Gauging ETF Liquidity: Look Beyond Volume and Fund Size

10 min read

When an exchange-traded fund (ETF) is first launched, its lower trading volume and smaller amount of assets under management (AUM) are often a concern for investors looking to invest sizable amounts. The worry: making a large allocation to the ETF will impact the price and hurt trade execution, eroding returns.

Investors are absolutely right to consider the potential price impact of trades, but there’s a key point to be aware of: an ETF’s AUM and trading volume are not indicators of its liquidity.

To understand why ETFs are structurally efficient trading vehicles and how to properly assess their ability to absorb large trades, it’s important to examine two topics: the root cause of price impact and ETFs’ creation and redemption mechanism.

Where Does Price Impact Come From?

Price impact in a stock trade is caused by an imbalance of supply and demand. If there’s more demand than supply for a security of any kind, buying it will push the price upward, as the trade is executed at progressively higher prices until the demand is exhausted. The net result is a higher average purchasing cost—and starting point for generating returns.

The Different Structure of ETFs Enhances Their Liquidity

The design of ETFs is fundamentally different; the vehicles typically represent a basket of multiple securities. As open-ended funds, ETFs have a creation and redemption mechanism that market makers can leverage—creating shares to meet demand and destroying shares to manage supply.

If an investor buys a large enough amount, a market maker can sell the ETF to the investor, then purchase its underlying basket of holdings, delivering these securities to the ETF issuer in exchange for newly created ETF shares. By creating new shares to meet the investor’s demand, the market maker can give the investor an attractive price that limits price impact—or avoids it altogether.

Essentially, the market maker uses the liquidity of the underlying securities and transfers it to the ETF vehicle. So the constraint on the ETF’s liquidity is not its volume or AUM but the liquidity of its underlying holdings. The deeper the market for the ETF’s underlying holdings, the easier it is for market makers to create and redeem them to meet the ETF’s demand—and the better the execution for end investors.

ETFs in Action: Examples of Eliminating Price Impact

Two real-world examples illustrate large trades where the ETF itself featured lower trading volume and AUM but investors were able to make large allocations with no price impact.

