Active Investing with Technology

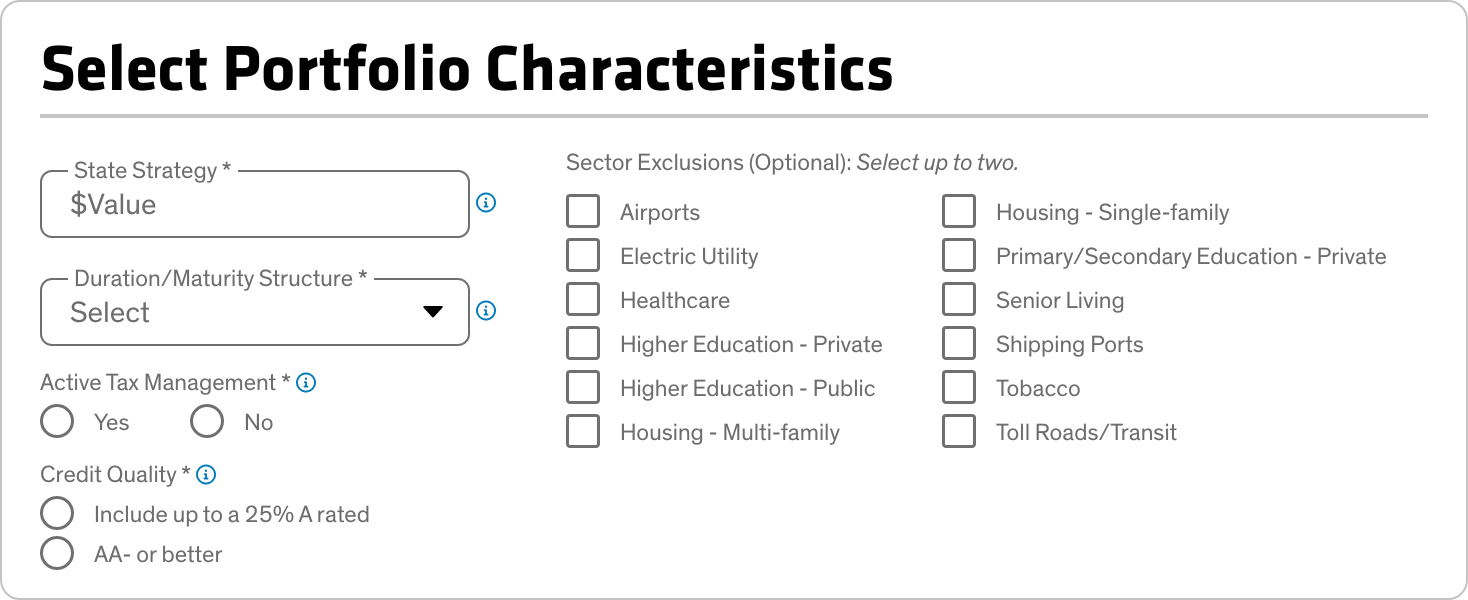

AbbieOptimizerTM is a portfolio-building engine that links real-time trading data and market liquidity metrics with clients’ individual needs, highlighting mis-priced opportunities and identifying tax optimization benefits. Watch the video to learn how we do it.