-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

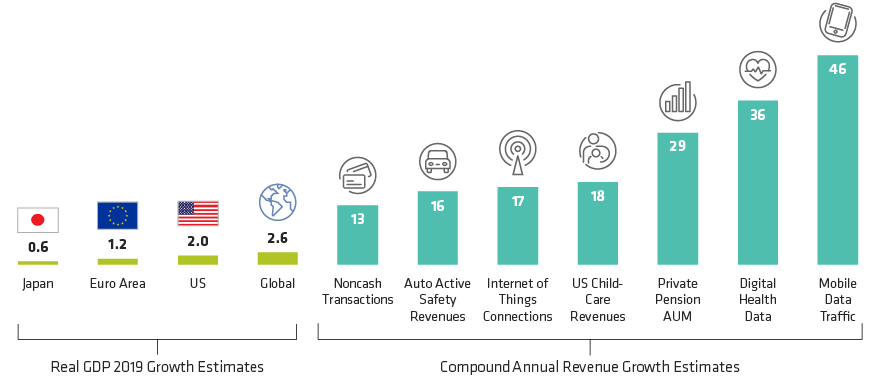

Finding Growth in a Low-Growth World

Growth Rates (Percent)

Current estimates do not guarantee future results.

Real GDP 2019 growth estimates based on AllianceBernstein economists’ forecasts as of June 30, 2019. All industry segments are global except for US child-care revenues. Compound annual revenue growth estimates are shown for different periods for each segment. Internet of Things connections from 2018 to 2025; auto active safety revenues, mobile data traffic and private pension AUM from 2017 to 2025; digital health data from 2018–2025; US child-care revenues from 2018 to 2022; noncash transactions from 2016 to 2021.

Source: Cisco Systems, Citigroup, Ericsson, IDC, OECD, Roland Berger, Statista, World Payments Report and AllianceBernstein (AB)