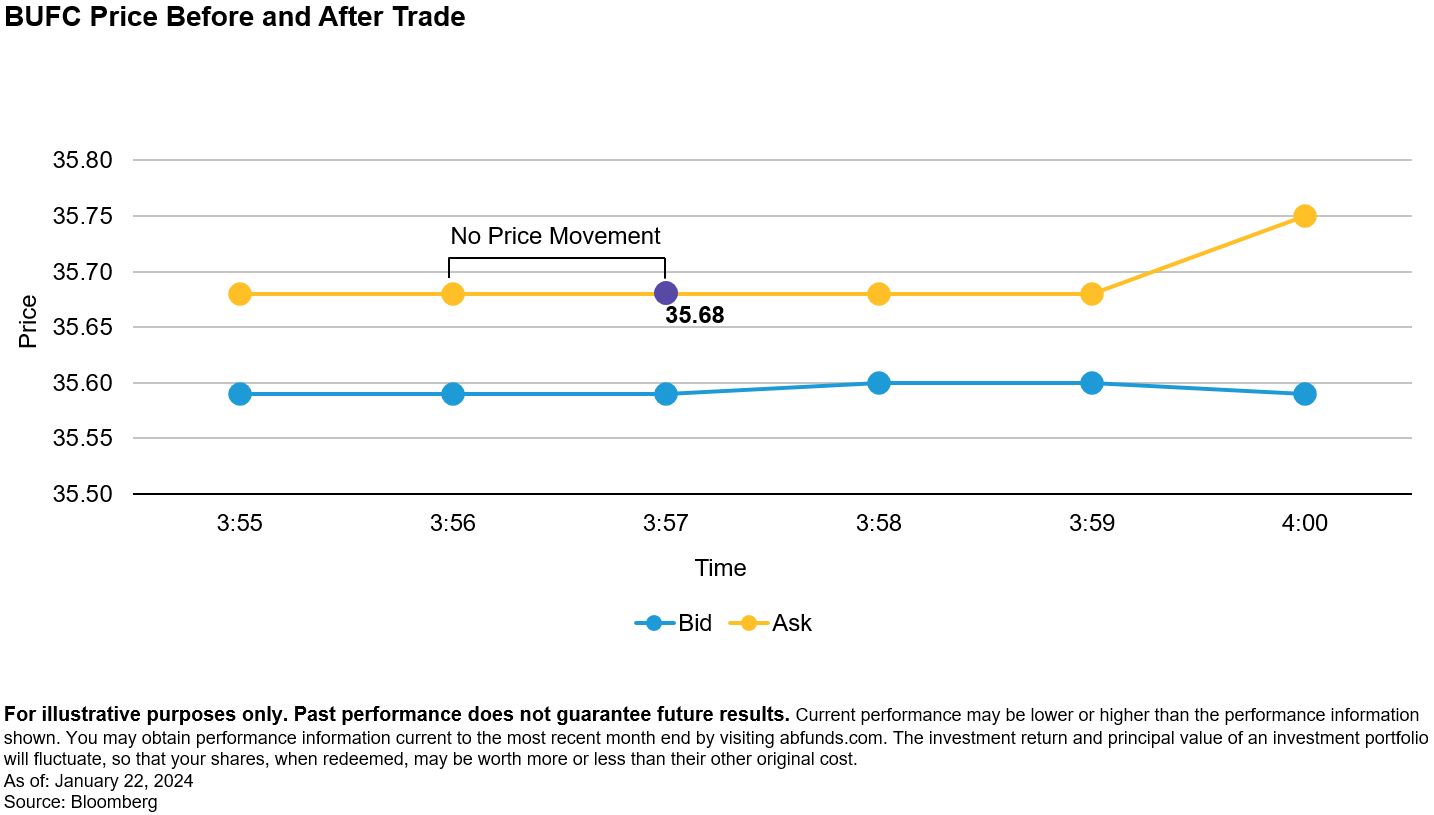

1) On January 22, 2024, a client purchased approximately $412 million of the AB Conservative Buffer ETF (ticker: BUFC), representing about 11.5 million shares. At the time, the trade amount was about 23 times the fund’s AUM, yet was executed at $35.68 per share—the best available offer price at the time. It was done in a single trade, and the price did not move.

