-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Big Market Selloff? Stay Dynamic With Risk Positioning

31 March 2020

4 min read

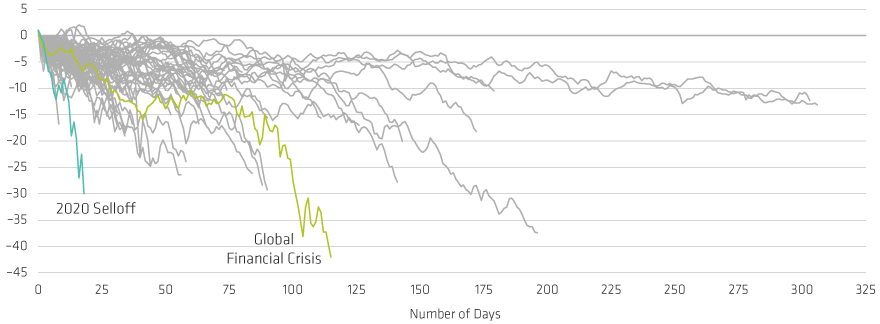

The Recent Equity Selloff Was the Fastest in More than Half a Century

Cumulative Percentage Decline of Global Stocks in Market Selloffs

Historical analysis does not guarantee future results.

As of March 16, 2020

Cumulative daily decline of MSCI World Index in equity market selloffs of more than 5% since 1965, based on daily returns.

Source: Bloomberg, MSCI and AllianceBernstein (AB)

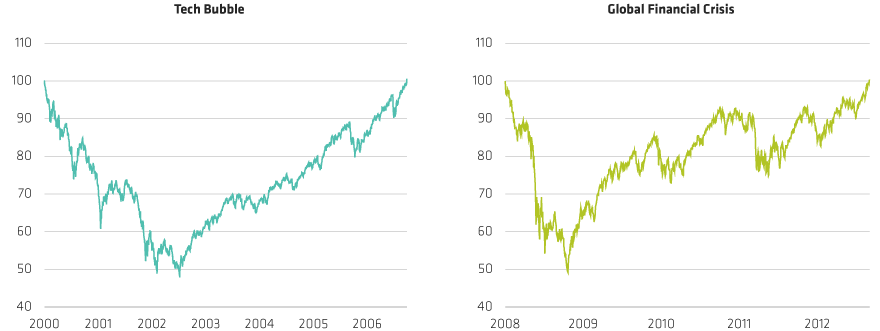

It Can Take Time for Markets to Find Bottom…and Recover…in Some Selloffs

Cumulative Daily MSCI World Index Returns

Historical analysis does not guarantee future results.

As of September 30, 2019

MSCI World Index daily returns indexed to 100. For technology bubble, September 5, 2000 equals 100. For GFC, May 19, 2008 equals 100.

Source: Bloomberg, MSCI and AllianceBernstein (AB)

About the Author