-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

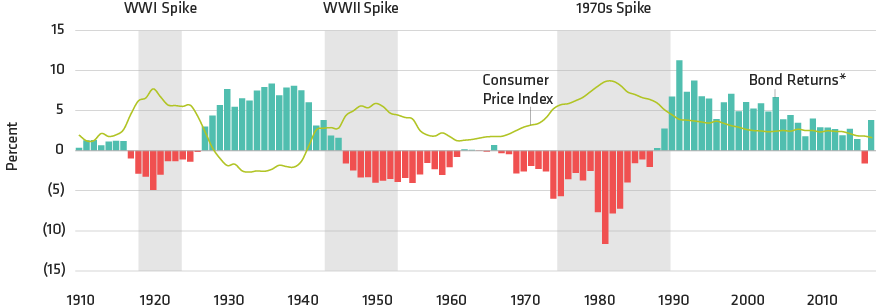

Inflationado? Muni Investors May Need To Seek Cover

Rolling 10-Year Annualized Municipal Bond Returns Less Inflation

Through December 31, 2017

Past performance does not guarantee future results.

This index uses the S&P Muni Bond Index from 1900 to 1949, the Moody's 10-Year AAA Muni Bond Index from 1950 to 1980 and the Bloomberg Barclays Municipal Index from 1980-January 31, 2017. Any indices cited herein are used for comparison purposes only. An investor generally cannot invest in an index, and its performance does not represent the performance of any AllianceBernstein (AB) portfolio. An unmanaged index does not reflect any fees or expenses associated with the active management of any AB portfolio.

*After subtracting annualized inflation over the same time period

Source: Bloomberg Barclays, Moody's Investors Service, S&P, US Bureau of Labor Statistics and AllianceBernstein (AB)

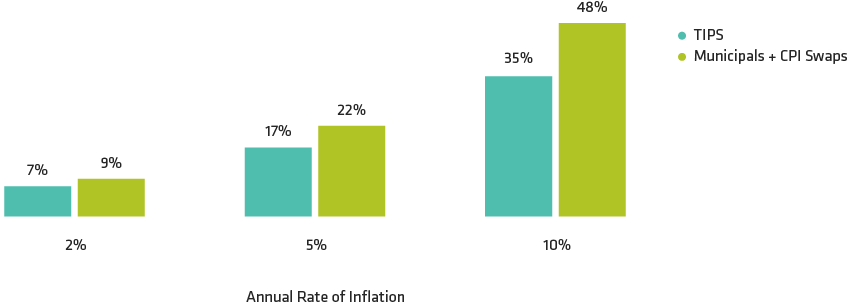

Cumulative After-Tax Return Forecast on Five-Year Securities

As of January 31, 2018

Past performance does not guarantee future results.

This is not, and you should not consider it to be, legal or tax advice. The tax rules are complicated and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation. These figures are for illustrative purposes only.

TIPS represented by five-year Treasury inflation-protected security with 0.034% real yield as of stated date; inflation and real yield for TIPS are taxed at a 40.8% federal rate. Municipal + CPI swaps return assumes a five-year AA-rated municipal yield of 1.77% and five-year CPI swap; the difference between the CPI and the fixed rate on the swap (1.955%) is taxed at the capital gains rate of 23.8%. Analysis assumes securities are held to maturity.

Source: J.P. Morgan, Municipal Market Data and AllianceBernstein (AB)