Theme 1: The Start-Up Enablers

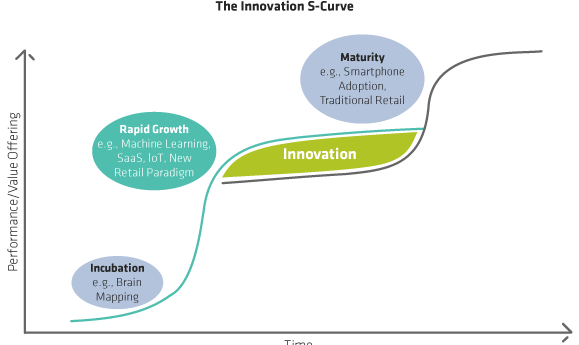

Many smaller technology companies are driving disruptive innovation. By developing the must-have tools used by new economy start-ups, their products are the engines of the unfolding technology revolution. With the increasing acceptance of pay-as-you-go cloud-based infrastructure and services offerings, barriers to entry for entrepreneurs have nose-dived. The average mobile app start-up needs just 5% of the capital that a dot-com–era start-up required, thanks to these enablers.

For example, Zendesk, a US company, offers a simple and affordable suite of products for businesses to communicate and serve customer support issues across channels that meets the evolving needs of enterprises in a digital and mobile world. Atlassian, based in Australia, provides collaborative software that improves productivity among teams within an organization. And Shopify of Canada provides a one-stop shop that enables start-ups and brick-and-mortar companies to set up an online storefront.

Theme 2: Empowering Digital Transformation

In an increasingly competitive climate, businesses that extract and understand data intelligence can gain an edge on competitors. Many companies are in the early stages of transitioning to digital manufacturing and automating their entire operations. Technology firms that provide the enterprise tools to harness information and drive improved productivity possess tremendous growth potential.

For example, French company Dassault Systèmes sees robust outlook in its product lifecycle management technology called 3D Systems, which helps companies reengineer their design and manufacturing processes digitally. ANSYS of the US makes software that expedites the development of autonomous driving systems by simulating millions of road conditions and improving computer learning. Semiconductor companies such as NVIDIA provide the supercomputing power to “train” computers to mimic human behavior, the first step in artificial intelligence.

Homework: Bottom-Up Analysis

While we are confident about the outlook for continued technology spending, identifying promising investment candidates is challenging. For many high-growth technology companies, valuations tend to be lofty, reflecting high-growth expectations for both revenue and earnings. The prevalence of cloud infrastructure and lowered entry barriers means the pace of innovation is accelerating. Only a limited number of companies with defensible and differentiated business models and a large addressable market will be able to deliver sustained growth toward profitability. This favors a selective approach and fundamental analysis, in our view.

Technology themes can also help point the way. In the era of big data, companies that provide cloud-based infrastructure and services functions to the broad economy seem poised to benefit. They’re like a power grid for the new economy—especially companies that provide tools to help enterprises gather, process, understand and utilize big data to improve productivity. Investors who find them can enjoy exposure to the power of technology growth trends with a degree of insulation from the regulatory risk hanging over the sector.