-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Finding Profitable Growth in Shaky Markets

Past performance does not guarantee future results. Current analyses do not guarantee future results.

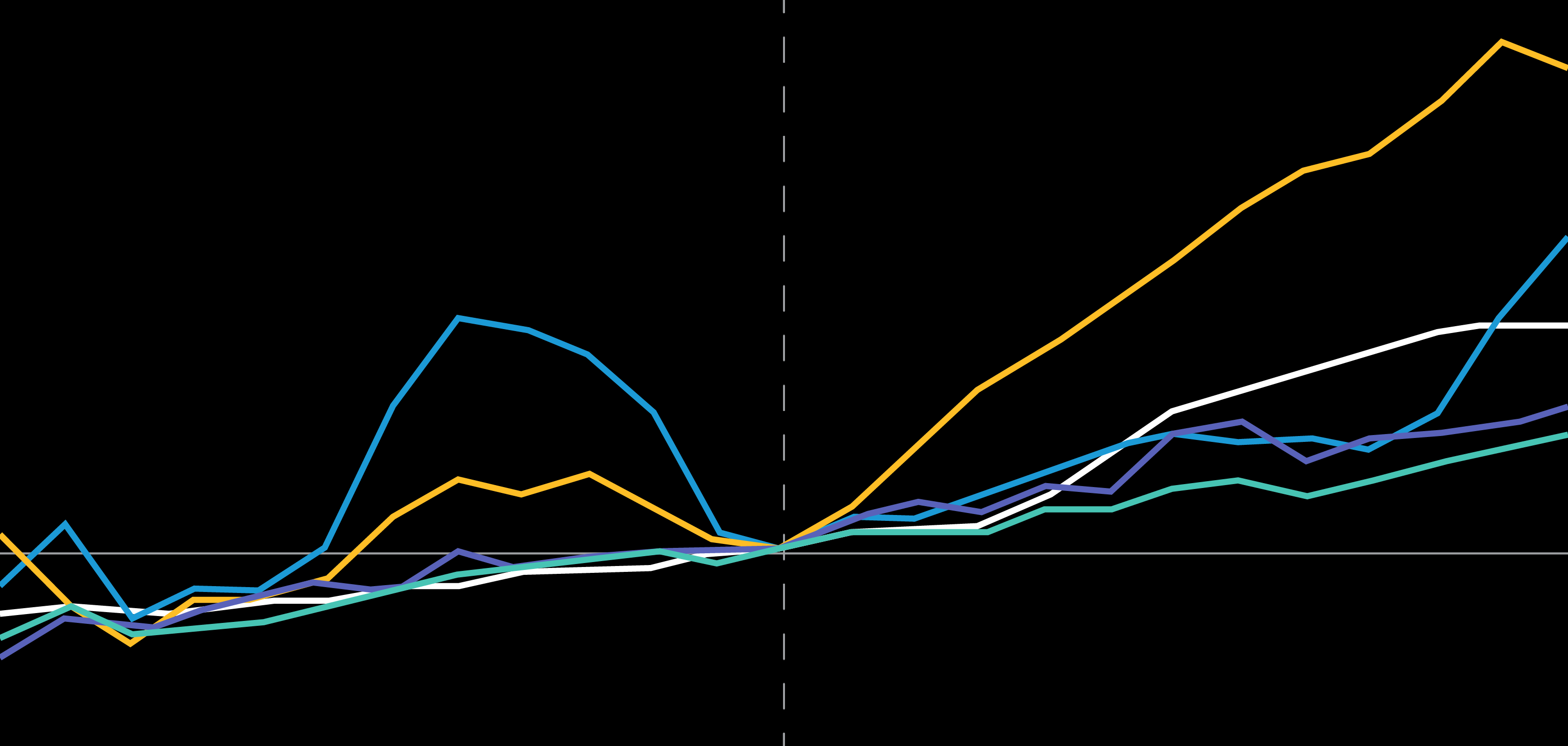

Left display represents global companies with market cap over $15 billion that fall into the top half of cash flow return on investment and also in the top half of five-year median asset growth. Right display is the Russell 1000 Growth universe subdivided into quintiles of valuation measured by price-to-sales. The valuations shown are the median for each quintile.

As of December 31, 2021

Source: Credit Suisse HOLT, FactSet , FTSE Russell and AllianceBernstein(AB)

Vinay Thapar is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities and a Portfolio Manager for the Global Healthcare Strategy. He is also a Senior Research Analyst, responsible for covering global healthcare. Before joining the firm in 2011, Thapar spent three years at American Century Investments as a senior investment analyst responsible for healthcare. Prior to that, he worked for eight years at Bear Stearns in the Biotech Equity Research Group, most recently as an associate director. Thapar holds a BA in biology from New York University and is a CFA charterholder. Location: New York

John H. Fogarty is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities. He rejoined the firm in 2006 as a fundamental research analyst covering consumer-discretionary stocks in the US, having previously spent nearly three years as a hedge fund manager at Dialectic Capital Management and Vardon Partners. Fogarty began his career at AB in 1988, performing quantitative research, and joined the US Large Cap Growth team as a generalist and quantitative analyst in 1995. He became a portfolio manager in 1997. Fogarty holds a BA in history from Columbia University and is a CFA charterholder. Location: New York