-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

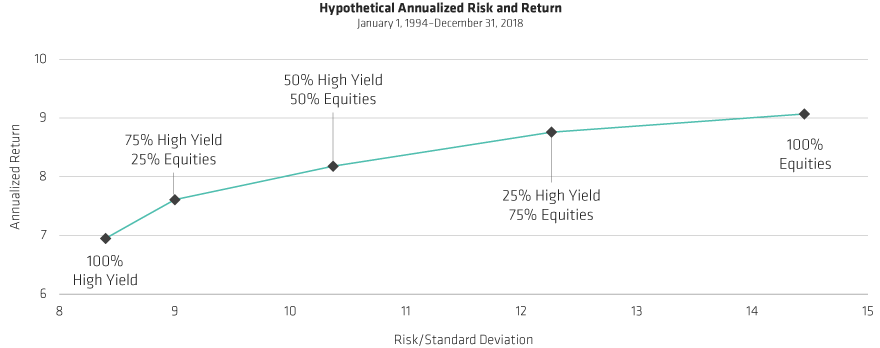

Looking to De-Risk? High Yield Can Help

A Combination of High Yield* and Equities† Has Historically Improved Risk-Adjusted Returns

As of December 31, 2018.

Past performance is not a guarantee of future results. There can be no assurance that an actual portfolio based on the hypothetical portfolio underlying the above illustration could be created or, if created, that it would achieve the results implied above or be profitable.

Diversification does not illuminate risk of loss.

*Based upon a hypothetical portfolio; accordingly, such performance is not based upon historical performance of any investment portfolio. This illustration is not intended to provide either a complete analysis regarding any or all of the variables that could affect any particular portfolio. High-yield is represented by Bloomberg Barclays US corporate high-yield.

†Equities is represented by S&P 500 index. All indices cited hearing are used for purposes of comparison purposes only. An investor generally cannot invest directly in an index, and its performance does not reflect the performance of any AB portfolio.

Source: Bloomberg Barclays, S&P and AllianceBernstein (AB)