-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Can We Afford a Housing Boom?

As of January 31, 2016

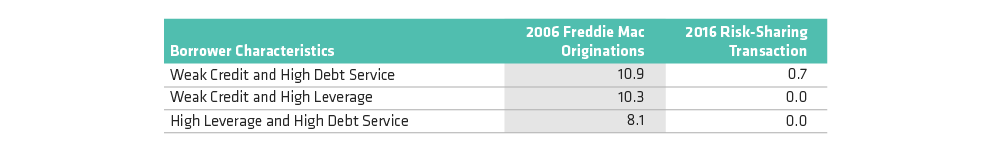

Weak Credit and High Debt Service cohort defined as borrowers with FICO score of less than 700 and debt-to-income (DTI) ratio greater than 45; Weak Credit and High Leverage cohort defined as borrowers with FICO score of less than 700 and current loan-to-value (CLTV) ratio greater than 80; High Leverage and High Debt Service cohort defined as CLTV greater than 80 and DTI ratio less than 45

Vintage statistics: 2006 data based on Freddie Mac 30-year purchase originations; 2016 data derived from STACR 2016-DNA1, a GSE credit risk transfer security

Source: Bank of America Merrill Lynch

Michael Canter is a Senior Vice President and Director of Securitized Assets at AB, heading the portfolio-management and research teams for these strategies. In addition, he is a portfolio manager for multi-sector fixed-income portfolios. Canter’s focus includes his role as the Chief Investment Officer of AB’s Securitized Assets Fund. His team is responsible for AB’s investments in agency mortgage-backed securities, credit risk–transfer securities, non-agency residential mortgage-backed securities, commercial mortgage-backed securities, collateralized loan obligations and other asset-backed securities. Canter has particularly extensive expertise in residential mortgages. In 2009, AB was selected by the US Department of the Treasury to manage one of nine Legacy Securities Public-Private Investment Program funds; he was the CIO of that AB-managed fund. In addition, Canter was called upon to give expert testimony to the US Senate Committee on Banking, Housing, and Urban Affairs in 2013 and the US House of Representatives Subcommittee on Housing and Insurance in 2017 on how US housing policy should be structured going forward. Prior to joining AB in 2007, he was the president of ACE Principal Finance, a division of ACE Limited (now Chubb). There, Canter managed portfolios of credit default swaps, asset-backed securities, mortgage-backed securities and collateralized debt obligations. He holds a BA in math and economics from Northwestern University and a PhD in finance from the Columbia University Graduate School of Business. Location: New York