-

The value of an investment can go down as well as up and investors may not get back the full amount they invested. Before making an investment, investors should consult their financial advisor.

Market Sell-Off Shows Risk Is a Moving Target

As of September 30, 2018

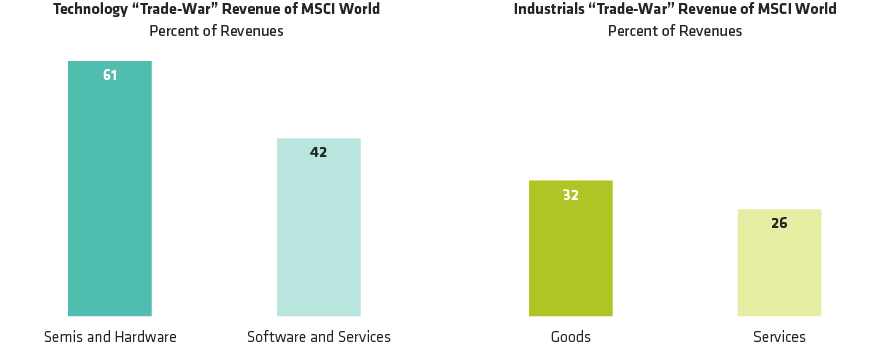

“Trade-war” revenue for US stocks is non-US revenue, and for non-US stocks is US revenue.

Source: FactSet, MSCI and AllianceBernstein (AB)

Past performance and current analysis do not guarantee future results.

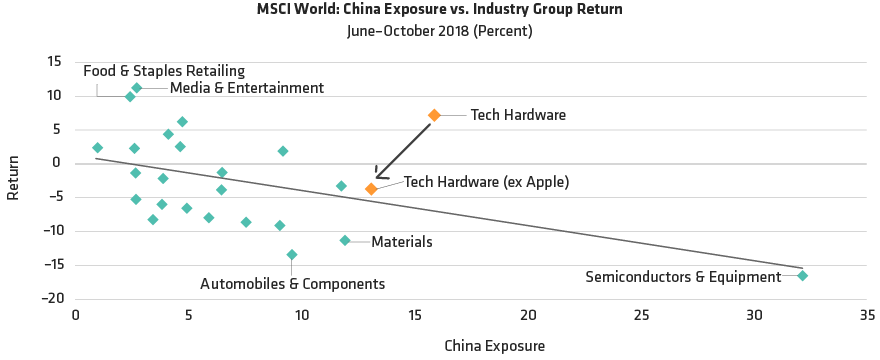

Industry exposure is based on a weighted average as of May 31, 2018.

Returns shown in US-dollar terms from June 1, 2018 through October 31, 2018.

Source: FactSet, MSCI and AllianceBernstein (AB)

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.