-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

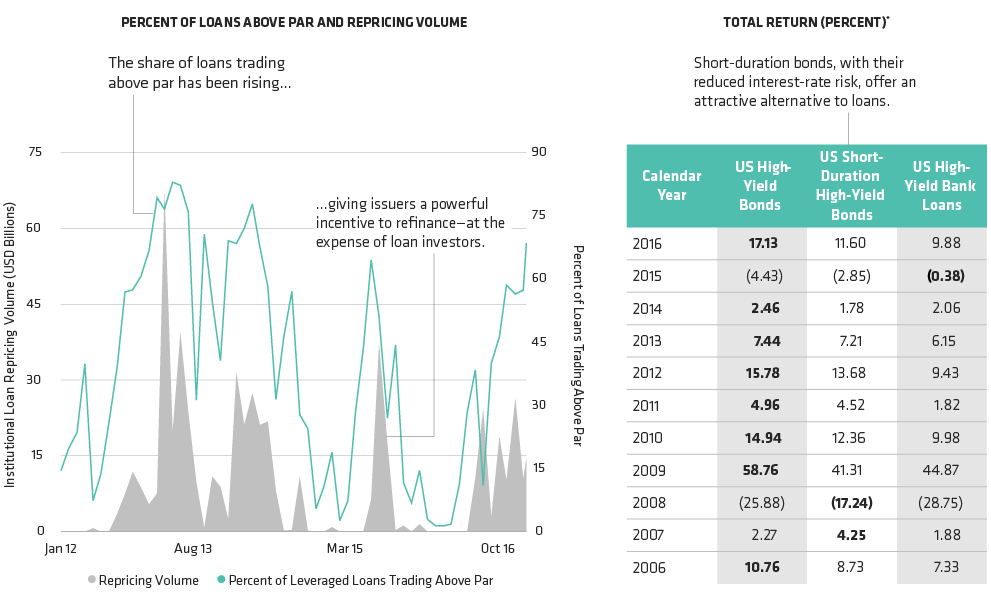

Want Protection Against Rising Rates? Think Beyond Loans

Past performance and historical analysis do not guarantee future results.

Left display as of December 12, 2016; right display as of December 31, 2016

*US High-Yield Bonds are represented by Bloomberg Barclays US Corporate High-Yield Bond 2% Issuer Capped; US Short-Duration High-Yield Bonds by Bloomberg Barclays US Corporate High-Yield Bond1–5 Year 2% Issuer Capped and US High-Yield Bank Loans by the Credit Suisse Leveraged Loans Index. An investor cannot invest directly in an index, andhe unmanaged index does not reflect fees and expenses associated with the active management of a portfolio.

Source: Bloomberg Barclays, Credit Suisse, J.P. Morgan, Morningstar and AB