What’s an investor to do, when faced with a Fed that’s gearing up to raise rates? Many investors over the past year have poured money into bank loans, in hopes of finding a panacea. Unfortunately, the bank loan market is not what it seems.

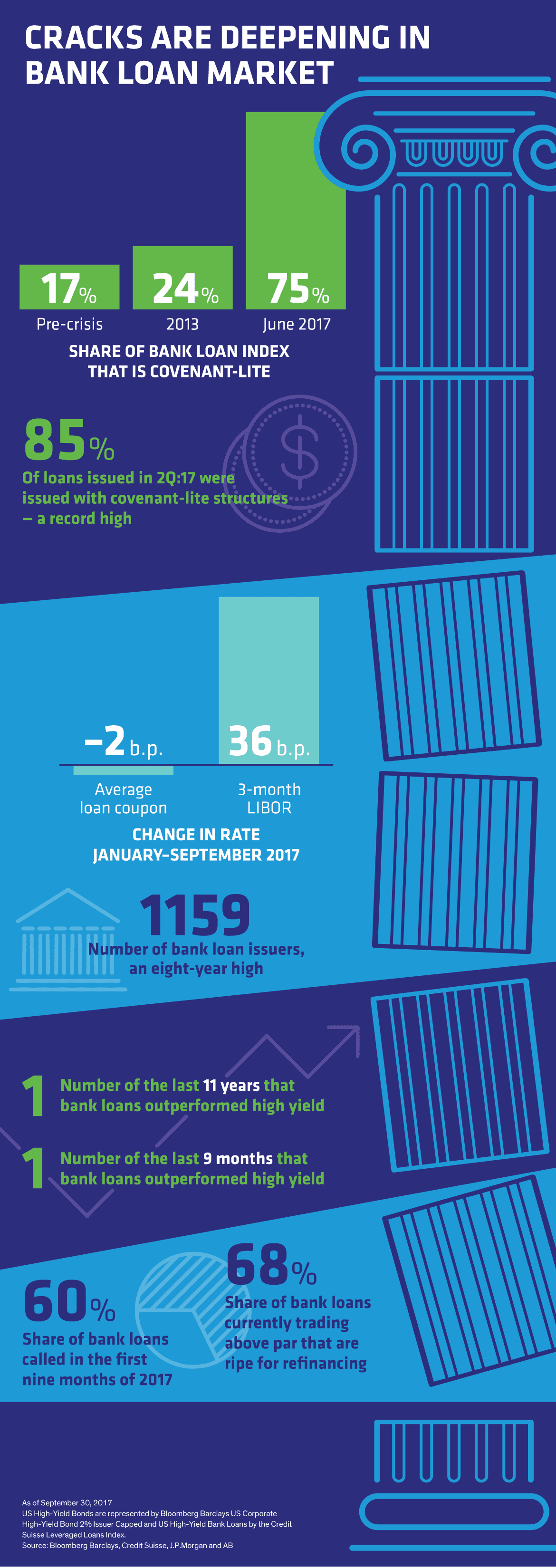

If you’ve bought a bank loan lately, chances are it lacks a usual protective agreement of a bond: a covenant. Before the global financial crisis, less than 20% of the bank loan market was what’s known as covenant-lite. Today? 75% and growing.

Shaky ground isn’t just measured by lack of protection. Bank loans are callable, and they’re being called in massive numbers. 60% of the market has been called so far this year, and another 70% is currently ripe for the same. That’s because this year’s wave of investment has touched off a record wave of refinancings.

Sadly, all of this in turn has led to lower coupons—not the higher rates investors were hoping for at all. How about returns? Dead last in the race with high-yield bonds.

So buyer, beware. Know your markets. And keep your horizons broad. Investors can still maintain a high level of income even in the face of rising rates—with a global, multi-sector approach to high-income investing.

Is the Bank Loan Market Showing Cracks?

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.