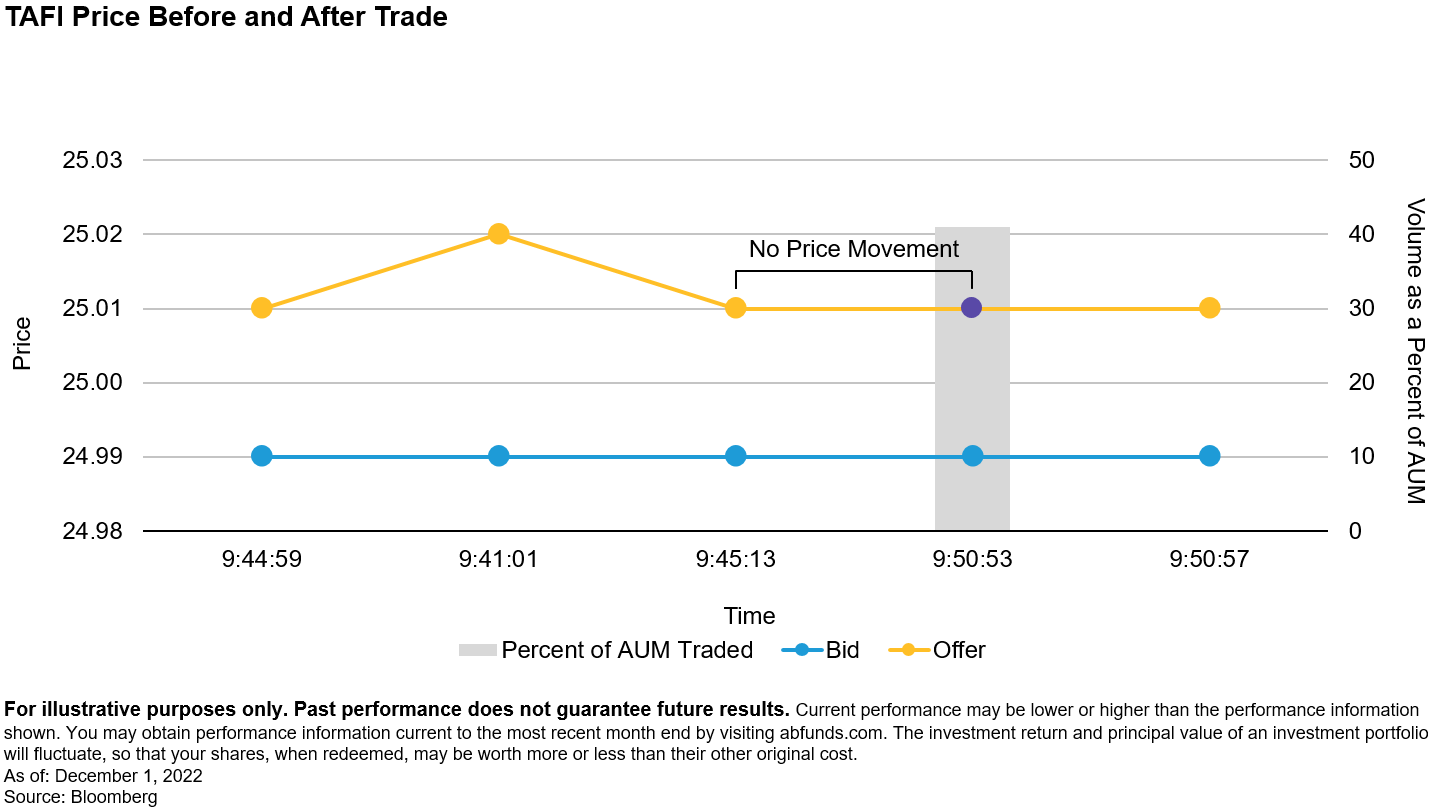

2) On December 1, 2022, a client purchased about $19.4 million of the AB Tax-Aware Short Duration Municipal ETF (ticker: TAFI). At the time, the ETF had been on the market for just over one month. Its total AUM was about $47 million, and its daily average trading volume since inception was approximately $746,000 per day. So the client’s trade amount equaled 41% of the fund’s AUM and 26 times its average daily volume, yet the trade was executed with no price impact.

The Big Picture: Volume and Size Don’t Tell an Accurate Liquidity Story

An ETF’s ability to absorb large trades with no price impact highlights that its volume and fund size don’t tell an accurate story about its actual liquidity. The average daily volume of an ETF indicates demand but not supply or possible liquidity capacity. The fund’s size in AUM shows how much capital investors have allocated to it, but says nothing about its capacity for growth with little to no price impact. An ETF’s creation and redemption mechanism enables it to dynamically expand and contract the supply of shares, minimizing or eliminating the price impact of large trades.

If you’re an investor looking for trading guidance, the AB ETF Capital Markets team offers complementary trade advisory services. You can reach us at etf.capitalmarkets@alliancebernstein.com. And you can find out more about AB’s actively managed ETFs here.

Investing in securities involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges, and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (NAV), and will fluctuate with changes in the NAV as well as with supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by authorized participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

