Investors enter 2019 facing a long list of macroeconomic and geopolitical risks. But there is some good news. Strategic approaches to equity and fixed-income markets can help investors rise to the challenges.

Will the global economy slow down, or even worse, slip into recession? Is inflation coming back? How do you navigate geopolitical risks, such as the Italian government’s fiscal plans, Brexit or trade wars? Will tighter monetary policy from central banks and rising interest rates shake financial markets? These are just a few of the questions that are keeping investors up at night these days.

In this article, we survey some of the biggest concerns hanging over financial markets as the new year begins. With a measured analysis that looks beyond the news headlines, we aim to help investors prepare for various scenarios and plan appropriately for their risk appetites.

Stay Invested as the Global Economy Slows

Fears of a global recession are palpable as the new year approaches. Yet is world economic growth likely to decline in 2019? It’s important to distinguish between a deceleration of growth and a recession—in which the economy actually shrinks.

The global economy is facing a confluence of challenges. US economic growth signals remain resilient, even though the pace of growth might be damped somewhat by monetary policy tightening. China’s economy is slowing and may require a significant dose of policy stimulus to prevent a deeper decline. Emerging markets have been hurt by a stronger dollar. Europe’s nascent economic recovery has hit some hurdles. In Japan, hopes of an end to deflation are tenuous amid anemic growth, and the government is planning various stimulus measures in 2019. Meanwhile, trade tensions add an unpredictable threat to global economic growth.

Taken together, these trends do suggest that the global economy will slow down in 2019, but probably won’t fall into recession. Investors who prepare for the worst by moving all their assets to the safety of cash might forfeit return potential if moderate growth continues, as we anticipate.

In this environment, we think it’s important for investors to stay in the market. Even today, with a global economic growth slowdown widely expected, corporate earnings are still projected to rise by 8.3% in 2019, according to consensus estimates. Equity valuations are reasonable following strong earnings and weak returns in 2018, while the global equity risk premium remains above average, even with higher rates. And although global corporate credit spreads have widened from very low levels, they don’t signal distress—and opportunities can still be found in pockets of the market.

But most importantly, it’s almost impossible to predict how financial markets will react to dynamic economic data or to perfectly time inflection points—on the way up or down. So, in our view, strategies that can help investors stick with a plan through potentially volatile markets are essential today.

Protect Portfolios from Inflation

Even as global economic growth slows, signs of inflation are starting to appear. For years, investors have grown accustomed to a low inflation world, fostered by central bank policy, globalization and technological progress. We think this may be coming to an end.

Cyclical forces, such as strong labor markets and tight capacity, are fueling higher prices. But there are also structural forces at work, such as the rise in populism in many countries, which threatens to curb the decades-long globalization trend that has supressed prices in many industries. In this environment, we still expect risk assets such as equities and credit to deliver returns, but along with that will come the significant volatility consistent with late-cycle dynamics.

If inflation persists even as growth slows, central banks may have no choice but to continue on the path of interest-rate normalization that many—particularly the US Federal Reserve—have begun. This could mean additional weakness in government bonds and other rate-sensitive assets (after a weak year in 2018). And it could create an unusual environment in which bonds and stocks underperform at the same time. Fortunately, these types of periods have tended to be short-lived. Fixed-income investors should consider including inflation-linked securities, such as US Treasury Inflation-Protected Securities (TIPS), to help offset some of the potential impact of rising inflation.

Commodities typically provide diversification and do well in rising inflation environments. But the risk for 2019 is that the slowdown in growth, particularly in emerging markets, compounded by trade tariffs, will all put pressure on commodity producers. The push-pull between weak demand and inflation may make this trade less effective than in the past. While commodities have a useful role to play, investors should be sensitive toward taking too heavy a position.

Don’t Build Investing Strategies on Politics

Geopolitical events are playing on the minds of investors. In turn, these influence investment decisions and stock market dynamics. Bad political news is always a fact of life for investors. But these days, many stresses are being driven by a retreat from globalism in many regions.

It can be tempting to think you can gain an investing edge from political insight. We think that’s a highly risky strategy. Since political outcomes are unpredictable (remember the Brexit vote?), staking any investment decision on the potential outcome of a political controversy or event is imprudent. What’s more, market responses to political outcomes can be surprising. Few investors predicted that US stocks would surge in the months following President Donald Trump’s election in November 2016.

However, political risk can be addressed in research, scenario analysis and active security selection. The key is to identify the most potent risks, avoid the most vulnerable companies and look for companies that could benefit as a political scenario plays out. However, always establish that a company’s fundamental investment thesis is not anchored to a political event or outcome.

For example, political pressures are mounting in Italy and the Italian government bond yield spread over German Bunds has widened. With every round of the Italian political game, we expect fresh bouts of volatility—although the systemic impact should remain limited. Given their large sovereign debt holdings, concerns about Italy have cast a shadow over Italian banks and the European banking sector in general—which is also creating opportunities. In fact, European banks’ fundamentals generally have improved over recent years, and we believe that their subordinated debt—in particular, Additional Tier 1 (AT1)—looks attractive now. We believe that fixed-income investors should focus more on those banks with relatively strong fundamentals and coherent business models (i.e., the more defensive stories).

Brexit is also creating ongoing investment headaches. There’s little clarity on what a final deal between the UK and European Union might look like. Certainly, many domestically focused UK companies could find their businesses squeezed if the British economy gets hit hard by the economic consequences of Brexit. Yet other UK-listed companies, with multinational operations and more resilient revenue sources, may enjoy a “Brexit discount” to their share price that doesn’t reflect their true long-term earnings potential.

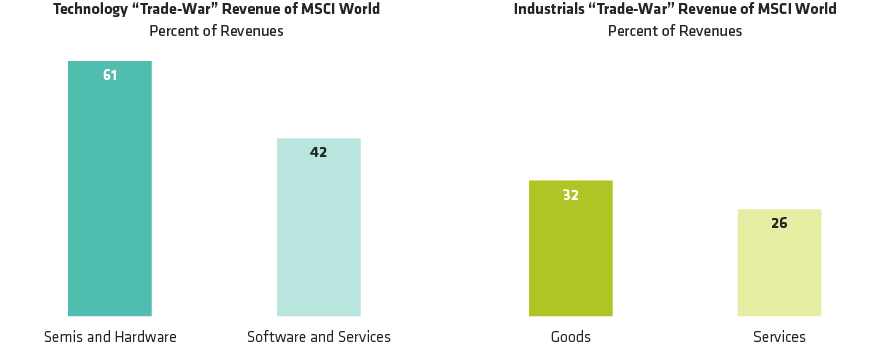

Meanwhile, as Chinese leaders wrestle with an already complex set of economic issues, the trade standoff is adding to the country’s problems. The truce announced in early December offers hope that a full-blown trade war can be avoided, but there are still many hurdles to a full resolution. Instead of positioning portfolios for an escalation or resolution of the trade war, we think investors should still consider the potential impact of a trade war when researching industries and companies. For example, we assessed what type of companies could get caught in the crossfire of an escalating trade war by identifying vulnerable revenue streams. We found that the technology and industrial sectors are both more exposed to trade winds than other sectors. Yet within those sectors, semiconductor and hardware industries look much more vulnerable than software and services (Display).