Go Both Ways to Manage Equity Volatility with ETFs

Key Takeaways

- Passive minimum-volatility equity strategies may be effective at playing defense, but they generally aren’t built to deliver in market rallies. That could hurt investors’ ability to build wealth over time.

- Active, low-volatility strategies that focus on quality, stability and price could provide an avenue to both mitigate downside risk and capture market upside.

- Investors seeking to navigate unsettled markets should consider the AB US Low Volatility Equity ETF (NYSE: LOWV) and the AB International Low Volatility Equity ETF (NYSE: ILOW) for non-US exposure.

The Drawbacks of Playing Defense Only

Risks ranging from an unsettled geopolitical picture to an evolving macro landscape to concentrated markets could rattle equity investors’ portfolios this year. This challenge bolsters the case for strategies that can play defense. But strategies designed for defense alone may fall short during market rallies.

One of the most popular avenues, minimum-volatility strategies typically accessed through passive ETFs, seek out low-volatility stocks. Allocations often include healthy doses of traditional defenders like utilities and consumer staples, which can generate income and help defend during market turbulence.

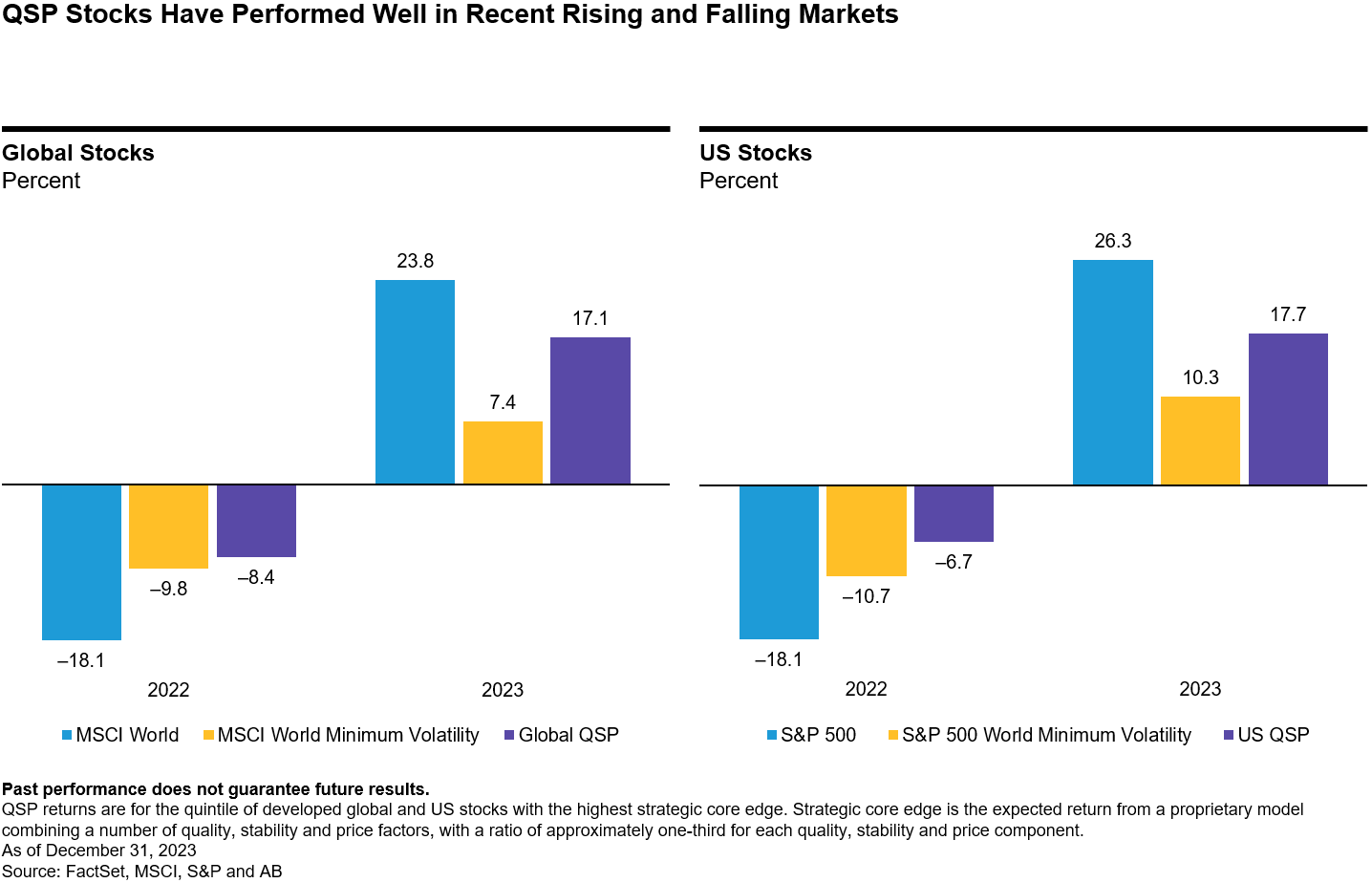

But minimum-volatility approaches may fail to deliver growth in rising markets, and over time, those lopsided return patterns can undermine results. In the 2022 global equity downturn, the MSCI World Minimum Volatility Index cushioned declines, but when equities rallied by 24% in 2023 led by a handful of US mega-caps, the index was up only 7.4%, trailing the market badly (Display). US patterns were similar.

