The AI Revolution Has Entered the World of Fixed Income ETFs

Empowering Active Investing in Credit Markets

AI helps our portfolio managers navigate an ocean of constantly changing data to analyze opportunities, making it an excellent fit for active fixed-income managers employing systematic approaches.

Think of AI as empowering a three-step investment process:

- Identify which bonds are attractive and unattractive using an objective ranking system

- Optimize those findings to create a portfolio

- Realize that portfolio through skillful implementation

Generating Fixed-Income Alpha with AI

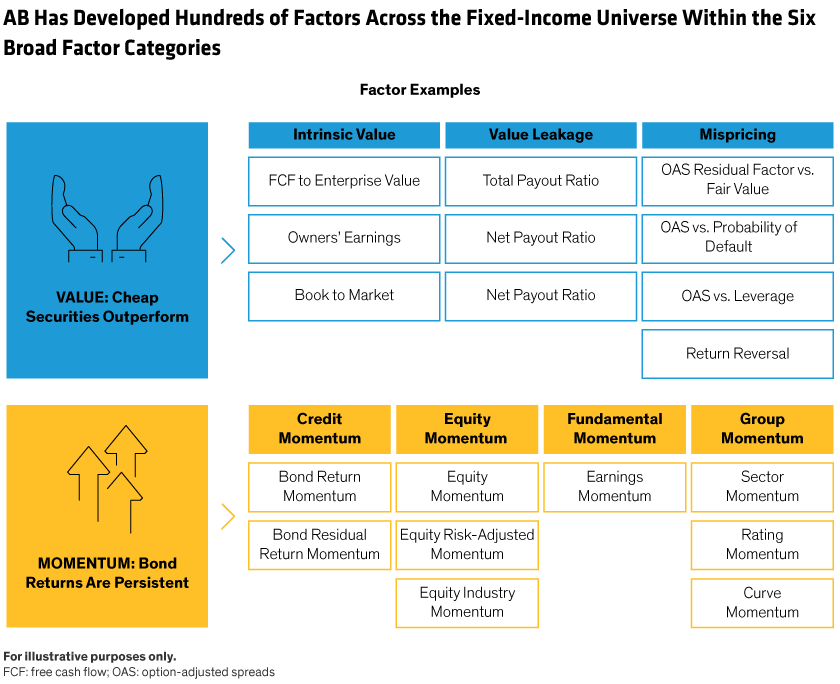

AB’s approach to investing using systematic techniques seeks to outperform bond market benchmarks principally through individual security selection. We aim to rank the securities in a benchmark to identify outperformance (alpha) potential, using an array of data-driven predictive characteristics, such as valuation, momentum or sentiment (Display).

Machine learning (ML) methods can improve analytics across multiple valuation data points to find new signals and make existing signals more effective, enhancing the managers’ ability to rank securities. AI can, for example, create valuation scores at both the individual bond level and the issuer level, creating different lenses through which to identify bond-price anomalies. AI also brings a new dimension to the probability of default analysis, improving on rigid academic models.

EYEG and CPLS: Two Fixed Income ETFs Harnessing the Power of AI

We use a sophisticated, active investment process by integrating AI into security selection for the AB Corporate Bond ETF (Ticker: EYEG) and the AB Core Plus Bond ETF (Ticker: CPLS).

In practical terms, our portfolio managers leverage advanced ML models to estimate real-time prices for corporate bonds with stale or missing prices, using real-time prices of liquid peers and other relevant market variables. This model-assisted price approach provides us with a more complete view of the trading universe and feeds intraday trading signals.

Embrace the Investing Evolution

As the world around us evolves with AI and technological breakthroughs, fixed-income investing is not left behind. With EYEG and CPLS, we’re embracing this AI evolution and believe we can make smarter, better-informed decisions—helping your clients meet their investment goals.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Investing in ETFs involves risk and there is no guarantee of principal.

Must be preceded or accompanied by a prospectus, which can be accessed here.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (a/k/a junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities.

Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest-rate risk. As interest rates rise, the value of bond prices will decline.

Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities may negatively impact the yield or value of a municipal security.

Tax Risk: The US Government and the US Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income received by shareholders from the Fund by increasing taxes on that income.

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.