-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Think Small in a Trade War? Yes, but Think Carefully, Too

.png)

Indexed daily returns as of June 30, 2018

Source: Russell Investments, S&P and AllianceBernstein (AB)

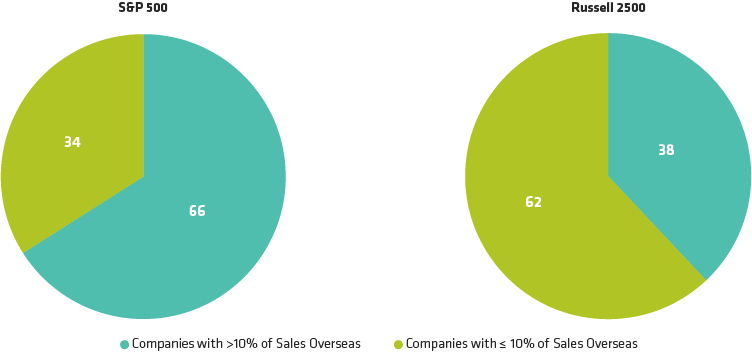

As of June 30, 2018

Source: FactSet, Russell Investments, S&P and AllianceBernstein (AB)

Samantha S. Lau was named Chief Investment Officer of Small and SMID Cap Growth Equities in October 2023. Previously, she was the co-chief investment officer of Small and SMID Cap Growth Equities since 2014. Lau joined the firm in 1999 as a portfolio manager/analyst responsible for research and portfolio management for the technology sector of AB’s Small and SMID Cap Growth strategies. From 1997 to 1999, Lau covered small-cap technology companies for INVESCO (NY) (formerly Chancellor Capital Management). Before joining Chancellor in 1997, she worked for three years as a healthcare securities analyst in the investment research department of Goldman Sachs. Lau co-chaired the Women’s Leadership Council at AB from 2019 to 2022. She holds a BS (magna cum laude) in finance and accounting from the Wharton School at the University of Pennsylvania and is a CFA charterholder. Location: New York

James MacGregor was appointed Chief Investment Officer of US Small and Mid Cap Value Equities in 2009. In this role, he acts as the lead portfolio manager for AB’s US Small and Mid Cap Value strategies. MacGregor was appointed Head of US Value Equities in 2019, responsible for all US Value portfolios in the areas of business management and talent development. From 2009 to 2012, he also served as CIO of Canadian Value Equities. From 2004 to 2009, MacGregor was director of research for Small and Mid Cap Value Equities, overseeing coverage of companies for the Small Cap and Small/Mid Cap Value services. He started as a research analyst covering a wide number of sectors for those same services. Prior to joining the firm in 1998, MacGregor was a sell-side research analyst at Morgan Stanley, where he covered US packaging and Canadian paper stocks. He also serves as a board member and volunteer for Xavier Mission, a charitable organization that provides basic services and opportunities for empowerment and self-sufficiency to New Yorkers in need. MacGregor holds a BA in economics from McGill University, an MSc in economics from the London School of Economics and an MBA from the University of Chicago. He is a CFA charterholder. Location: New York