Insights

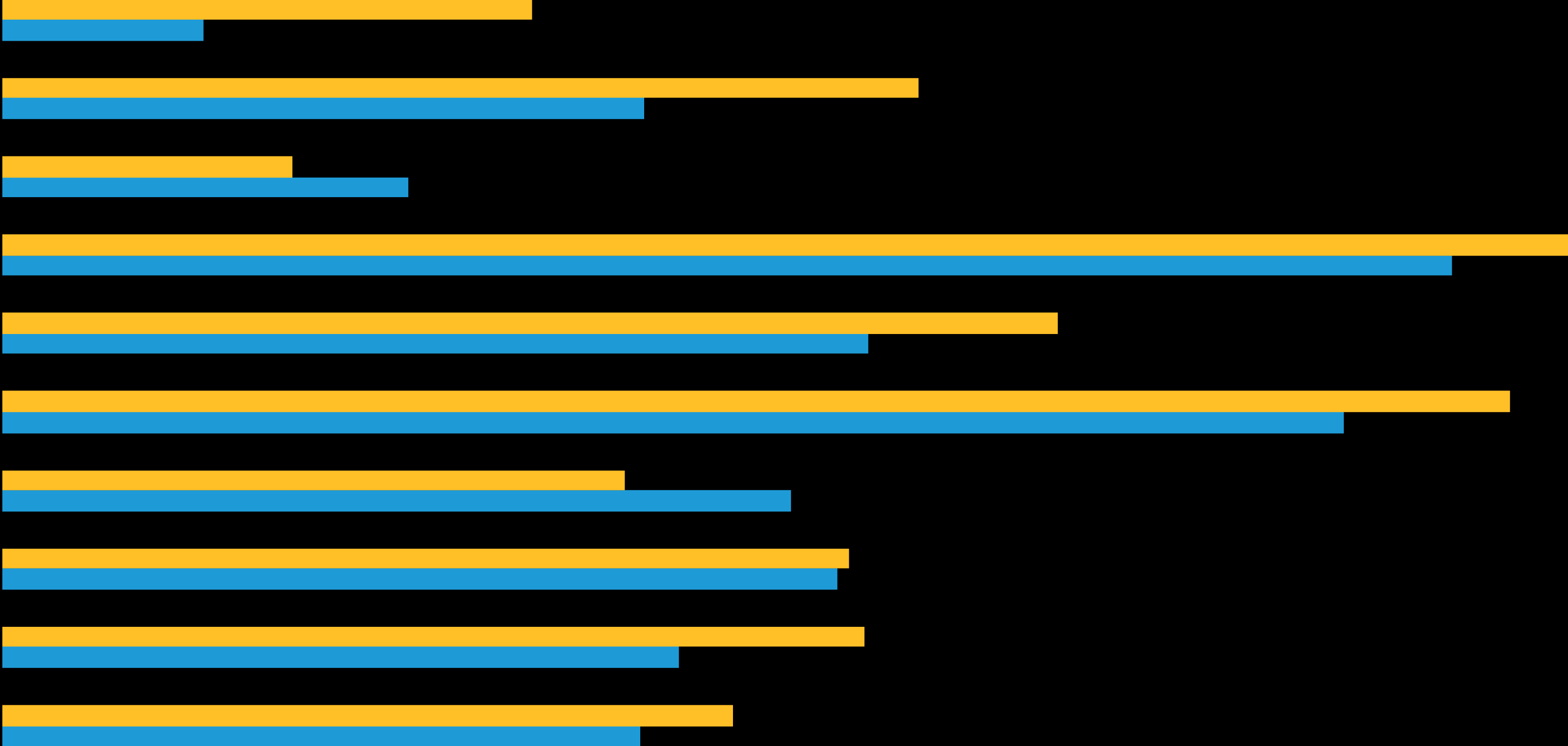

Showing 1-13 of 1,215 Results

What triggered April’s Treasury sell-off? What’s next? And how should investors manage duration risk?

Extreme fear in equity markets has often been followed by extremely good returns.

Emerging-market stocks have done particularly well after equity market crises in the past.

President Trump’s tariffs bring déjà vu for the euro-area economy: it’s back to slower growth and lower rates.

Recent months have seen an upending of the economic and geopolitical system. The investment community has, rightly, focussed on the impact of tariffs but the changes are deeper than that. They amount to a loss of trust that is likely to be demi-permanent and unlikely to be restored.

As volatility rises, staying invested is a strategic priority for capturing long-term return potential in a broadening market.

How might the recently announced US trade measures translate into economic reality?

The wide range of private assets has a lot to offer insurance investors, in our view.

Trade wars threaten longstanding trade partnerships and could weigh on the global economy.

Generating income is often front of mind for investors. But it's important to stay flexible.

As stocks dip, bonds are stepping up.

Global growth should continue to slow if US policy direction remains unclear. Inflation has waned but tariffs could boost prices in the near term. We expect most central banks to ease further yet more slowly. While broad uncertainty prevails, we don’t forecast a recession in any major economy for 2025.

Risk management is being put to the test in 2025. How can equity portfolio teams cope with multiple hazards across equity markets this year?