Financial conditions tightened rapidly as a result, accelerating the slowdown already underway. Market expectations of peak policy rates have declined since June, likely reflecting the significant slowdown in activity as well as recent commodity price declines. We also note that markets increasingly see the Fed reversing its stance in early 2023, suggesting heightened expectations of meaningful deterioration in economic growth over the next six months.

Despite high uncertainty, consumer and corporate sectors appear resilient and we see a relatively shallow slowdown as our base case. Meanwhile, supply and demand imbalances are improving as fiscal and monetary support policy are withdrawn and economies reopen. If these trends continue, we expect inflation to gradually normalize and allow central banks to follow less restrictive policy in response to slower growth.

Supply and Demand Imbalances Are Improving in the Goods Sector

With the rise in commodities, US headline inflation surged (9.1%) well above core (ex food and energy), which peaked at 6.4% in March and currently stands at 5.9% year over year. However, due to slowing activity and demand destruction, the Bloomberg Commodity Index has since dropped 15% below its June high. Central banks have looked past commodity price volatility historically. Given concerns about inflation expectations, however, the Fed now sees headline inflation as meaningful in the current cycle. This decline in commodities, if it persists, could provide relief for headline inflation as well as for goods categories exposed to commodities, such as consumer staples.

The initial post-pandemic inflationary impulse was driven by US goods consumption surpassing pre-crisis levels by nearly 20%, while supply was constrained by factory shutdowns, component shortages and logistics capacity. Now we’re seeing gradual adjustments on both the demand and supply sides. Goods consumption, now closer to 13% over pre-pandemic levels, is reverting to trend. Meanwhile, manufacturing capacity utilization and supplier delivery times have been improving.

Logistics costs and delays are also easing. The New York Fed’s Global Supply Chain Pressure Index seems to have peaked in December 2021, except for a blip in May due to more China lockdowns. China’s zero-COVID policy remains a risk, but we don’t expect severe broad-based lockdowns to return. China-to-US shipping rates are down 40% to 60% from late 2021 peaks. At the same time, order backlogs are starting to clear, and inventory-to-sales ratios are returning to pre-pandemic levels. Although manufacturing activity may be losing its tailwind, these improvements should bring pricing behavior closer to “normal.”

Prices Easing for Durable Goods, But Nondurables Reflect Commodities Pressures

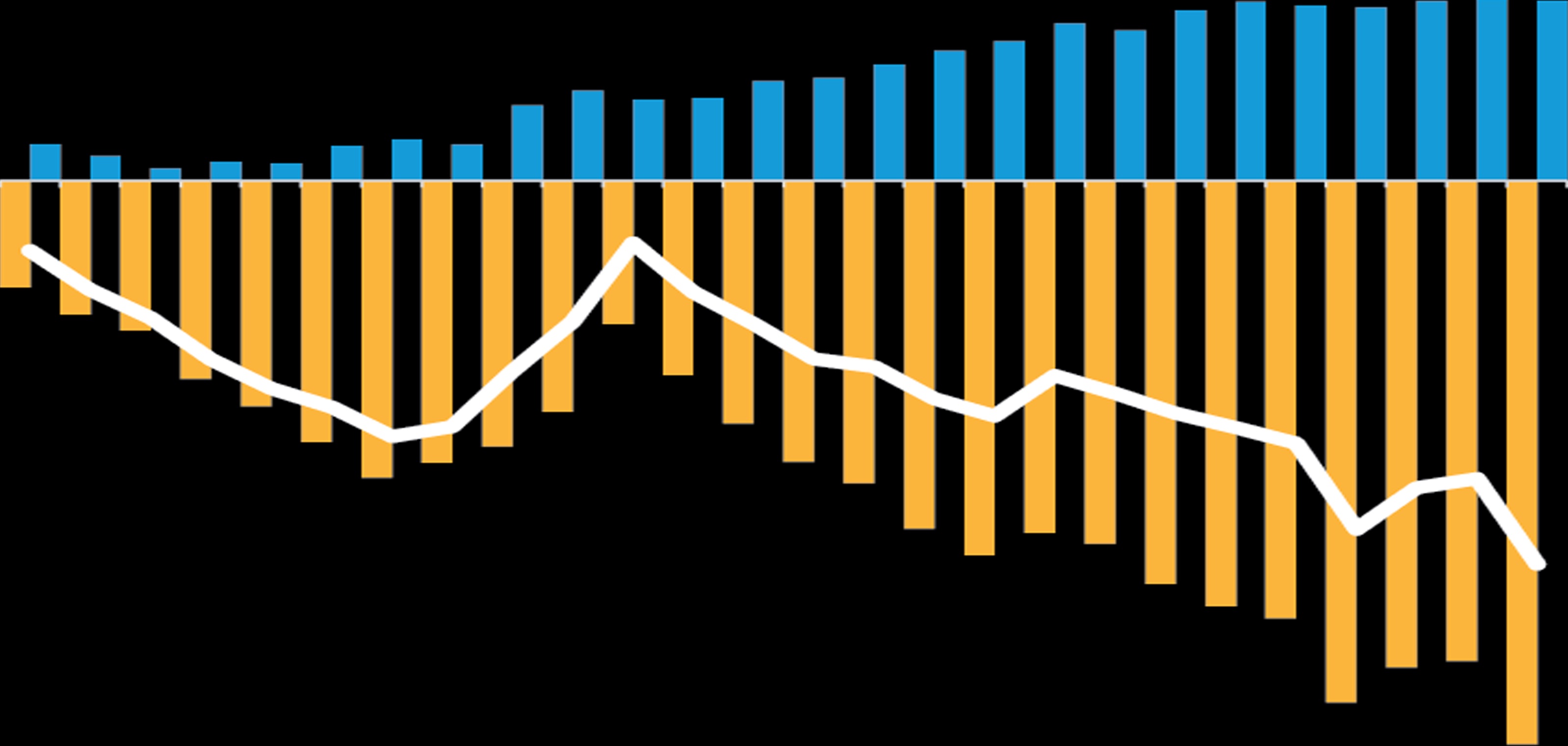

Durable goods, the dominant driver behind early post-pandemic price pressures, appear to be reverting to pre-pandemic disinflationary trends. Post-pandemic, durable goods inflation averaged 5% on an annualized basis, compared to its pre-pandemic average of –1.9% in 2014–19 (Display). The run rate over the last three months was just 1% on an annualized basis. We see more room to improve since auto manufacturing has yet to fully emerge from its supply-chain challenges.