BUFC: Risks to Consider

Active Trading Risk: The Fund expects to engage in active and frequent trading, which will increase the portfolio turnover rate. A higher portfolio turnover increases transaction costs and may negatively affect the Fund’s return. Buffer/Cap Change Risk: A new hedge period buffer and a new hedge period cap are established each time the Options Portfolio is implemented, including after an upside-ratchet event. The duration of a hedge period cap or hedge period buffer may vary. Buffered Loss Risk: There can be no guarantee that the Fund will be successful in its strategy to buffer against underlying ETF price declines. Despite the intended hedge period buffer, a shareholder may lose money by investing in the Fund. If, during a hedge period, an investor purchases shares of the Fund after the date on which the Fund has entered into FLEX Options or sells shares of the Fund prior to the expiration of the FLEX Options, the hedge period buffer that the Fund seeks to provide may not be available and the investor may not receive the full, or any, benefit of the hedge period buffer. The Fund does not provide principal protection, and an investor may experience significant losses on an investment in the Fund. A blended portfolio of expiring options and new options could impact the Fund’s ability to realize the full, or any, benefit of the hedge period buffer and may subject the Fund’s return to an upside limit that is slightly lower or higher than the hedge period cap for the applicable hedge period. Accordingly, an investor may bear losses against which the hedge period buffer is anticipated to protect and may be subject to an upside limit that is lower than the hedge period cap. Capped Upside Risk: If an investor purchases shares of the Fund after the first day of a hedge period and the value of the underlying ETF shares is at or near the hedge period cap for that hedge period, there may be little or no ability for that investor to experience an investment gain on their Fund shares unless the Fund engages in an upside ratchet of the Fund’s Options Portfolio. If an investor does not hold their shares of the Fund for an entire hedge period, the returns realized by that investor may not replicate those the Fund seeks to achieve. If the underlying ETF experiences gains during a hedge period in excess of the hedge period cap, unless the Fund has engaged in an upside ratchet the Fund will not participate in those gains beyond the hedge period cap. Cash Transactions Risk: The Fund intends to effectuate all or a portion of the issuance and redemption of creation units for cash, rather than in-kind securities. As a result, an investment in the Fund may be less tax-efficient than an investment in an ETF that effectuates its creation units only on an in-kind basis. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. FLEX Options Correlation Risk: Although the value of the FLEX Options structure held by the Fund generally correlates with the share price of the underlying ETF, the FLEX Options are exercisable at the strike price only on their expiration date, and their daily valuation will not change at the same percentage as the share price of the underlying ETF. Accordingly, the Fund’s NAV or market price will not directly correlate on a day-to-day basis with the share price of the underlying ETF. FLEX Options Liquidity Risk: The FLEX Options are listed on an exchange; however, there is no guarantee that a liquid secondary trading market will exist for the FLEX Options. A less liquid trading market may adversely impact the value of the FLEX Options and the value of your investment. FLEX Options Valuation Risk: FLEX Options held by the Fund will be exercisable at the strike price only on their expiration date. The value of the FLEX Options will be determined based upon market quotations or using other recognized pricing methods. The value of a FLEX Option prior to its expiration date may vary because of related factors other than the value of the underlying ETF. During periods of reduced market liquidity, or in the absence of readily available market quotations for the holdings of the Fund, FLEX Options may become more difficult to value, and the judgment of the Advisor, as the Fund’s valuation designee, may play a greater role in the valuation of the Fund’s holdings due to reduced availability of reliable objective pricing data. Hedge Period Risk: The Fund’s investment strategy is designed to deliver returns that reference an underlying ETF and are based on options contracts that are designed to be in place for 90-day periods, although in some cases the Fund will hold options contracts of longer duration. The Fund may not hold its Options Portfolio for the full duration of the options contracts, and the Advisor may change the Options Portfolio at any time, which would begin a new hedge period. There is no guarantee that any upside ratchet will be successfully implemented or that it will deliver the desired investment result. Leverage Risk: To the extent the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates, and any increase or decrease in the value of the Fund’s investments. Non-Diversification Risk: The Fund may have more risk because it is “non-diversified,” meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value. Underlying ETF Risk: The Fund invests in FLEX Options that reference an ETF, which subjects the Fund to certain of the risks of owning shares of an ETF as well as the types of instruments in which the underlying ETF invests. New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

TAFI: Risks to Consider

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (a/k/a junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities. Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest-rate risk. As interest rates rise the value of bond prices will decline. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities may negatively impact the yield or value of a municipal security. Tax Risk: The U.S. Government and the U.S. Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income received by shareholders from the Fund by increasing taxes on that income. New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

AllianceBernstein L.P. (AB) is the investment Advisor for the Fund.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.