ETF Face-Off: Floating-Rate Funds vs. Short-Duration High Yield

Our Key Takeaways

- The Fed has started to cut rates, which could lead to outflows for floating-rate funds.

- High-yield bonds seem better positioned for the range of possible interest-rate scenarios, and they seem stronger fundamentally, as they’re composed of higher-rated issuers than floating-rate bank loans.

- The pendulum could be swinging from floating-rate funds toward short-duration high-yield bonds as the optimal near-term credit allocation.

- We think the AB Short Duration High Yield ETF (NYSE: SYFI) is an attractive choice. It’s an active bond portfolio that seeks attractive income with less volatility than traditional high yield.

Falling Yields Favor Bonds, Not Floating-Rate Funds

Rising coupons on high-yield floating-rate funds were hailed as an antidote to rising rates when the Fed was tightening monetary policy. With the Fed now ready to change course, these funds may face pressure, and we think income seekers may wish to consider swapping into short-duration high-yield bonds.

Floating-rate funds seem riskier at this stage of the cycle: their variable coupons fall when rates fall. And with no duration, they don’t benefit from a price boost as yields decline—the way bonds do. The Fed started to cut rates in September, which could trigger investors to sell out of floating-rate funds.

Even in normal times, shorter-duration high-yield has the potential to deliver high income with lower volatility than intermediate-duration strategy. From 1989 through June 2024, the Bloomberg US High Yield 1–5 Year Ba/B Index1 returned 7.5% annualized with 6.1% volatility versus 7.1% and 8.6% for the Bloomberg US Corporate High Yield Index2.

Analysis provided for illustrative purposes only and is subject to revision.

