-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Can US Stock Investors Rely on Earnings Growth?

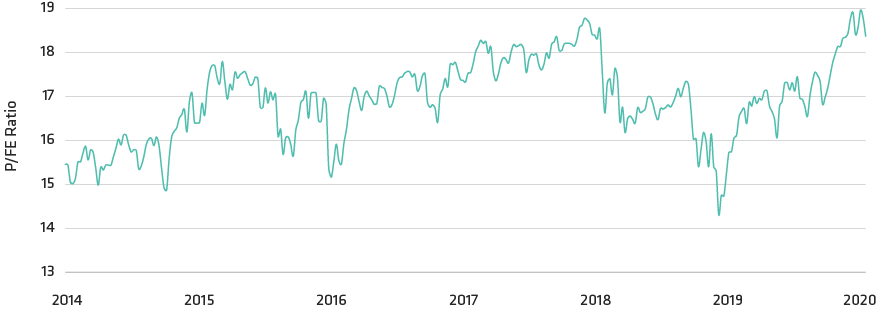

S&P 500: Price/Forward Earnings

Past performance and current analyses do not guarantee future results.

Through January 31, 2020

Based on consensus operating earnings estimates for the next 12 months.

Source: Bloomberg, S&P and AllianceBernstein (AB)

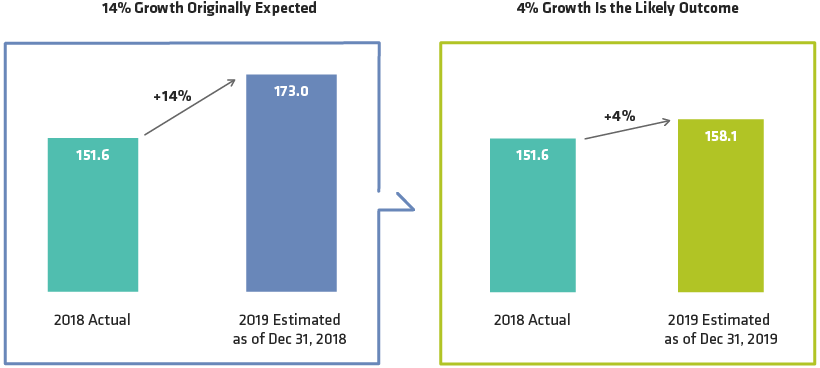

S&P 500: Operating Earnings per Share

Past performance and current analyses do not guarantee future results.

As of December 31, 2019

Source: S&P and AllianceBernstein (AB)

S&P 500: EPS Growth and Returns

Past performance and current analyses do not guarantee future results.

As of December 31, 2019

EPS: earnings per share

Source: S&P

James T. Tierney, Jr. is Chief Investment Officer of Concentrated US Growth. Prior to joining AB in December 2013, he was CIO at W.P. Stewart & Co. Tierney began his career in 1988 in equity research at J.P. Morgan Investment Management, where he analyzed entertainment, healthcare and finance companies. He left J.P. Morgan in 1990 to pursue an MBA and returned in 1992 as a senior analyst covering energy, transportation, media and entertainment. Tierney joined W.P. Stewart in 2000. He holds a BS in finance from Providence College and an MBA from Columbia Business School at Columbia University. Location: New York