The calendar reads 2016, but turmoil in US high yield has some investors thinking 2008. To us, the current situation looks more like the bursting of the dot-com bubble than the start of a new global crisis.

That doesn’t mean it’s going to be all smooth sailing this year. When the dot-com bubble burst at the turn of the century, defaults rose and the broad market suffered. But the problems were concentrated in one or two overleveraged sectors and didn’t spill over to the entire financial system like the 2008 financial crisis.

What did happened to high yield in the dot-com days? Here’s a refresher: telecom companies borrowed heavily in the 1990s to invest in high-speed network cables. By 2000, telecom debt accounted for about a third of the Barclays US High Yield Index.

Most companies, however, miscalculated the true cost of their investments. When the bubble burst in 2002, telecom bonds plunged, pulling the market down with them.

Today’s Problem Sector: Energy

Flash forward to today’s high-yield sell-off. It’s been led by a sharp decline in energy-sector bonds, which had become the biggest weight in the index by mid-2014. The buildup was the result of extensive borrowing to finance exploration and production in North America. Those projects became unprofitable when oil prices plummeted.

So what does this mean for the market now?

In 2002, high-yield defaults rose, but mostly among telecoms. The rest of the market held up fairly well. We wouldn’t be surprised to see things follow a similar script this time around, with defaults concentrated in energy-sector bonds.

Of course, investors who are heavily exposed to energy debt will take their lumps. Energy lost nearly 24% in 2015, compared to 4.5% for the broader market. And it was a concentration in distressed debt, including energy bonds, that prompted a well-known mutual fund to suspend redemptions last month.

But for those with diversified portfolios, this may be an opportunity to scoop up attractive valuations on higher-quality, non-energy bonds.

More Cash, Less Leverage

The 2008 global financial crisis was different. It grew out of massive leverage throughout the financial system—notably at financial firms and federally insured banks—as opposed to one or two sectors. And its repercussions were felt across markets and the world. We don’t see that this time around.

To start with, mutual funds have more cash on hand than they did in 2007–2008, largely because bond markets are less liquid. That puts managers in a better position to handle redemptions.

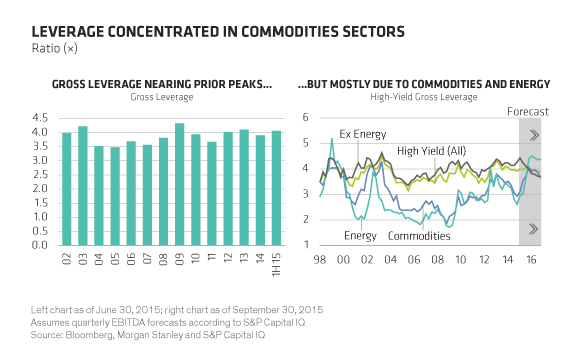

Second, the breadth of risk in the system today is different. For example, the volume of annual leveraged buyouts peaked at $186 billion during the current credit cycle. In 2007, volume reached $434 billion. And while overall gross leverage in high yield is near prior peaks, it’s being driven mostly by energy-sector and other commodities companies (Display). For non-energy companies—the majority of the high-yield index—lower commodity costs will help the bottom line, not hurt it.