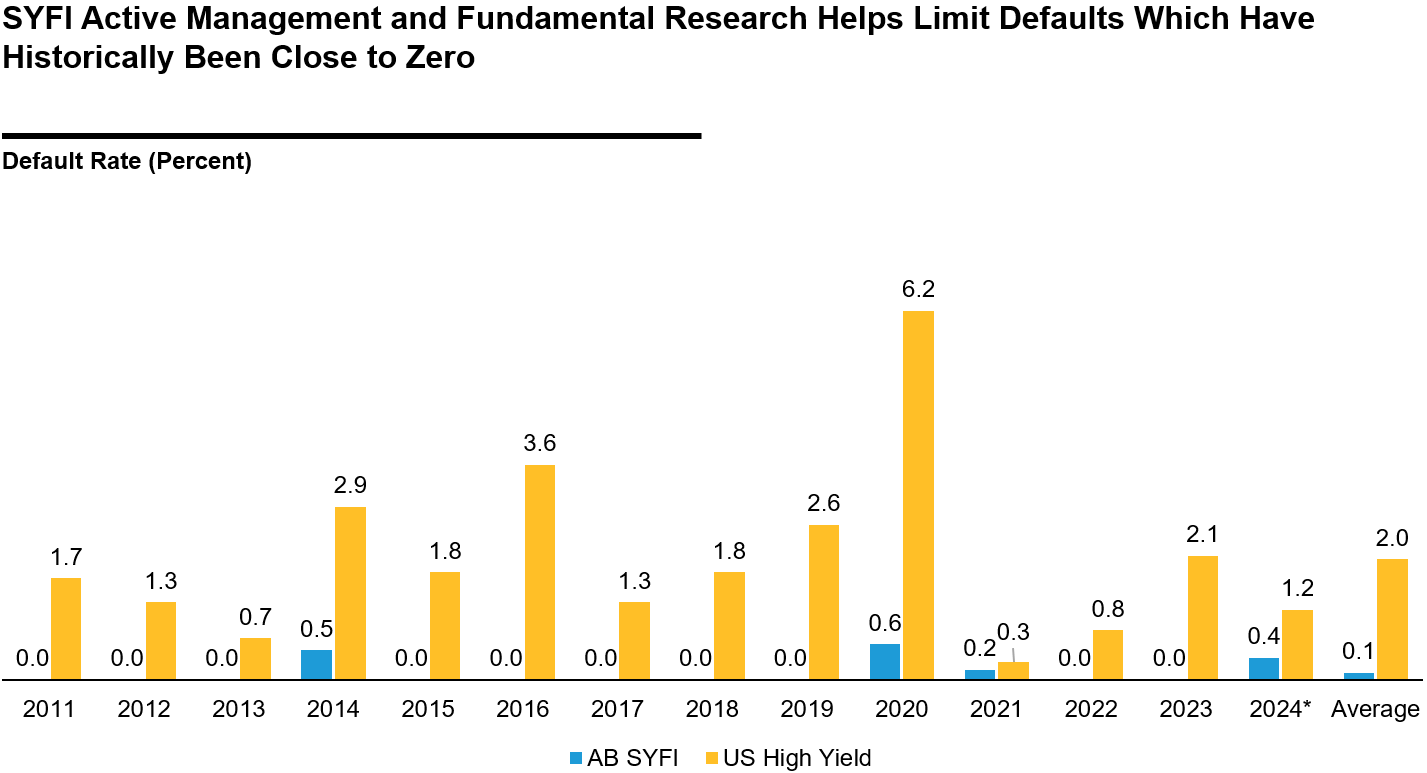

SYFI defaults calculated over last 12 months by AB internal systems. High-yield market defaults represented by Bloomberg US Corporate High Yield Index default rate as reported by J.P. Morgan. Default rate represents the annual weight of securities in the portfolio or index that fail to fulfill debt obligations.

As of July 31, 2024, Source: J.P. Morgan and AB

Performance prior to close of business July 8, 2023, performance reflects AB Limited Duration High Income Advisor Share Class —December 8, 2011

for additional fund information, please visit: https://www.alliancebernstein.com/us/en-us/investments/products/mutual-funds/fixed-income/ab-limited-duration-high-income-portfolio.advisor.018528331.html

Fundamentals Matter: High-Yield Bonds Look Stronger

From a credit perspective, floating-rate funds may be facing strain today. Many floating rate borrowers saw financing costs rise along with interest rates, whereas most high-yield bond issuers had an opportunity to secure lower fixed financing costs before the Fed began hiking.

The high-yield bank-loan market, the predominant hunting ground of floating-rate funds, has seen its quality decline over the years. Today, 69% of the S&P LSTA Leveraged Loan Index3 is rated B or lower versus 46% in 2010. For the Bloomberg US Corporate High Yield Index, quality has improved, with its lower-rated share down to 49% from 62%. That could spell more credit risk for floating-rate funds.

We think high-yield bond fundamentals will likely weaken, with a slowing economy and higher financing costs, but we think default risk is mostly priced into markets for weak industries and individual issuers. And market fundamentals are starting from their strongest point since the 1990s. Still, avoiding defaults is particularly important today, given recent poor recovery rates. As we see it, this calls for an active hand at credit selection.

Investors with bank-loan exposure face a pressing question: Is the pendulum swinging from floating-rate funds toward short-duration high-yield bonds? We think it is, and the opportunity to rotate into short-duration high-yield bonds stands out.

SYFI: Seeking Attractive Income and Active Credit Management

Looking to pivot from floating-rate exposure into fixed-rate short-duration high-yield bonds to capitalize on the fleeting interest-rate opportunity? Explore the AB Short Duration High Yield ETF (NYSE: SYFI).

Its actively managed, research-driven bond portfolio seeks attractive income with less volatility than traditional high yield, and it dynamically manages risk through the credit cycle. Since inception, SYFI has avoided over 75% of US high-yield defaults, which could affect passive or less-skilled active strategies. On an annualized basis, the Portfolio’s default experience has been 0.1%, well below the roughly 3% for the Bloomberg US High Yield Index.

If you’re an investor looking for trading guidance, the AB ETF Capital Markets team offers complementary trade advisory services. You can reach us at etf.capitalmarkets@alliancebernstein.com. And you can find out more about AB’s actively managed ETFs here.

How to Take Action

Sign Up

Visibility Into Our ETF Insights.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

1The Bloomberg US High Yield 1-5 Yr Ba/B Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

2The Bloomberg US Corporate High Yield Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

3The S&P LSTA Leveraged Loan Index is a market-value weighted index designed to measure the performance of the US leveraged loan market.

Investing in securities involves risk, and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (NAV) and will fluctuate with changes in the NAV as well as the supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions, and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline. Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market. Diversification Risk: Portfolios that hold a smaller number of securities may be more volatile than more diversified portfolios, since gains or losses from each security will have a greater impact on the Portfolio’s overall value. Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Interest-Rate Risk: As interest rates rise, bond prices fall and vice versa—long-term securities tend to rise and fall more than short-term securities. Market Risk: The market values of the Portfolio's holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein L.P. (AB) is the investment adviser for the Fund.

Distributed by Foreside Fund Services, LLC. Foreside is not related to AB.