The fundamentals of emerging markets are looking very strong right now. Global economic growth is firming, and emerging markets’ economic growth is accelerating.

Not just the growth of the countries, but the growth of the earnings in the companies. And the risks are coming down. The external balances of the countries are improving, the currencies are firming, so this is a great setting for investing in emerging markets.

I think a lot of investors have been apprehensive about adding to emerging markets because they’re concerned about the impact of higher interest rates in the United States. I think those concerns are way overdone. What we see is that, as interest rates are rising in the United States, it’s because global growth is improving, and so the demand for the goods produced in emerging markets is improving. We’re seeing it in the exports and the sales of these companies and countries.

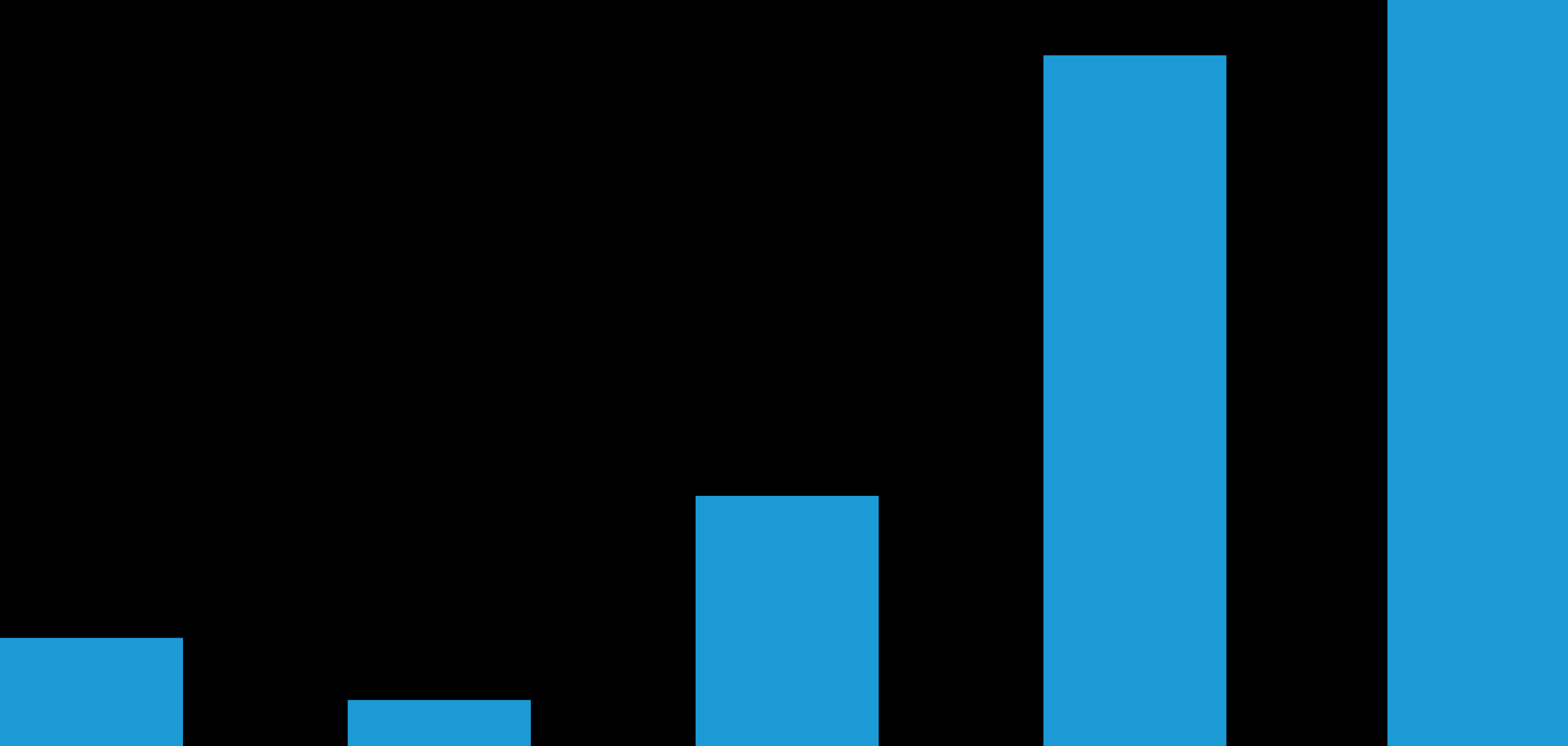

So this is part of the broader, fundamental picture that’s getting better. When we look back to the mid-2000s, when the Fed raised rates from 1% to 5¼, emerging-market stocks were up 135%. They’re only 25% into that rally again, and I think there’s a lot more room to run.

I think concerns about protectionism have actually been less impactful on the broad market than people might have feared. The obvious casualty has been Mexico so far, which last year suffered greatly because of concerns about relations with the United States; but as people look to other countries that have trade imbalances with the US, it becomes more complex.

For example, the iPhone is something that’s produced in a number of different Asian countries. Not because of low labor costs, but because of [a] very competitive cluster of businesses that cooperate together and produce a product that people want at a competitive price. And we’ve never made an iPhone in the United States.

You can’t simply snap your fingers and say, “We must make those here.” If you did, they would surely cost thousands of dollars, and Americans don’t want to pay that much. So it’s not so easy to just onshore products that were made offshore, if they were made offshore for a reason other than low labor costs.

Currency risk is something that needs to be taken into account when investing in emerging markets. It accounts for about one-quarter of the volatility in the typical portfolio. So we think it’s important to manage currency risk actively. It can be either a way to dampen volatility or a way to improve return, or at least the consistency of return.

What’s exciting about investing in emerging markets is: it’s a part of the capital markets where there are still efficiencies that active managers can take advantage of. Information flows more slowly, people fail to see connections across industries around the world or across countries, and that means that if you bring a research-based approach, you can either outperform the market meaningfully, or you can reduce the inherent volatility of a traditional emerging-market passive approach.