-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

What Does the DeepSeek Halo Teach Us About Chinese Stocks?

Historical analysis does not guarantee future results.

HSTech Index refers to the Hang Seng Tech Index.

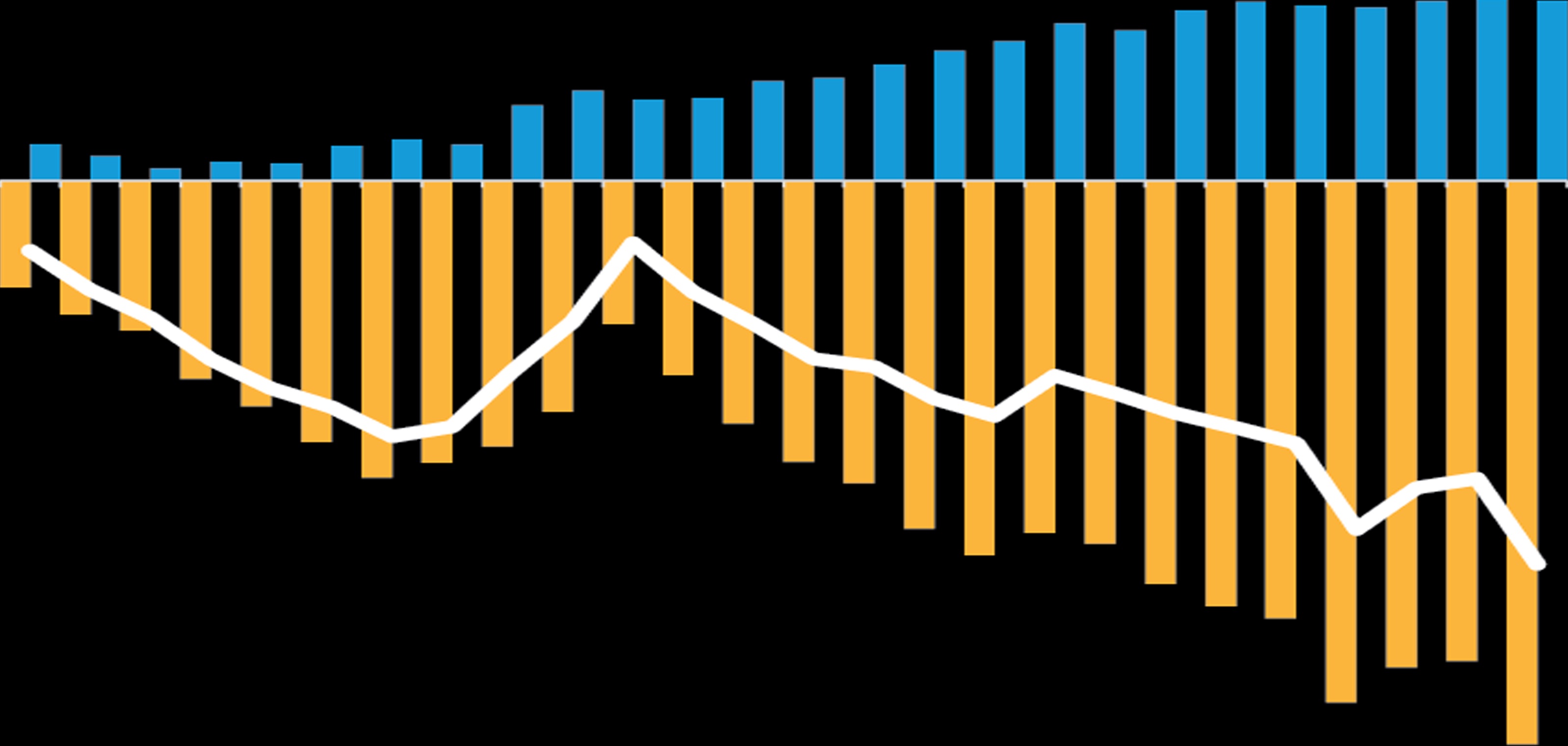

Left display as of January 31, 2025; right display as of February 18, 2025

Source: Bloomberg, Hang Seng Indexes, MSCI and AllianceBernstein (AB)

Historical analysis does not guarantee future results.

*Chatbot Arena is an open platform for crowdsourced AI benchmarking, developed by researchers at UC Berkeley SkyLab and LMArena. With over 1,000,000 user votes, the platform ranks best LLM and AI chatbots using the Bradley-Terry model to generate live leaderboards.

Left display as of February 20, 2025; rght display as of December 31, 2023

Source: Artificial Intelligence Index Report 2024, Stanford University; Wei-Lin Chiang, Lianmin Zheng, Ying Sheng, Anastasios Nikolas Angelopoulos, Tianle Li, Dacheng Li, Hao Zhang, Banghua Zhu, Michael Jordan, Joseph E. Gonzalez and Ion Stoica, "Chatbot Arena: An Open Platform for Evaluating LLMs by Human Preference," UC Berkeley Sky Computing Lab and LMArena, 2024, https://lmarena.ai/?leaderboard; and AB

Historical analysis does not guarantee future results.

*Applicants from China filed mostly in digital communication and the US filed mostly in computer technology. Japan, South Korea and Germany filed moslty in electrical machinery. Note: Based on published Patent Cooperation Treaty applications.

Left display as of August 2024; right display as of November 2024

Source: World Intellectual Property Organization

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

John Lin is the Chief Investment Officer of China Equities. He has been a Portfolio Manager for AB China Equities since 2013 and for Emerging Markets Value Equities since 2021. From 2008 to 2022, Lin served as a senior research analyst, responsible for covering financials, real estate and conglomerate companies in Hong Kong and China. He joined the firm in New York in 2006 as a research associate, covering consumer services companies for US Small & Mid-Cap Value Equities. Previously, Lin was a technology, media and telecom investment banker at Citigroup. He holds a BS (magna cum laude) in environmental engineering from Cornell University, and an MBA from the Wharton School at the University of Pennsylvania, where he earned the distinction Graduation with Honors. Location: Singapore