A Focus on Quality, Stability and Price

It isn’t easy to design a strategy to mitigate risk and capture upside, but we think an actively managed portfolio focused on quality, stability and price (QSP) may be the answer. Quality companies’ strong business models and recurring revenue streams help drive upside participation, and stability can cushion against down markets. A focus on valuations can help avoid overly expensive stocks—which can be especially important when traditional defensive sectors may be pricey.

QSP attributes don’t work in a vacuum; they’re interdependent. Checking all the boxes, in our view, leads to a collection of stocks with a solid track record in both falling and rising markets. In 2022, a universe of global equities with strong QSP features fell by 8.4%—cushioning market declines as minimum volatility did. And last year, they rose by 17.1%, capturing more of the market’s gains1.

Defense and Capital Growth: Not Mutually Exclusive

Passive strategies aren’t generally sensitive to valuations when allocating to low-volatility stocks, while an active approach using thoughtful, fundamental research has the potential to uncover often overlooked names in a way that passive minimum-volatility strategies can’t.

Passive strategies aren’t equipped to set aside or adjust the weights of stocks that seem expensive. Active strategies, on the other hand, can search for stable, quality businesses the market doesn’t fully appreciate. Zeroing in on valuation may help counter market volatility.

So, in our view, there’s no contradiction between positioning for long-term capital growth and playing defense. Portfolios that achieve these twin targets can help investors stay in equities through changing market conditions—which may lead to better outcomes.

LOWV and ILOW: Helping Manage the Downs and Ups of Equity Markets

Investors seeking equity strategies to help navigate volatile markets should explore the AB US Low Volatility Equity ETF (NYSE: LOWV) for exposure to US stocks and the AB International Low Volatility Equity ETF (NYSE: ILOW) for exposure to non-US stocks.

These actively managed, high-conviction portfolios of primarily large-cap equity companies are selected by focusing on QSP factors. LOWV seeks capital appreciation with an emphasis on lower volatility compared to the S&P 500, while ILOW seeks a similar performance pattern versus the MSCI EAFE.

If you’re an investor looking for trading guidance, the AB ETF Capital Markets team offers complementary trade advisory services. You can reach us at etf.capitalmarkets@alliancebernstein.com and you can find out more about AB’s actively managed ETFs here.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

There is no guarantee for less share price volatility.

Investing in securities involves risk, and there is no guarantee of principal. Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

1. Each month, QSP returns reflect the performance of the top 20% of stocks that our proprietary model identifies as having the strongest combination of three factors: Quality, Stability, and Price. These factors are used to estimate the future performance of a stock. Quality focuses on how well a company generates profits and manages its finances. We look for companies with high free cash flow, strong returns on investment, and efficient use of resources. Stability examines how consistent and predictable a company's performance is. We favour companies with lower volatility in their stock price and more stable financial metrics. Price ensures that we are investing in companies at a reasonable cost, considering both their current price and expected returns. We prefer stocks that are priced attractively relative to their cash flow and dividend yield. The combination of these factors gives each stock a "Strategic Core Edge" score (the weight of Q, S and P in our model is approximately one third each). The top 20% of stocks with the highest scores are included in the QSP group, and their average return represents the QSP performance for that month.

LOWV Risks:

Equity Securities Risk: The Fund invests in publicly traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased. Market Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors. Non-Diversification Risk: The Fund may have more risk because it is “non-diversified,” meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

ILOW Risks:

Capitalization Size Risk (Small/Mid): Small- and mid-cap stocks are often more volatile than large-cap stocks. Smaller companies generally face higher risks due to their limited product lines, markets and financial resources. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors. Market Risk: The market values of the Fund’s holdings rise and fall from day to day, so investments may lose value. Non-Diversification Risk: The Fund may have more risk because it is “non-diversified,” meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV.

MSCI World Index: captures large and mid-cap representation across 23 Developed Markets (DM) countries

MSCI World Minimum Volatility Index: aims to reflect the performance characteristics of a minimum variance strategy applied to the MSCI large and mid cap equity universe across 23 Developed Markets countries

S&P 500 Index: measures the performance of about 500 U.S. companies across 11 sectors.

S&P 500 Minimum Volatility Index: designed to reflect a managed-volatility equity strategy that seeks to achieve lower total risk.

AllianceBernstein L.P. (AB) is the investment Adviser for the Funds.

Distributed by Foreside Fund Services, LLC. Foreside is not related to AB