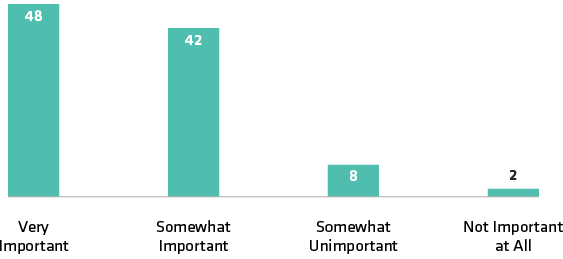

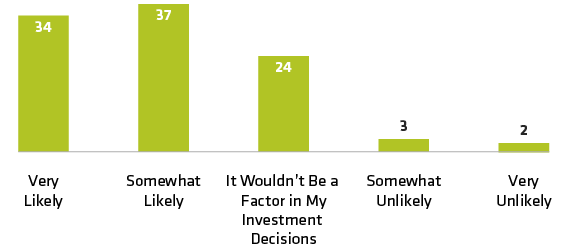

DC Plan Participants Voice Their Interest in Responsible Investing

Percent of Respondents

Percent of Respondents

As of January 1, 2019

Source: AB Research, 2018

Jennifer DeLong is a Senior Vice President, Managing Director and Head of Defined Contribution, responsible for leading AB’s defined contribution business in North America. She oversees product management and development, marketing, participant communications, and client services for the firm’s institutional custom target-date and lifetime income solution clients. Additionally, DeLong is responsible for firm’s Collective Investment Trust business and is President of the AllianceBernstein Trust Company. Since joining AB in 1999, she has held various senior client relationship management, product management and marketing roles, all primarily focused on defined contribution, 529 college savings plans and sub-advisory insurance services for both institutional and retail clients. Before joining the firm, DeLong worked in various sales, marketing and client relationship management roles for both small and mega-sized defined contribution plans. She holds a BS in business management with a minor in international business from The College of New Jersey, as well as FINRA Series 6 and 63 licenses. Location: New York