-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

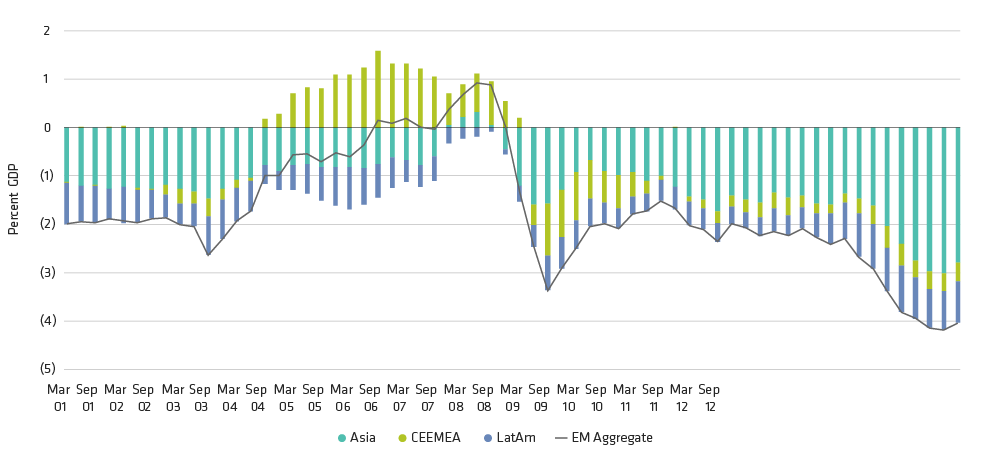

Emerging-Market Debt

Putting the Fiscal House in Order

Through March 31, 2017

CEEMEA = Central and Eastern Europe, Middle East and Africa

Source: Haver Analytics and AB

Christian DiClementi is a Senior Vice President and Lead Emerging Market Debt Portfolio Manager at AB. He is also a member of the Global Fixed Income, Absolute Return and Income portfolio-management teams, and oversees emerging-market investments across AB’s suite of fixed-income products. DiClementi joined the firm in 2003. Prior to becoming a member of the Emerging Market Debt portfolio-management team in 2013, he served as a member of AB’s Economic Research Group, focusing mainly on sovereign fundamental research for the Caribbean, Central American and Latin American regions. Previously, DiClementi worked as an analyst in the firm’s Quantitative Research Group, with an emphasis on global sovereign return and risk modeling, and as an associate portfolio manager responsible for municipal bond portfolios. He holds a BS in mathematics (summa cum laude) from Fairfield University. Location: New York