-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

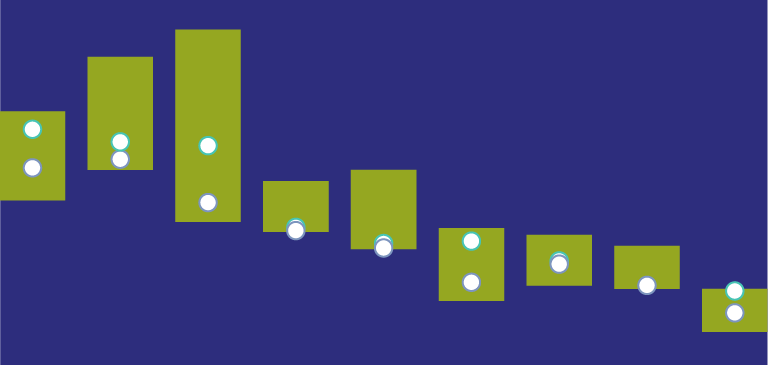

Middle Market Direct Lending’s Illiquidity Premium Shines in Current Market

Past performance does not guarantee future results.

As of March 31, 2021

Large corporate loans reflect large loans executed via banks and non-bank lenders. Middle market loans reflect loans executed via non banks.

Source: Refinitiv

Brent Humphries joined AB in 2014 as a founding member and President of AB Private Credit Investors, where he has primary responsibility for overseeing all aspects of the business, including chairing the investment committee, fundraising, investor relations, investment originations, structuring and underwriting, as well as ongoing portfolio management and compliance. He previously held the same position with Barclays Private Credit Partners. Prior to joining Barclays, Humphries served as group head, generalist financial sponsor coverage for Goldman Sachs Specialty Lending Group, and later led its structured private equity initiative. Before that, he served as a partner and managing director of the Texas Growth Fund, a middle market private equity firm. Humphries previously worked in leveraged finance with NationsBank and J.P. Morgan, and as a financial analyst with Exxon. He holds a BBA in finance with an emphasis in accounting from the University of Oklahoma and an MBA from Harvard Business School. Location: Austin