-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

The Ripple Effect

COVID-19 and Multi-Asset Portfolio Construction

Historical analysis do not guarantee future results.

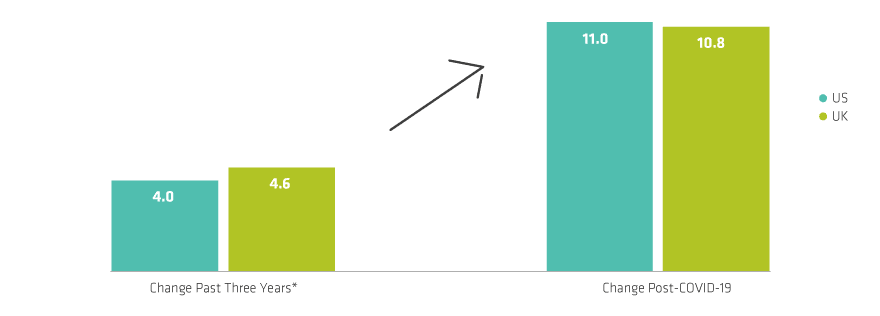

As of May 23, 2020

*Increase in average share of credit card online spending in May 2020 relative to March 2020 for US; month to mid-April relative to January and February 2020 for UK.

Source: BAC, Bloomberg Barclays and AllianceBernstein (AB)

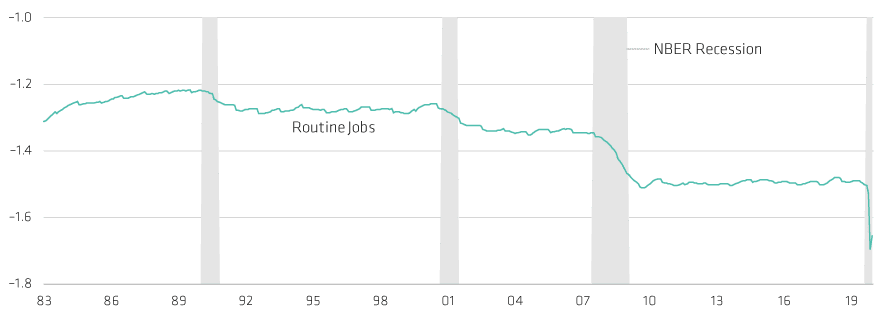

Historical analysis do not guarantee future results.

Through May 28, 2020

“Routine jobs” are defined by Jaimovich and Sui in Job Polarization and Jobless Recoveries, 2018 as those in “sales and related occupations” and “office and administrative support occupations,” “production occupations,” “transportation and material moving occupations,” “construction and extraction occupations,” and “installation, maintenance, and repair occupations.” They’re expressed as a six-month moving average percentage of the population converted to a logarithmic scale.

Source: Federal Reserve Economic Data, National Bureau of Economic Research and AllianceBernstein (AB)

Caglasu Altunkopru is Head of Macro Strategy in the Multi-Asset Solutions Group at AB. She was previously a sell-side analyst at AB, covering equity portfolio strategy for six years. Altunkopru joined the firm in 2005, covering the European Household and Personal Care sector, and her team was ranked among the top three in Institutional Investor and Extel surveys. Prior to joining AB, she worked as a management consultant with The Boston Consulting Group, Bain & Co. and McKinsey, serving clients in the consumer goods and financial services sectors. Altunkopru holds a BS in mathematics from the Massachusetts Institute of Technology and an MBA from Harvard Business School. Location: New York