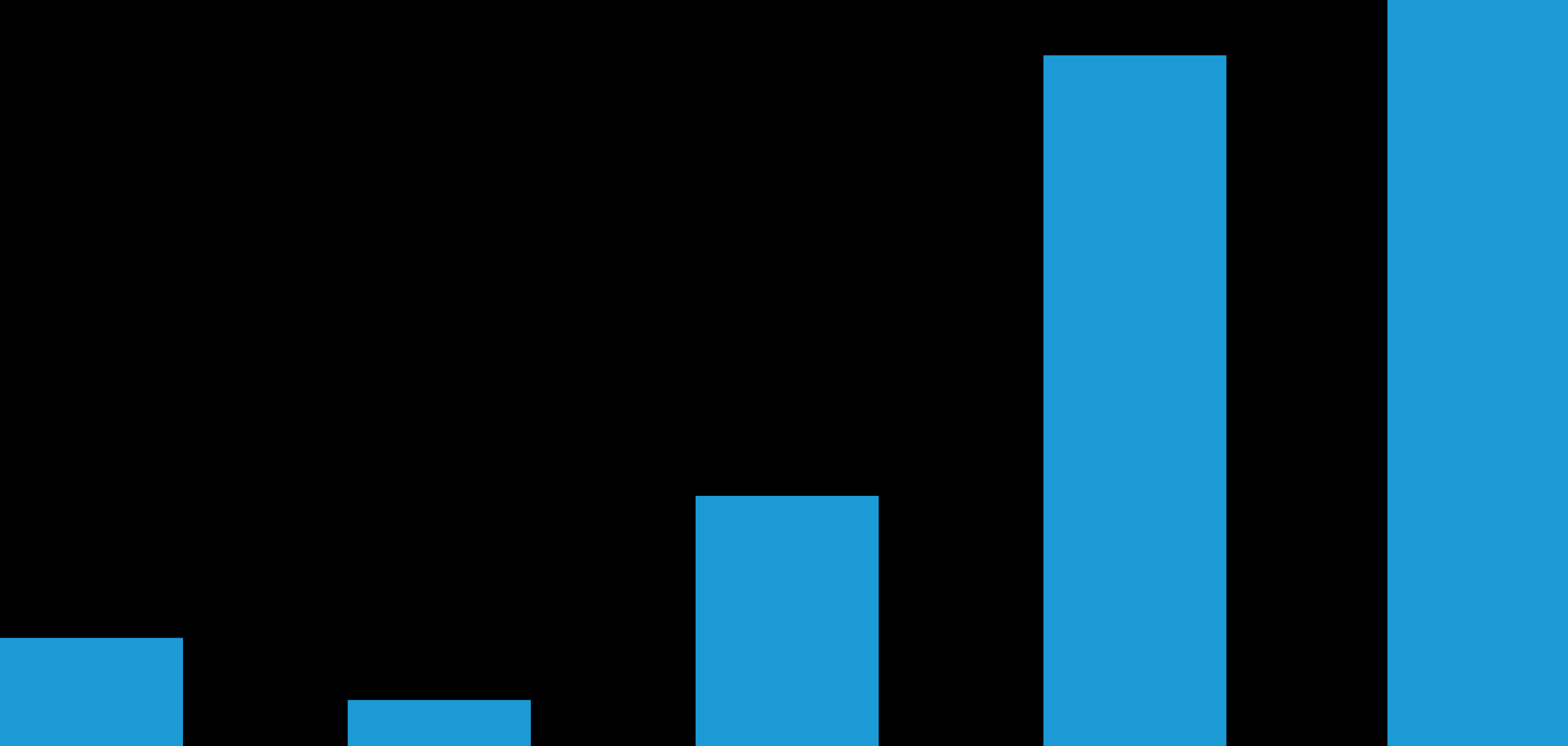

First is there’s a misconception that these companies are all old industry, or old economy, bad environmental actors. I’d say this is a myth. The emerging-market corporate bond universe has dramatically shifted away from oil and gas in recent years toward sectors like consumer and renewable utilities.

Second, I’d say that the universe has improved dramatically in recent years because of the issuance of green and sustainably linked bonds. Finally, emerging-market corporations are actually the leaders in developing the materials needed for the carbon transition. More than half the world’s lithium and copper actually comes from emerging-market companies. If you put it all together, emerging-market corporates are actually part of the solution toward a greener environment.

SK: I haven’t seen the index look this good ever before. However, what about the individual components?

PO: Emerging-market corporations have slightly lower governance standards than developed-market peers. That said, there’s a large dispersion in both emerging-market and developed-market governance scores. We’ve seen, kind of, governance concerns in both emerging markets—like NMC Health, a healthcare company in the Middle East—in recent years, but we’ve also seen them in developed markets—like the green skills issues earlier in 2021. Because of that, we think governance is a tricky issue but shouldn’t weigh too negatively for emerging-market corporations.

SK: Unfortunately, a lot of investors think this is too complicated, and they don’t do the extensive due diligence that is required to actually differentiate within the sector.

PO: There are groups that can help, like Sustainalytics or MSCI, but that’s only really part of the puzzle. The real solution is using a 360-degree approach—collaboration across economics, analysts, responsible investing, the portfolio managers. That’s what really brings out the true ESG insights. And that’s what I think empowers us to take really high conviction views in the ESG arena.

SK: However, investors still believe that it’s too new or niche to be effective. What’s your view regarding that?

PO: We’ve been doing ESG research for many years now. It might’ve been called different things in the past, but really looking at environmental, social and governance concerns? That’s part of the DNA of the AB investment process.

And second, and more importantly, I’d say that ESG risks are true credit risks. Our research has shown that about two thirds of the recent most underperforming bonds in the EM corporate universe have come specifically from ESG reasons over time. So, you can really do yourself a favor by doing ESG research, which will really impact portfolio performance over time.

SK: Well, thank you Patrick for busting those myths. It’s extremely important to analyze ESG risk because they materially add alpha to portfolios.

PO: I agree that ESG is critical for driving investment performance.

Four Big ESG Myths About Emerging-Market Corporates

-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Patrick O’Connell is a Senior Vice President and Director of Responsible Investing Portfolio Solutions and Research for public markets. In this role, he develops strategies and tools that help integrate ESG considerations into the teams’ research, engagement and investment processes across AB’s Equities and Fixed Income businesses. From 2021 to 2024, O’Connell served as director of Fixed Income Responsible Investing Research. Earlier in his career, he served as a corporate credit research analyst, focusing on emerging-market corporates in Latin American and African countries. O’Connell joined the Emerging Markets research team in 2013 after working as a credit analyst covering US high-yield energy credits at AB. Prior to joining the firm in 2012, he was a desk analyst at UBS Investment Bank, where he helped allocate capital on the trading desk. O’Connell holds a BS in accounting and finance (magna cum laude) from Villanova University and is a CFA charterholder. Location: New York