-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Can US Stock Investors Rely on Earnings Growth?

03 February 2020

3 min read

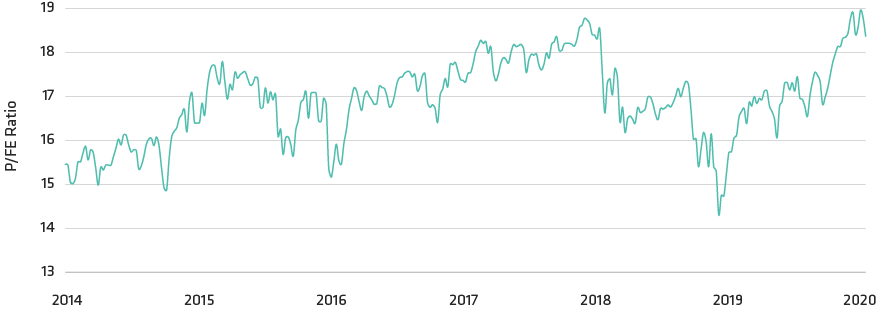

US Stock Valuations Recovered in 2019

S&P 500: Price/Forward Earnings

Past performance and current analyses do not guarantee future results.

Through January 31, 2020

Based on consensus operating earnings estimates for the next 12 months.

Source: Bloomberg, S&P and AllianceBernstein (AB)

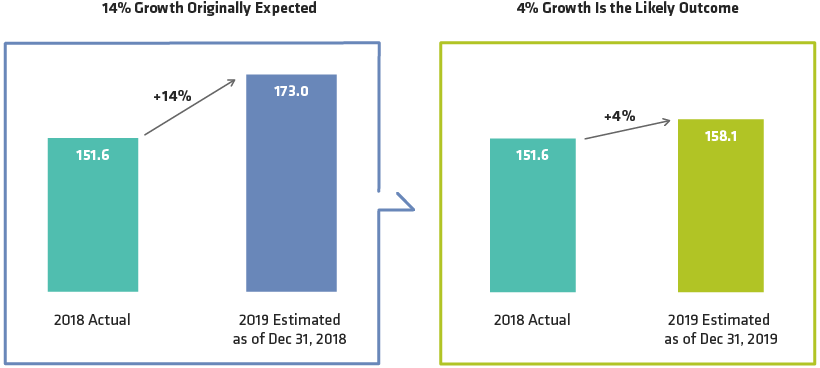

Earnings Growth Has Come Down from Initial Expectations

S&P 500: Operating Earnings per Share

Past performance and current analyses do not guarantee future results.

As of December 31, 2019

Source: S&P and AllianceBernstein (AB)

Earnings Growth and Market Performance Don’t Always Match

S&P 500: EPS Growth and Returns

Past performance and current analyses do not guarantee future results.

As of December 31, 2019

EPS: earnings per share

Source: S&P

About the Author