-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Five Multi-Asset Strategies for 2020’s Challenges

Past performance is not necessarily indicative of future results. There is no guarantee that any estimates or forecasts will be realized.

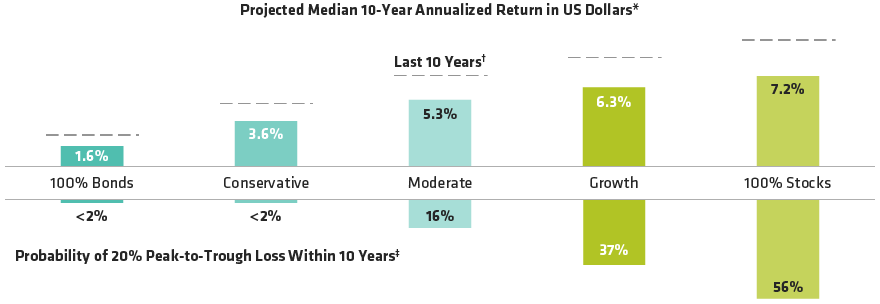

*Bonds are represented by 60% global investment-grade bonds and 40% global sovereign bonds; stocks are represented by a universe similar to the MSCI World; both are reported in and hedged into Euros.

Reflects compound growth rates from July 1,2009, thorugh June 30, 2019. Stocks represented by MSCI World Total Return Index Hedged To Euros.

Bonds represented 60% Bloomberg Barclays Global Aggregate Corporate Total Return Index Hedged to Euros and 40% Bloomberg Barclays Global Aggregate Treasuries Total return Index Hedged to Euros.

Probability of a 20% peak-to-trough decline in pretax, pre-cash-flow cumulative returns iwthin the next 10 years. Because the Wealth Forecasting System uses annueal capital-market returns the probability of peak-to-trough losses measured on a more frequent bases (such as daily or monthly) may be understated. The probabilities depicted above include an upward adjustment intended to account for the incidence of peak-to-trough losses that do not last an exact number of years.

Source: Lipper, MSCI, Russell, S&P and AllianceBernstein (AB)

-

Be Warier in Equities—Consider Europe and Emerging Markets

-

Resist the Urge to Ditch Duration

-

Consider Select Alternative Strategies

-

Unfollow the Trend

-

Broaden Your Income Horizons